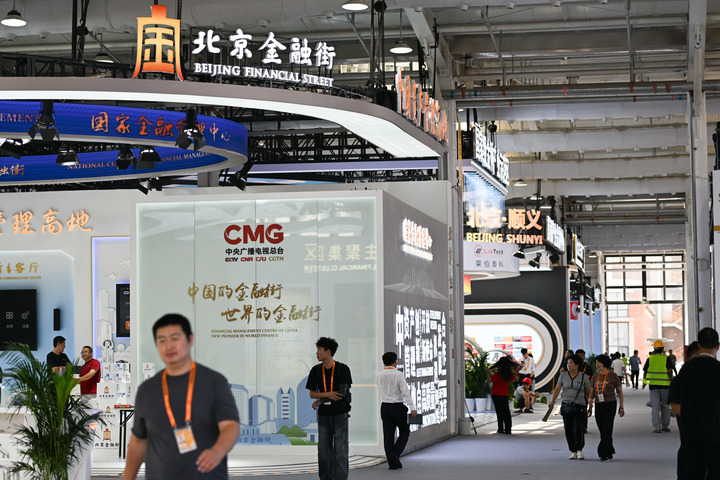

Photo taken on September 9, 2025 shows the interior view of the financial service exhibition hall of 2025 China International Fair for Trade in Services. (Xinhua/Chen Zhonghao)

BEIJING, Sept. 17 (Xinhua) -- During September 10-14, a collective debut of latest innovations of nearly 100 financial institutions from home and abroad showcased the digital and smart tools-driven financial development.

Bringing all these to the public was the thematic financial service exhibition of 2025 China International Fair for Trade in Services (CIFTIS), which was held in Shougang Park in Beijing, capital of China.

-- AI-enabled immersive exhibition highlights digital, smart future for finance

Compared with the previous sessions, more artificial intelligence (AI) technologies were employed by financial exhibitors to present the profound, innovative integration with finance during this year's thematic exhibition.

For instance, the booth of Industrial and Commercial Bank of China (ICBC) attracted crowds of visitors as its large model with an around 100 billion-level parameter scale outlined a tech system grounded in large model support and application paradigms.

Currently, the ICBC large model has been applied in more than 300 scenarios in 20-plus business fields such as the financial market. Taking customer-facing transactions for example, the bank crafted the ChatDealing intelligent agent, a system that automatically assists traders and client managers in completing entire processes of quotation and inquiry, improving related client service efficiency by about three times.

Tech companies are also expanding their presence in digital and smart vehicles-empowered finance. Tencent approached the public earlier this year with an enhanced version built on basic mixed-element large models -- "Hunyuan Turbo S" and employed it widely in optimizing internal and external efficiency.

Within LiCaiTong, Tencent's wealth management platform, "asking DeepSeek" function now allows picture shooting-based fortune seeking where a user needs only to take photos of an item and analysis over related producer, market and industry will be attained, helpful to better seize investment opportunities, said Guo Chunxu, who took charge of the Tencent AI exhibition zone this year.

Others delved deeper into blending digital and smart tools with financial infrastructure. In the real time trading data demonstration zone of NetsUnion Clearing Corporation (NUCC), visitors could directly feel how the world leading retail payments clearing institution by number of transactions leverages distributed cloud computing framework to ensure operation of online payment systems.

Within a stylish digital Renminbi marketplace covering nearly 1,000 square kilometers of immersive exhibition zones this year, many financial institutions exhibited "digital Renminbi+" related innovation.

Among them, Postal Savings Bank of China demonstrated digital Renminbi, intelligent risk control and other technological application and via simulated scenarios, the bank offered customers a chance to experience the convenient digital financial service in consumption and governmental service.

-- Exploring new paths for financial development

Apart from exhibiting activities, thematic meeting zones and conferences were also arranged for financial participants this year to pool wisdom and explore the future of finance together with financial regulators, associations, and think tanks.

During the "Beijing Service" releasing ceremony, Beijing Municipal Bureau of Financial Work unveiled for the first time outstanding local cases in financial sector such as those serving national strategies and urban development, promoting sci-tech, green, inclusive, pension and digital finance, and facilitating cross-border finance and convenient payment.

Being a collection of many firsts nationwide, these cases either reaped economic and social benefits or were highly recommendable for replication in a wider scale, contributing "Beijing experience" to industry-wide reforms and development.

For example, the case book tells that Beijing Branch of Agricultural Bank of China takes advantage of the cross-border financial service platform of the Beijing branch of State Administration of Foreign Exchange (SAFE) and shares data with SAFE and China Export & Credit Insurance Corporation, helping the latter improve financing efficiency by nearly 30 percent.

As regards payment facilitation, "Mifang Card" was jointly launched for foreigners seeking "China Travel" by the Beijing branches of Bank of China and China Unicom, and Beijing Municipal Administration and Communication Card Co., Ltd.

By combining digital Renminbi payment service, communication service and Beijing travel service, "Mifang Card" can gratify inbound travelers' basic demand for payment, communication and travelling.

Regardless of others, financial institutions and tech companies are endeavoring to find more pathways from digital and smart tools to drive the future development of finance.

(Edited by Duan Jing with Xinhua Silk Road, duanjing@xinhua.org)

A single purchase

A single purchase