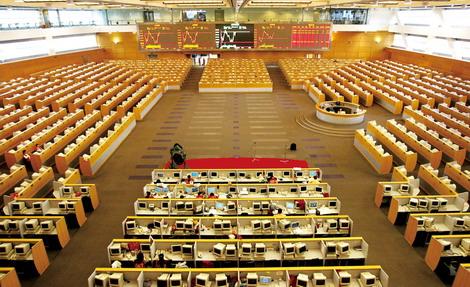

(Shanghai Stock Exchange)

BEIJING, June 6 (Xinhua) -- Nearly seven in 10 Chinese-listed companies on China's NASDAQ-style board are poised to register hefty profits for the first half of this year, casting light on momentum in emerging sectors and the solid economic fundamentals of the country.

As of Monday, nearly 69 percent of 64 Chinese publicly traded companies listed on the ChiNext had forecast profit growth or projected that losses would be transferred to gains in the January-June period, according to data from Choice, a leading financial data provider.

The profitability of listed companies offers insight into broader economic performance, analysts said.

Breakdown figures revealed that only 12 companies, or 18.8 percent of the total, are set to witness profit decreases or go into debt for the first six months, and the remainder have not made profit projections.

Five listed companies, including Zhejiang Jingsheng Mechanical and Electrical, predicted having the potential to at least nearly double their net profits in the first six months.

Zhejiang Jingsheng Mechanical and Electrical, a giant in the photovoltaic industry, forecast its net profit to surge between 70 percent and 100 percent year on year in the first six months, due to rising outlays on research and development.

Smart manufacturing now features on the company's production lines, reducing operational costs and improving work efficiency. Moreover, strengthened efforts on new product design and upgrading in tandem with stock option incentive plans sharpened technological competitiveness.

The company is testimony to Chinese businesses' ascent on the global value chain and the nation's economic restructuring.

China is moving toward an economy boosted by consumer spending, innovation and services, reducing reliance on investment and exports of low value-added goods, all helped by stronger efforts in innovation and research.

Chinese listed companies reported brisk profit growth in 2016, as they ramped up spending on research and development, with emerging sectors outperforming traditional industries.

Combined net profits from growth enterprises listed on the tech and emerging sector-heavy ChiNext board surged 36.7 percent in 2016, faster than the 4.3-percent growth from publicly traded companies on the two main bourses in Shanghai and Shenzhen, according to data from Choice.

On a national scale, China's research and development expenditure rose 9.4 percent in 2016 year on year to 1.55 trillion yuan (about 228 billion U.S. dollars), accounting for 2.08 percent of gross domestic product in 2016, data from the National Bureau of Statistics (NBS) revealed.

Smart manufacturing and emerging sectors such as next-generation IT technology will embrace stellar growth in China over the next decade, and these sectors will all have complete supply chains that will attract massive investment, Guotai Junan Securities said in a report.

"China's transition to slower but structurally rebalanced growth continues," the World Bank said in a recent report.

China's economy expanded 6.7 percent in 2016, the slowest growth rate in over a quarter of a century, but tangible economic restructuring achievements are emerging.

However, some industry observers cautioned that the process of transferring technological innovation into successful products for listed companies would be a bumpy road, with a number of advanced economies striving to be front runners.

"Industrial upgrading and increasing productivity will take many years of reforms, instead of being achieved overnight," said Zhao Yuncheng, a senior official at the NBS.

Moreover, slightly tightened market liquidity and tougher supervision to ward off financial risk weighed on the performance of many listed companies, despite their surging profit growth.

China's benchmark Shanghai Composite Index edged down to 3,091.66 points Monday, from 3,135.92 points on January 3, the first trading day of the year. The ChiNext Index, China's board of growth enterprises, fell to 1,761.25 points from 1,963.26 points over the period.

A single purchase

A single purchase