BEIJING, June 23 (Xinhua) -- Since China proposed the Belt and Road Initiative (BRI) in 2013, the effective multilateral cooperation in various forms conducted between China and nations and regions jointly building the Belt and Road (B&R) has produced fruitful results in shaping a diversified B&R investment and financing system to enable related construction.

-- Belt and Road financial policy coordination in steady progress

China, as a responsible action taker for the BRI, has widely cooperated with related countries and regions in formulating a batch of financial policies, rules and systems dedicated to establishing a long-term, stable and sustainable B&R investment and financing system with controllable risks.

Table: The Belt and Road investment and financing rules

| Name of the Rules | Details |

| Guiding Principles on Financing the Development of the Belt and Road | In May 2017, China's Ministry of Finance as well as its counterparts of 26 nations including Argentina, Belarus, Cambodia, Chile, etc. jointly endorsed the principles, which contain 15 articles and target building a long term, stable and sustainable financing system that is well placed to manage risks. |

| Green Investment Principles (GIP) for the Belt and Road | In November 2018, Green Finance Committee of China Society for Finance and Banking and the City of London's Green Finance Initiative (now UK-China Green Finance Centre) co-launched the GIP as a set of principles to accelerate green investments among the Belt and Road Initiative countries and regions. |

| Debt Sustainability Framework for Participating Countries of the Belt and Road Initiative | On April 25, 2019, China's Ministry of Finance released the framework on the second Belt and Road Forum for International Cooperation. The framework, based on the IMF/World Bank Debt Sustainability Framework for Low Income Countries (LIC-DSF) and the national conditions and development stages of BRI countries and regions as well, is formulated with the aim to promote sustainable economic and social development of BRI countries and regions. |

Source: Public information

In July 2020, the Ministry of Finance of Saudi Arabia became the 29th one to endorse the Guiding Principles on Financing the Development of the Belt and Road, which represented the first guiding document that BRI participating countries made for boosting financial integration under the BRI.

With forward-looking and pragmatic advices for building a financing system suitable for the BRI, the guiding principles reflected consensus of all related parties on financing channels, financing environment, and financial regulation and supervision under the BRI.

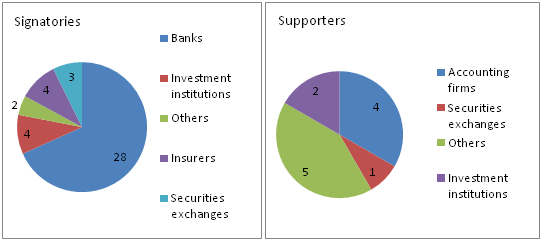

Regarding the GIP, the set of principles had received sign-ups from 41 institutions and official support from 12 organizations by May 31, 2022. The signatories and supporters altogether have served as an important source of funds for the green development of the Belt and Road, said Gabriel Wong, PwC head of China Corporate Finance.

Chart: Composition of GIP signatories and supporting organizations

Source: PwC

Industry experts believed that releasing of the Debt Sustainability Framework for Participating Countries of the BRI presented China's open attitude over related issues and meanwhile attention on the concrete conditions and development needs of low income BRI countries and regions, helpful to optimize the decision-making by various BRI participants and propel high quality development of the Belt and Road.

-- Diversified investment and financing system energizes the Belt and Road construction

Building a diversified investment and financing system is always an integral part of the Belt and Road construction. Since 2013, financial institutions of varied types have been mobilized to actively take part in establishing the diversified Belt and Road investment and financing system. Under the system, the increasingly diversified participants, financial products and financial services played an important role in deepening international production capacity cooperation and win-win cooperation with BRI countries and regions.

Among the diversified financial participants, China-headquartered commercial banks actively facilitated development of related companies in the BRI countries and regions and provided financing solutions and comprehensive financial service solutions to the leading businesses of BRI countries and regions which take part in the BRI-related infrastructure projects, introduced Gabriel Wong.

For Industrial and Commercial Bank of China (ICBC), it financed infrastructure, agriculture, and industrial development in the BRI countries and regions mainly with debt financing vehicles such as loans. By the end of 2021, ICBC had operated 125 branches in 21 BRI countries and provided financing for a large number of overseas projects in electricity, telecommunication, railway, port, aviation, shipping, and municipal infrastructure sectors.

Capital market, which functions as the infrastructure for the diversified Belt and Road investment and financing system, also saw ever deepening cooperation between China and countries and regions jointly building the Belt and Road.

In March 2018, China's Shanghai and Shenzhen stock exchanges announced to roll out the pilot "Belt and Road" bond services, encouraging government institutions, companies and financial institutions from the BRI countries and regions and enterprises in China to issue bonds on the two bourses to finance the Belt and Road construction. By the end of August 31, 2021, companies from the BRI countries and regions issued altogether panda bonds in excess of 50 billion yuan, injecting enormous vitality into the Belt and Road construction.

-- Green Belt & Road construction applauded amid broader BRI cooperation

By now, financial institutions in China, represented by policy banks, special investment funds, and commercial banks, have participated in financing a great number of Belt and Road green finance projects.

According to the GIP official website, many financial institutions and companies in China such as Silk Road Fund, China Development Bank (CDB), the Export-Import Bank of China, Agricultural Development Bank of China, ICBC, Bank of China, Agricultural Bank of China, China Construction Bank, Industrial Bank, Hong Kong Exchanges and Clearing Limited, and Ant Financial Services Group have signed up to the GIP to promote green investment.

By linking the capital providers for Belt and Road programs together, GIP leverages more green investment in BRI countries and regions from its signatories via financial means, which helped guide and supervise parties concerned in coping with the carbon emission and environmental pollution challenges, noted Wong.

For example, CDB adheres to the green development concept in serving the Belt and Road construction. The bank supported lots of clean energy and people's livelihood programs. By guiding enterprises to develop, construct and operate projects in accordance with international ecological and environmental protection ideas and rules, CDB aided them to well balance realization of economic benefits, social benefits and ecological benefits as well. (Contributed by Duan Jing with Xinhua Silk Road, duanjing@xinhua.org)

A single purchase

A single purchase