China CEE Investment Cooperation Fund (The Fund), initiated by the Chinese government, was established in Luxemburg to contribute to the economic growth of the 16 countries of Central and Eastern Europe.

The objective of the Fund is to identify and partner with dynamic businesses and together contribute to the vibrant growth of the CEE economies whilst providing good returns to the investors.

The Fund’s cornerstone investor is Export Import Bank of China and Eximbank Hungary. The Fund’s stage I started formal operation from the beginning of 2014, closing at 435 million US dollars while the planned size was 500 million US dollars. The Fund’s stage II was intended to raise one billion US dollars and is being constructed. The Fund will last for 10 years, of which the first five-year is the period of investment and the second five year is the period for investment exiting, but both of the two periods can be prolonged by one year.

Background

In April 2012, Wen Jiabao, the then Chinese Premier, proposed when he attended the first China-CEE Summit in Warsaw that China would initiate establishment of the China CEE Investment Cooperation Fund (Stage I).

After a year of hard work, the Fund (Stage I) was officially established by China Exim Bank with other institutional investors from the CEE region in November 2013. Later during the second China-CEE Summit, Chinese Premier Li Keqiang announced establishment of the Fund (Stage I), which was written into the Bucharest Guidelines for Cooperation between China and Central and Eastern European Countries, a programmatic document for cooperation between China and CEE countries.

In December 2014, Chinese Premier Li Keqiang announced during the third China-CEE Summit to kick off establishment of the Fund (Stage II), which was also included in the Bucharest Guidelines for Cooperation between China and Central and Eastern European Countries.

Investment Fields

China CEE Investment Cooperation Fund invests in (not limited to) such fields as infrastructure, energy, telecommunication, and special manufacturing in 16 CEE countries. The Fund focuses on investing in brown field projects with stable cash flows and green field projects with high growth potential and an individual investment usually does not exceed 65 million US dollars, and accounts for about 20 percent to 50 percent stakes in the project. The Fund expects around 12 percent rate of returns from each investment.

Portfolios

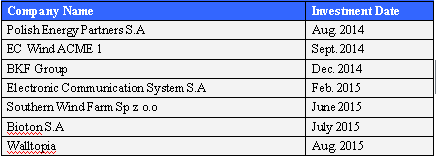

By November 11, 2015, the Fund had completed seven investment deals and exited partially a project.

The following table shows the names of companies that China CEE Investment Cooperation Fund has invested in:

Case Study

The Fund’s first investment came to Warsaw Stock Exchange-listed Polish Energy Partners S.A. During the process, Bank of China’s Poland branch led and participated in a consortium loan provided together with the European Bank for Reconstruction and Development (EBRD) as well as two Polish banks to support the Fund’s first investment, marking the first case of combing investment and lending from a Chinese bank in CEE region and paving the way for Chinese lenders to explore future financing modes.

Advantages

China CEE Investment Cooperation Fund is a government-backed fund, adhering to market-oriented and commercial operation.

The Fund upholds its historical mission as a policy bank on basis of realizing certain investment returns, pays attention to both speed and quality of growth, fund size and returns, development and management in an effort to actively serve the national economic and trade strategies.

It aims to seek fortune in the effective value of invested companies, vigorously optimize invested companies’ capital structure and corporate management, efficiently integrate resources of invested companies so as to produce synergy effect and provide long-term and stable capital for invested firms.

The Fund’s investment in CEE countries has played an active role in supporting Chinese enterprises to “go out”, introducing advantageous products of CEE nations into China, boosting cultural exchanges, improving people’s livelihood and innovating financial cooperation.

A single purchase

A single purchase