BEIJING, May 5 (Xinhua) -- The Baltic Exchange has published its weekly report of the dry and tanker markets for April 25-29, 2022 as below:

Capesize

The Capesize market had a positive week overall with the BCI and 5TC route average at 2,003 points and $16,609, closing at 2,136 and $17,713. The first half of the week remained positive amid strong support from the Pacific. The C5 West Australia to China trade continued to climb from last week, but lost ground from the high of $12.245 gradually to below $12 by the weekend. It was reported that in first quarter of 2022, China's iron ore imports from Brazil were down a massive 24 percent year-on-year, which was still significantly higher than the volumes from Australia. Later in the week the market saw increased enquiry from Brazil, as well as west coast Africa. The C3 Brazil to Qingdao run settled at $25.457 on Friday, which was a decline of close to a dollar compared with Monday. The north Atlantic region was generally balanced, brokers said. The market will return on Tuesday after a long weekend in both the east and west.

Panamax

Overall, the Panamax market returned a lacklustre week with momentum lacking. The Atlantic market contracted early on, then rebounded, as the week ended and bids in the north returned a little stronger. An 81,000dwt delivery Continent fixed midweek a fronthaul trip via US Gulf redelivery China at $37,000, typifying the mean average rate for route P2A on the week. Asia, by contrast, had limited support on some of the longer round trips via NoPac and Australia route P3A lost $1,000 over the course of this week. Rates on the shorter Indonesian round trips softened, with talk of an average 76,000dwt giving delivery China rumoured to have agreed a rate in the region of $13/14,000 levels for an Indonesian coal round. Period news remained thin. An 81,000dwt agreed a rate of $30,000 for five to seven months trading at the start of the week, although other activity was very limited.

Ultramax/Supramax

A rather positional market over the last week. Whilst in the Atlantic healthy demand was seen from the US Gulf, other areas had a rather lacklustre feel. Asia also saw split sentiment as from the south little fresh enquiry appeared from Indonesia. Further north, with congestion still being seen in China, fresh tonnage position remained thin. Period enquiry was healthy, a 63,000dwt open China fixing one year at $31,000 and in the Atlantic another 63,000dwt open US Gulf fixing 24 months trading at $24,500. Strongest gains were seen from the US Gulf. A 63,000dwt fixed from here for a trip to Sweden at around $60,000 and there was also healthy demand from North Asia. A 56,000dwt fixed from China to the Mediterranean at $35,000. However, it was a mixed bag from the Indian Ocean. A 57,000dwt open Chittagong fixed via EC India to China in the mid $17,000s during midweek and as the week closed a 63,900dwt was heard fixed delivery Mumbai trip via Arabian Gulf redelivery Chittagong at $38,000.

Handysize

With mainly positive sentiment in both basins, the BHSI made gains. This was largely due to the US Gulf which saw numbers increase day-on-day. A 38,000dwt fixed from Houston to the Continent with an intended cargo of wood pellets at $38,000. And East Coast South also remained positive with a 38,000dwt at Recalada rumoured to have fixed a trip to West Coast South America at $53,000. Another unnamed large handy fixed at around $44,000 for a trip from Recalada to North Brazil. A 37,000dwt fixed from the UK to East Coast Mexico with an intended cargo of fertiliser at $24,000 for the first 40 days and $27,000 for the balance. In South East Asia, a 37,000dwt was fixed via North Australia to China in the high $20,000s. Period activity saw a 32,000dwt open in China fixing three to five months trading at $29,500 and a 37,000dwt in Brazil fixing three to five months at $31,500 both worldwide redelivery.

Clean

Upswings in freight for the majority of CPP vessels this week was highlighted by the BCTI rising 173 points to 1,249. In the Middle East Gulf, firm sentiment and thinning tonnage has driven the LR2s of TC1 75,000 Middle East Gulf / Japan up 72.86 points to WS234.29. The LR1s also followed suit and TC5 55,000 Middle East Gulf / Japan escalated to WS287.14 (+WS75.71). The TC17 35,000 Middle East Gulf / East Africa continued to strengthen this week and rates have jumped again, hiking 83.34 points to WS421.67 and the TCE breaching $40,000 per day. West of Suez, on the LR2s, TC15, the 80,000 Mediterranean / Japan run - after a period of resting at $2.9m - has pushed up to just under the $3.5m mark, seeing the TCE also turn positive (currently +$5,000 per day). The LR1s of TC16 60,000 Amsterdam / Offshore Lomé, have come up around 25 points to just under WS200 mark with a still firming sentiment at time of writing. On the UK-Continent, MRs have been very busy. Both TC2 and TC19 have markedly been the biggest improvers of the week. TC2 rose 96.23 points to WS305.67 and TC19 jumped to WS313.57 (+WS91.43). The USG MR market ticked up after bottoming out midweek. TC14 38,000 US Gulf / UK-Continent came back up 7.14 points to WS176.43 and TC18 the MR US Gulf / Brazil trip also gained an incremental WS4.29 to WS214.29. The MR Atlantic basket TCE rose from $18,510 per day to $31,015 per day. TC9 30,000 Primorsk / Le Havre saw a recharge in activity, coming up WS31.43 to WS350 at the end of week. In the Mediterranean TC6 30,000 Skikda / Lavera’s continued to soften throughout the week losing 75.71 points to WS275.31.

VLCC

The VLCC sector has seen rates softening in all markets this week. A 280,000mt Middle East Gulf/USG (via Cape of Good Hope) fell 3.75 points to a fraction above WS26, particularly after Exxon were reported to have taken an oil trader’s relet on subjects at WS25 to the UK Continent. In the 270,000mt Middle East Gulf/China market rates decreased two points to WS47 (a round trip TCE of minus $2,800 per day), with Unipec again active on this route. In the Atlantic region, the reduced demand has kept rates on a downward trajectory. For the 260,000mt West Africa/China route rates have fallen eight points to the WS48.25 level (minus $1,000 per day round-trip TCE). In the 270,000mt US Gulf/China market the rate has shed $625,000 to settle at the $6m mark (a round voyage TCE of minus $1,200 per day).

Suezmax

Rates for the 135,000mt Novorossiysk/Augusta fell a further 75 points this week and are now assessed at the WS175 level (a round-trip TCE of $62,000 per day). In West Africa the pressure on charterers has eased and the rates continue to decline. A 130,000mt Nigeria/UKC is now valued at 40 points lower than last week at WS78 (a round-trip TCE of just below zero $ per day). For the 140,000mt Basrah/West Mediterranean route, the rates have slipped seven points to WS47 with Petroineos, Hellenic and Exxon reported to have taken vessels on subjects around this level.

Aframax

The 80,000mt Ceyhan/Mediterranean market fell again this week, losing another 16 points to around the WS150 level (a round-trip TCE of $20,100 per day). In Northern Europe the rate for 80,000mt Hound Point/UK Continent came off eight points to WS157.5 (a round-trip TCE of $24,400 per day). In the Baltic Sea the continuing Ukraine crisis keeps Russian crude destined for Far Eastern markets and the assessment for the 100,000mt Primorsk/UK Continent trip is now 225 points lower than last week at WS300 (a round voyage TCE of $108,800 per day). Across the Atlantic, the market continued to trend lower with rates for the shorter-haul 70,000mt EC Mexico/US Gulf route falling 44 points to WS182.5-185 level (a round-trip TCE of $20,600 per day). For the 70,000mt Caribbean/US Gulf trip, rates slipped 43 points this week to the WS177.5-180 region (a round-trip TCE of $20,100 per day). In the 70,000mt US Gulf/UK Continent market, rates are now 20 points lower than a week ago at a fraction above WS167.5 ($16,200 per day round-tip TCE).

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

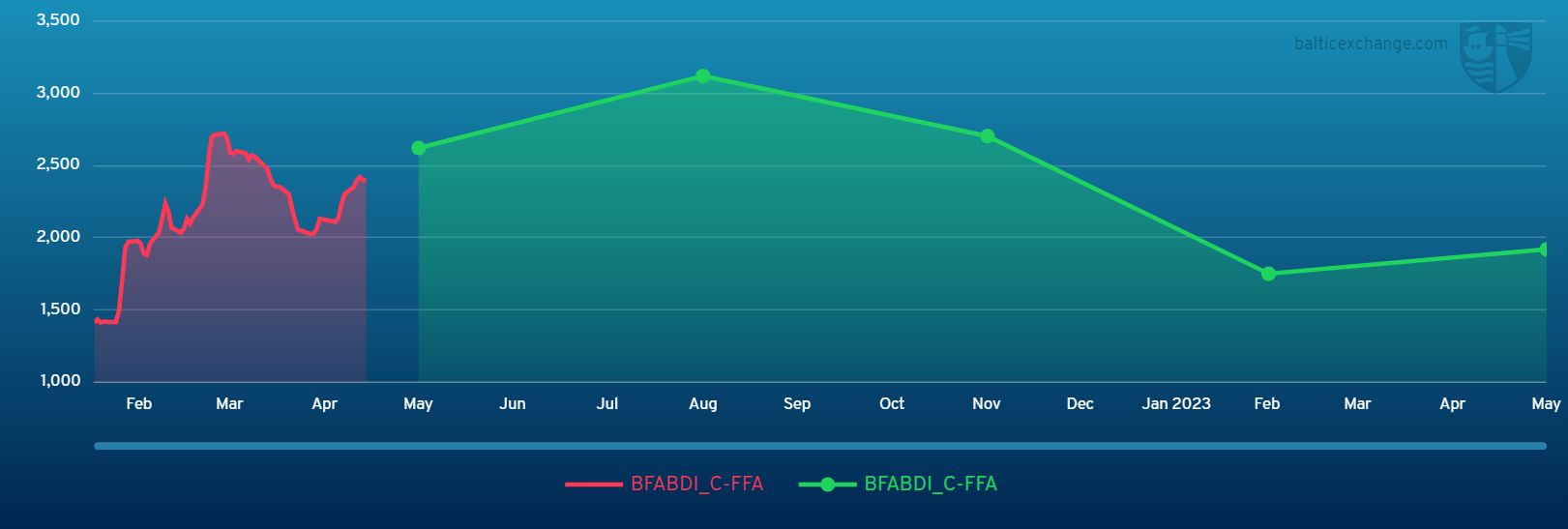

Chart shows Baltic Dry Index (BDI) during April 29, 2021 to April 29, 2022

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of time charter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.

(Source: The Baltic Exchange, edited by Niu Huizhe with Xinhua Silk Road, niuhuizhe@xinhua.org)

A single purchase

A single purchase