The Ministry of Finance and the General Administration of Customs and the State Taxation Administration jointly issued the notice on the Hainan Free Trade Port's zero-tariff policy for raw and auxiliary materials, releasing the free trade port's first list of zero-tariff commodities.

The notice specifies that import duties, import value-added taxes, and consumption taxes will be exempt for imported raw and auxiliary materials consumed in the importing company's own production process, for import-process-export production activities, or for import-service-export in the process of trade in services or enterprises registered in the Hainan Free Trade Port as independent legal entities, before passing through island-wide customs clearance.

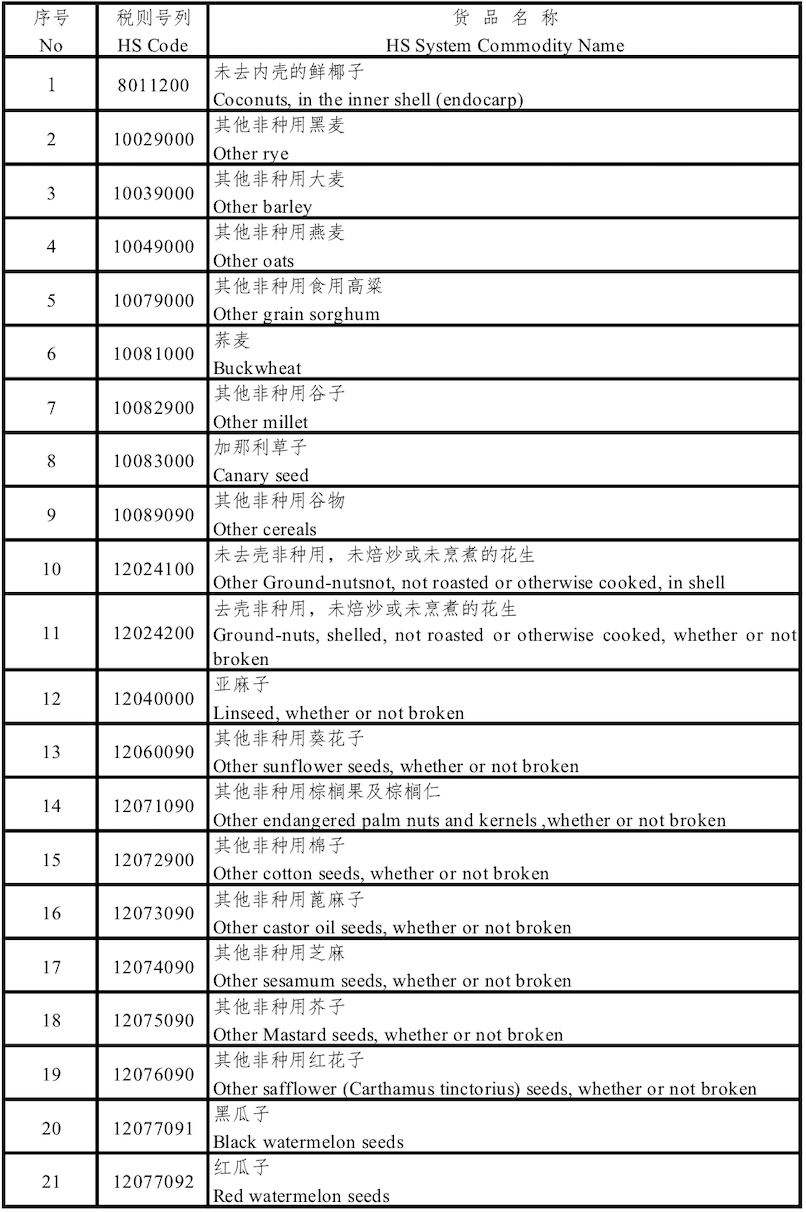

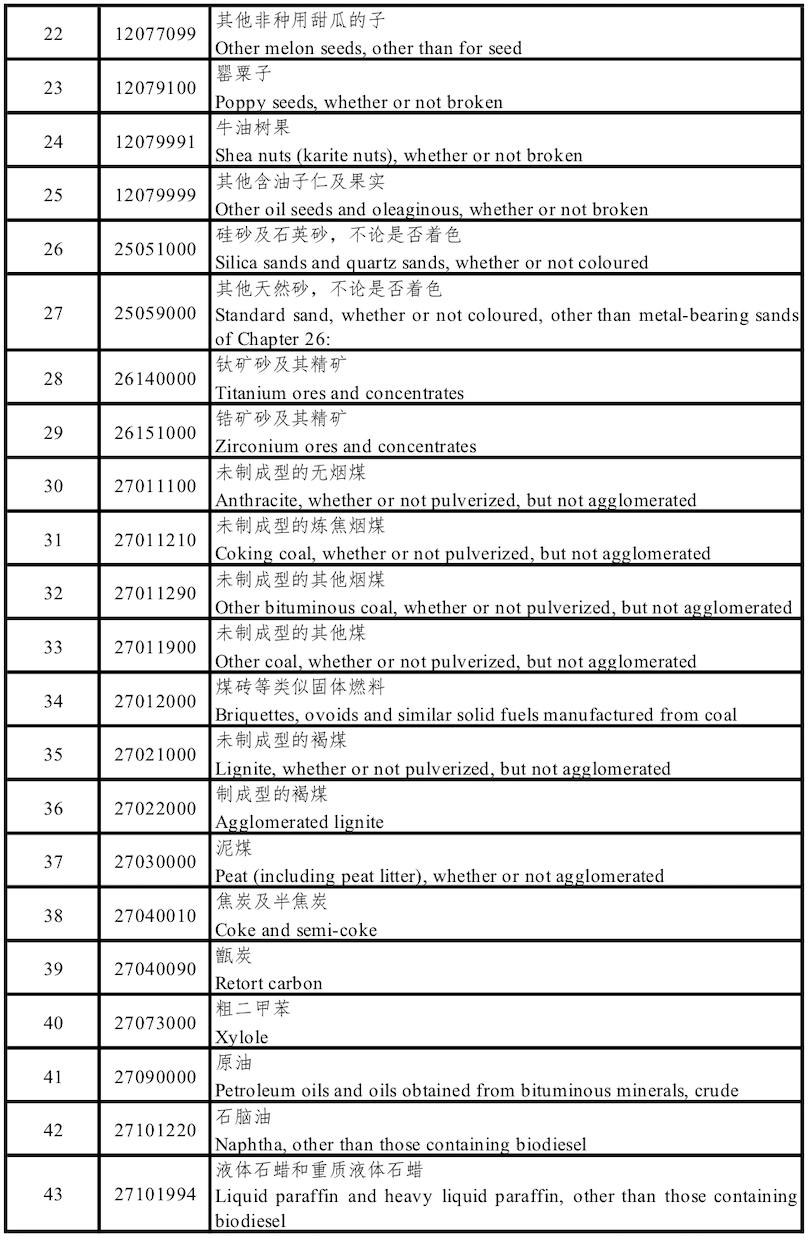

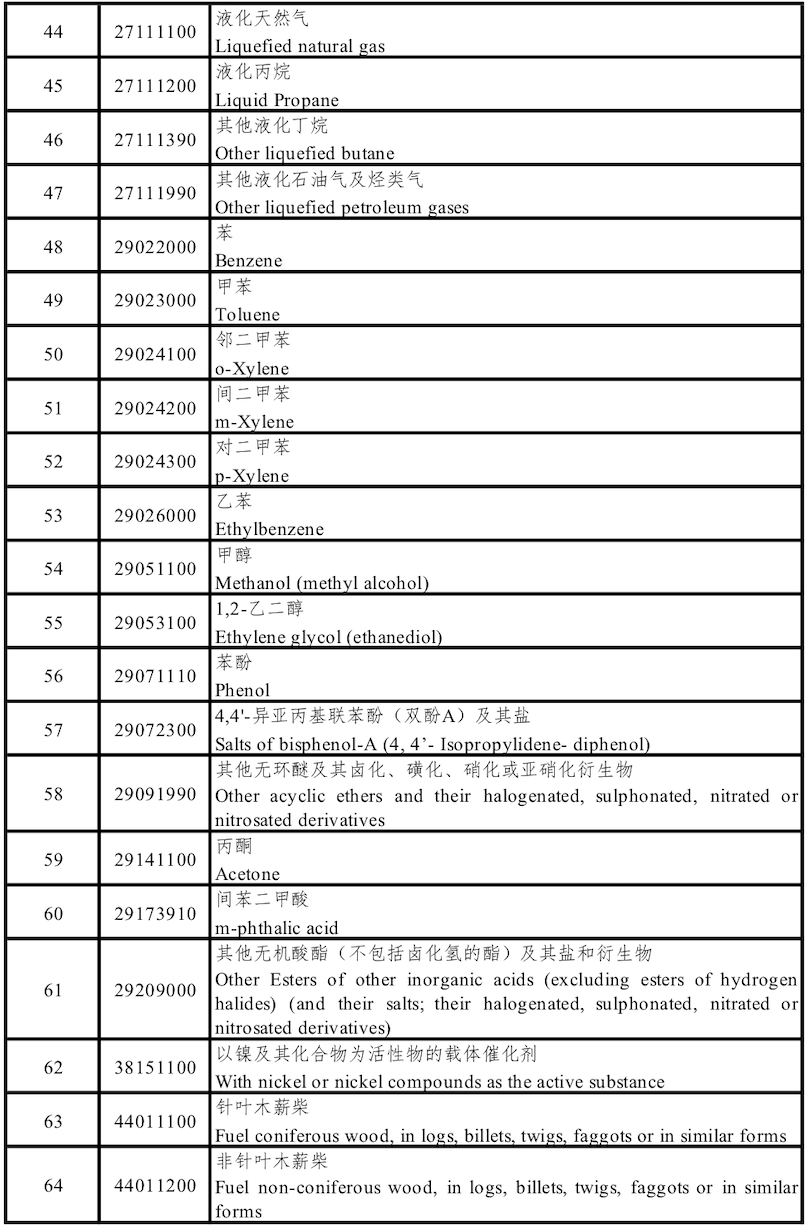

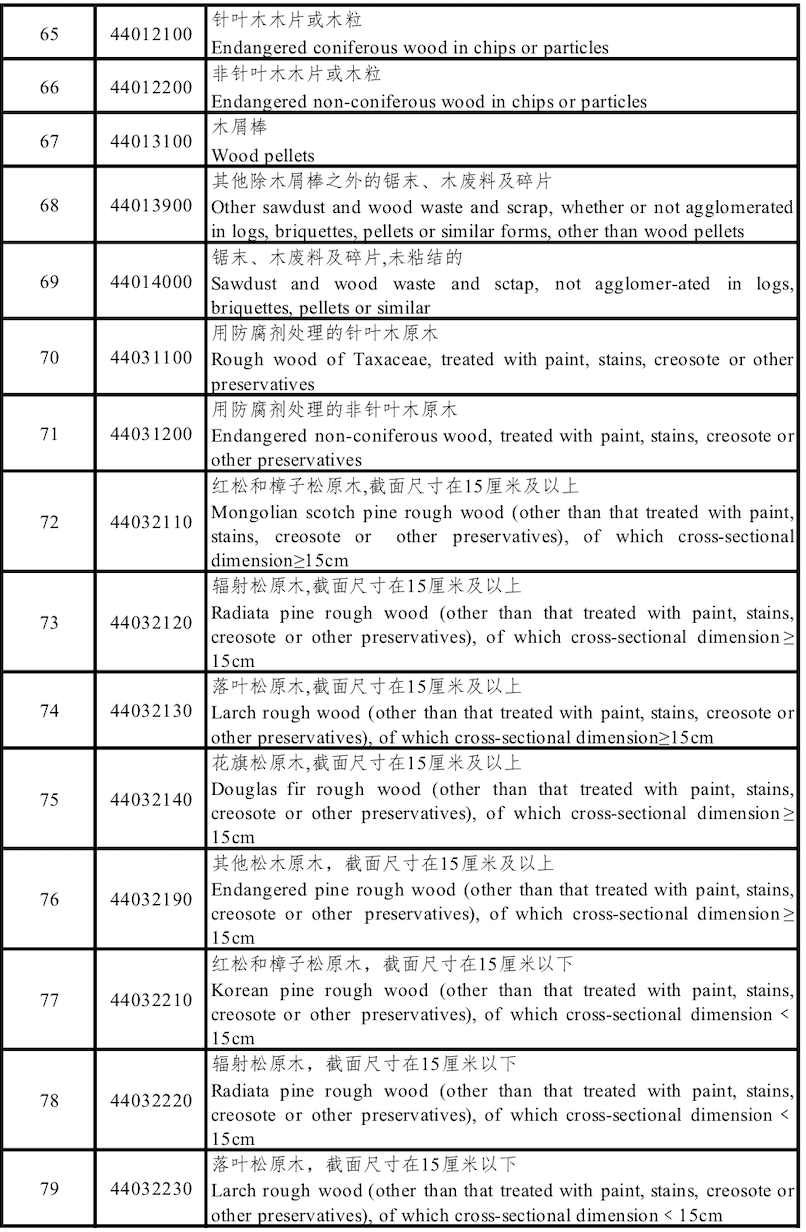

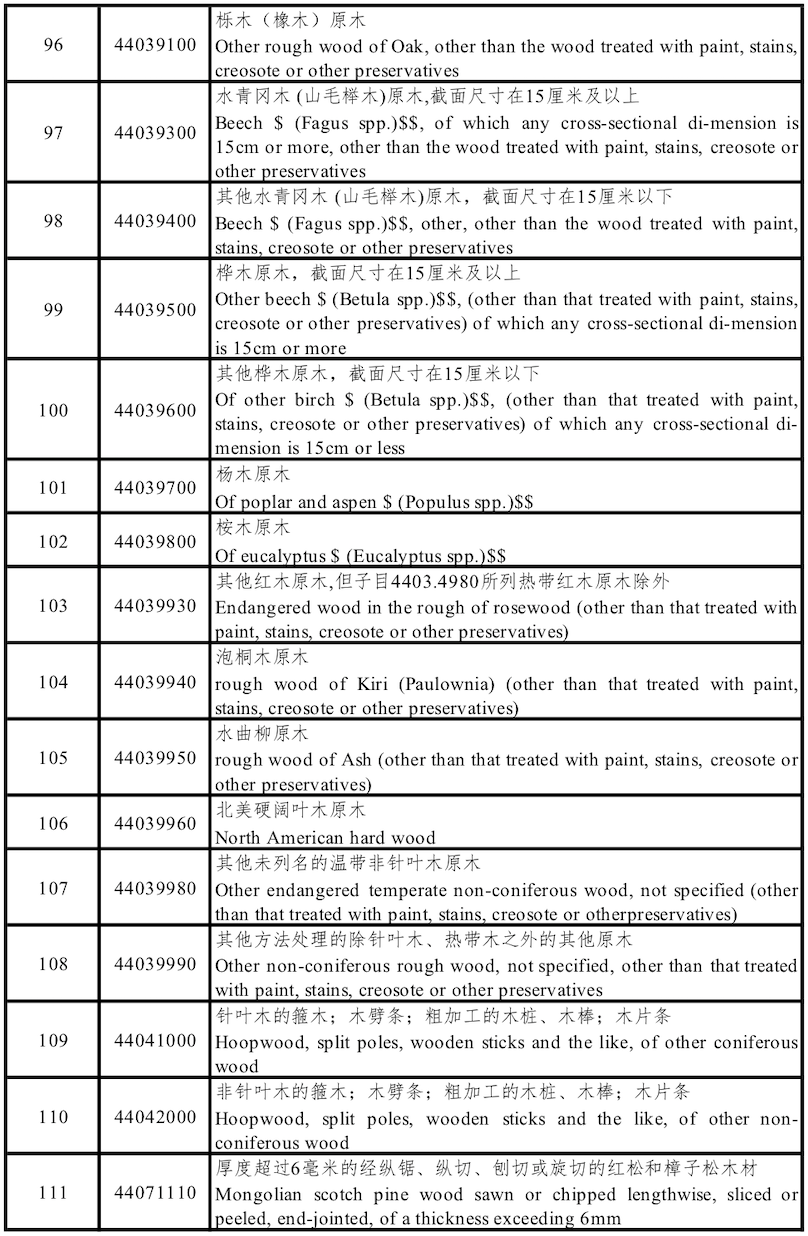

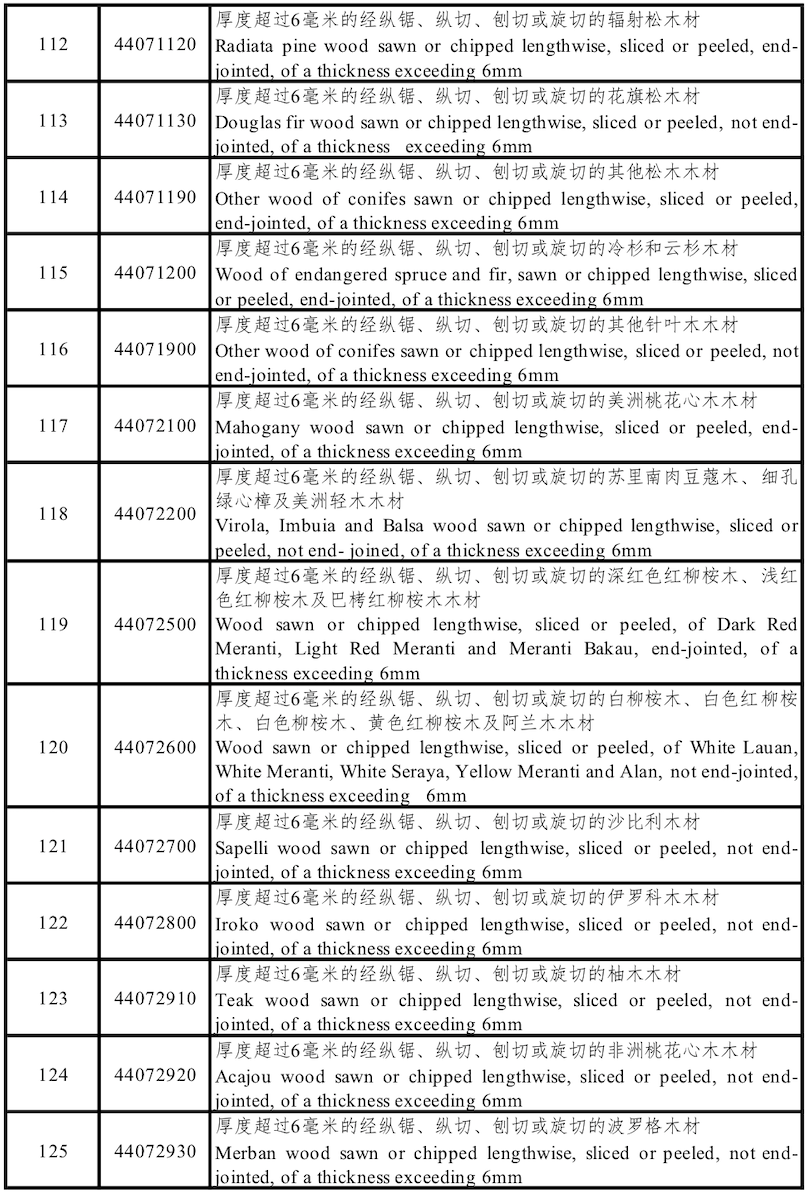

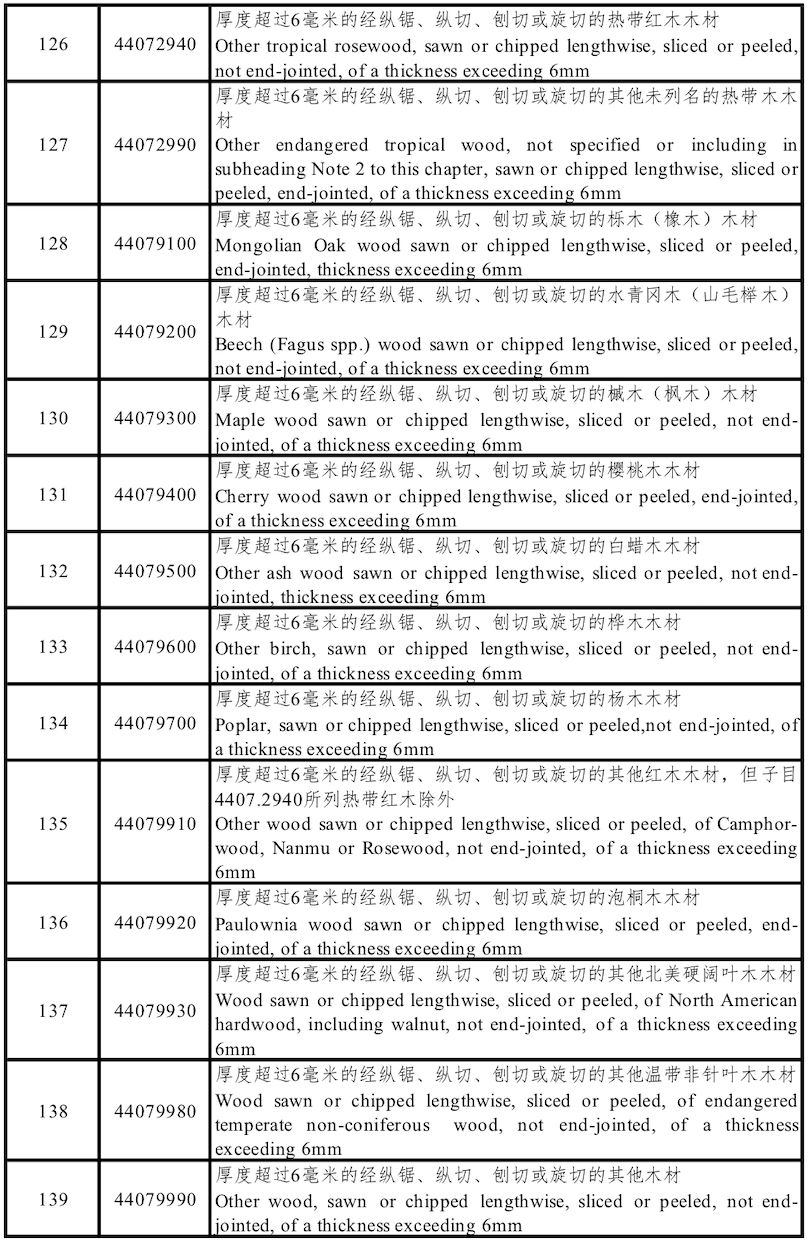

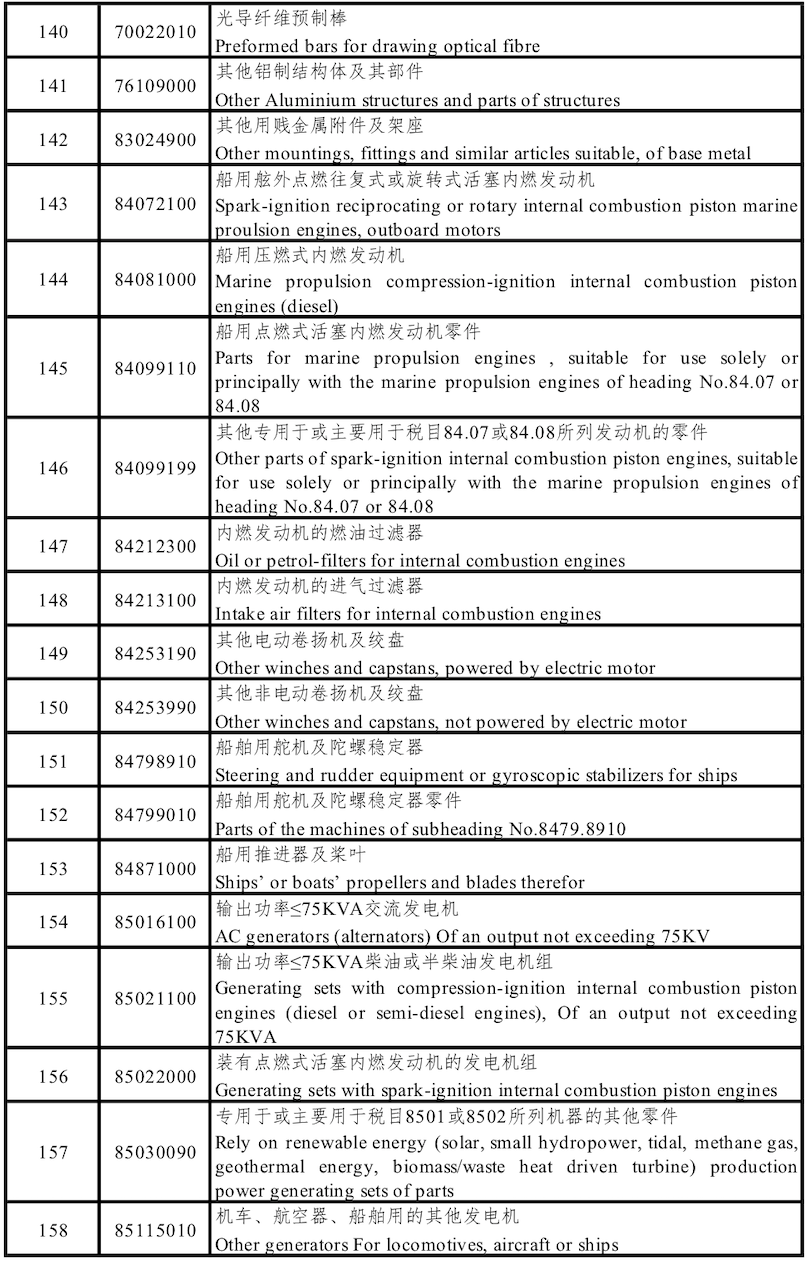

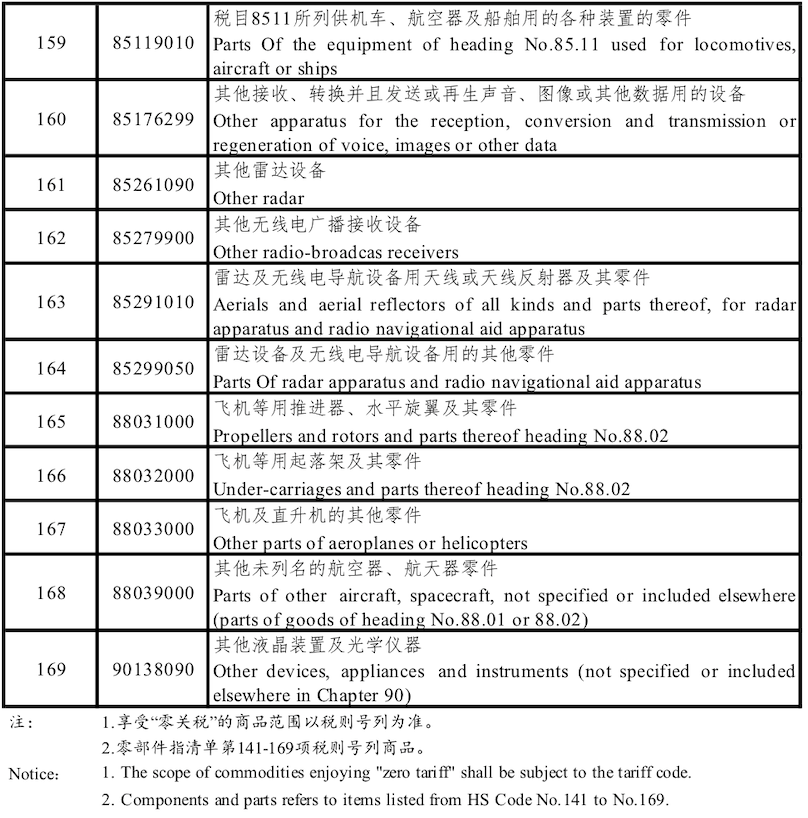

This notice will be implemented from December 1, 2020. The Zero-tariff raw and auxiliary materials are subject to positive list management. The first batch of materials consists of 169 items with eight-digit HS Codes, including agricultural products such as coconuts, resource products such as coal, chemicals such as xylene, performed bars for drawing optical fibre, and more. The contents of the list are dynamically adjusted by relevant departments in accordance with the actual needs and regulatory conditions of Hainan.

The details of Hainan Free Trade Port's zero-tariff policy for raw and auxiliary materials is hereby notified as follows:

1. Before the operation of the island-wide customs clearance, for enterprises registered in Hainan Free Trade Port as independent legal entities, the imported raw and auxiliary materials consumed for own production, for import-process-export production activities, or for import-service-export in the process of trade in service, are exempt from import duties, import value-added taxes and consumption taxes.

2. Zero-tariff raw and auxiliary materials are subject to positive list management, and the specific scope is shown in the appendix. The contents of the list are dynamically adjusted by the Ministry of Finance and relevant departments in accordance with the actual needs and regulatory conditions of Hainan.

3. Parts and components listed in the appendix are subject to the zero-tariff policy for raw and auxiliary materials and should be used for maintenance of aircraft and ship (including maintenance of related parts and components). Should any one of the following conditions be met, import tariffs, import value-added taxes and consumption taxes could be exempted:

(1) Items used to repair aircraft and ships (parts and components included) that enter the border and would be re-transported out of the country;

(2) Items for the maintenance of aircraft (parts and components included) operated by aviation companies whose main operating base is in Hainan;

(3) Items used to repair ships (parts and components included) operated by shipping companies registered in Hainan as independent legal entities and whose port of registry are ports in Hainan Province.

4. Zero-tariff raw and auxiliary materials are restricted to production and use by enterprises in the Hainan Free Trade Port, subject to customs supervision, and are prohibited to be transferred within or leave the island. In case of real necessity for the materials to be transferred or leave the island due to bankruptcy and other reasons, approval must be obtained taxes should be paid. For goods processed and manufactured with zero-tariff raw and auxiliary materials to be sold on the island or in the mainland, import tariff, import value-added tax and consumption tax of the corresponding materials must be paid, and domestic value-added tax and consumption tax shall be collected according to regulations. The export of goods processed and manufactured with zero-tariff raw and auxiliary materials shall be implemented in accordance with current tax policies for export goods.

5. Enterprises importing raw materials listed in the positive list and voluntarily paying import value-added tax and consumption tax can apply at customs declaration.

6. Relevant departments should strengthen supervision through information-based and other means, prevent and control possible risks, promptly investigate and deal with violations, and ensure the smooth operation of the zero-tariff policy for raw and auxiliary materials. Relevant departments of Hainan Province should strengthen information inter-connectivity and share regulatory information on aircraft and ships.

7. This notice will be implemented from December 1, 2020.

Appendix: Hainan Free Trade Port List of Zero-Tariff Raw and Auxiliary Materials

(Source: hiHainan & IEDB)

A single purchase

A single purchase