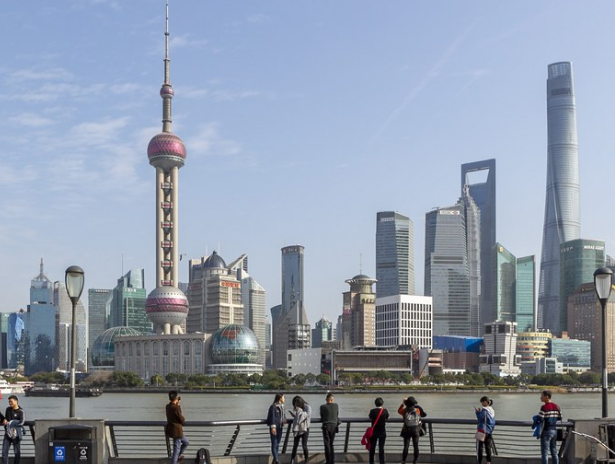

Tourists admire the skyline view of Lujiazui area at the Bund in Shanghai, east China, Jan. 6, 2020. (Xinhua/Wang Xiang)

BEIJING, Sept. 12 (Xinhua) -- Overseas institutional investors increased their holdings of Chinese government bonds in August as the yield remained attractive, official data showed.

By the end of August, the country's central government bonds held by foreign investors surpassed 2.2 trillion yuan (about 340.74 billion U.S. dollars), up 17.3 billion yuan from the previous month, data released by the China Central Depository & Clearing Co., Ltd. (CCDC) showed.

Foreign investors' holdings of bonds issued by China's policy banks topped 1.05 trillion yuan during the period, while their holdings of local government bonds stood at 9.45 billion yuan, the data showed.

The outstanding bonds held by overseas institutional investors reached nearly 3.41 trillion yuan as of the end of August, of which 2.48 trillion yuan was under depository via the Global Connect program and 921.63 billion yuan via the Bond Connect Program, according to the CCDC.

Currently, overseas institutions may access China's inter-bank bond market through the Global Connect (direct holding) or the Bond Connect (multi-tiered custody). Enditem

A single purchase

A single purchase