BEIJING, Sept. 2 (Xinhua) -- The Baltic Exchange has published its weekly report of the dry and tanker markets for August 26-30, 2024 as below:

Capesize

The Capesize market experienced a strong recovery this week after a mixed start partly due to a public holiday on Monday in the UK. In the Pacific, the week began with steady activity, but the market initially showed signs of weakening, with the C5 index slightly dipping to $10,985 on Tuesday. However, from Wednesday onward, the Pacific market surged as all three major miners returned, pushing the C5 index up consistently, reaching $11,635 by Thursday. However, the momentum eased slightly toward the end of the week. In the Atlantic, the market also strengthened throughout the week. Initial optimism was tempered by a softer transatlantic fixture, which led to a drop in the C8 index on Tuesday. However, as the week progressed, the C3 index showed consistent growth, fuelled by strong demand on the south Brazil and West Africa to China markets, ending at $28.00. Overall, the BCI 5TC index rose significantly, ending the week at $25,700.

Panamax

The Panamax market provided further losses this week and is showing little signs of abating. Despite a steady level of activity, this failed to stem the tide with both basins yielding substantial losses. The Atlantic saw rates erode for a further successive week, as pressure from the nearby and committed ships continued to underpin the market. Limited activity from east coast South America, the primary focus being mid-September arrival with the APS load port rates now hovering around the mid $15,000 plus mid $500,000 mark, but with limited activity throughout the week. Asia witnessed similar falls as a lack of demand on the longer round trips remained the nemesis to an already weak market. There were reports midweek of an 82,000dwt delivery from China achieving $10,250 for an Australian round trip, but activity remained light as rates drifted. Period activity remained muted but included reports of an 81,000dwt delivery India achieving $15,400 for one-year employment.

Ultramax/Supramax

Generally the market has seen a mixed affair this week. There was increased activity from the US Gulf and rates had pushed up slightly but options for owners with vessels open from the south Atlantic remained rather limited. A 61,000dwt open Houston fixed via US Gulf to Italy with Petcoke at $22,000. Across the Continent and Mediterranean, there was not much activity and sentiment remained fairly positional. Asia experienced a generally balanced week, despite spot orders having been covered and the cargo book getting shorter as owners are still being chased, which ultimately closed the spread. A 63,000dwt open Qinzhou fixed for trip via Vietnam to Bangladesh with Clinker at $21,000. Period cover was short, with a 63,000dwt open Japan fixing 6/9 months trading $17,850, while a 63,000dwt open Dafeng placed on subjects for 4-6 months $17,850.

Handysize

It was a quite week for the Handy sector, with activity remaining slow across the Continent and the Mediterranean with sentiment appearing positional. A 33,000dwt open Kaliningrad fixing inter-cont at $11,000. The US Gulf kept its positive pace and saw plenty of fixing activity being recorded across all sizes and tonnage started tightening up a touch. A 38,000dwt open Philadelphia heard fixed for Savannah to Continent with wood pellets at $18,000. The south Atlantic remains soft despite some positional fixtures and limited positive signs in sight. In the Pacific market there were little to no changes in the market fundamentals. Overall, rates appeared rather stable this week, although the market felt more supported. On the period market, a 34,000dwt open Vecaruz placed on subjects for short period at $15,100.

Clean

LR2

MEG LR2's once again were subject to downward pressure this week. The TC1 rate for 75Kt MEG/Japan dropped another 14.17 points to WS115.83 while the 90kt MEG/UK-Continent TC20 voyage also dipped by $100,000 to $3,984,560.

West of Suez, the Mediterranean/East LR2's were somewhat muted. The TC15 index came down circa 10% to $2,943,532, a Baltic TCE of just $5,839/day round trip via Suez.

LR1

In the MEG, LR1's did not feel the pressure like their larger siblings this week. The 55kt MEG/Japan index of TC5 remained unchanged at WS138.75 from end of last week. The 65kt MEG/UK-Continent of TC8 managed to climb $148,850 to $3,277,300.

On the UK-Continent, a 60Kt ARA/West Africa run on TC16 also remained flat around the WS127.5 – WS130 level.

MR

For another week the MR's in the MEG remained on their current path. The TC17 35kt MEG/East Africa reflected this by staying at the WS205 level (showing a daily TCE of about $17,710/day round trip)

On the UK-Continent, MR's regained some confidence this week, with reports of available tonnage a little thinner. The 37kt ARA/US-Atlantic coast of TC2 hopped up 15.69 points to WS135.74, which gives a Baltic round trip TCE of $11,956/day and the TC19 run (37kt ARA/West Africa) came up 15.32 points to WS155.62.

Across the Atlantic, the MR's began to come off a tick this week. TC14 (38kt US-Gulf/UK-Continent) lost 12.5 points to WS154.29 (about $16,000/day basis a round trip TCE). The 38kt US Gulf/Brazil on TC18 went from WS232.5 to WS204.2, erasing last week's improvement, (a daily round trip TCE of $34,808) and the 38kt US-Gulf/Caribbean of TC21 closed 20% lower than last week at $639,286.

Handymax

In the Mediterranean, 30kt Cross Mediterranean (TC6) took a heavy downward blow to the tune of 57.55 points this week to close at WS151.78. In northwest Europe, the TC23 30kt Cross UK-Continent added 21.34 points to its value taking it to WS155.61 with higher levels reported on subjects at time of writing.

VLCC

The VLCC market softened again across this week. This was seen in the MEG by the TD3C benchmark of 270,000 mt Middle East Gulf to China falling through the WS50 mark by 7.65 points where it is currently assessed at WS44.7. This level generates a daily round-trip TCE of $20,733 basis the Baltic Exchange's vessel specification.

In the Atlantic, the Baltic routes were also subject to downward pressure. The 260,000mt West Africa to China came off by 7.5 points to WS49.72 showing a round voyage TCE of $26,651/day. The rate for 270,000mt US Gulf to China shed $250,000 of its value from this time last week. It is currently pegged at $7,300,000 corresponding to a round-trip daily TCE of $31,856.

Suezmax

The Suezmax market in West Africa continued its positive movement up this week. The rate for 130,000mt Nigeria to UK Continent went from WS78.61 to WS82.36 (a daily round-trip TCE of $27,699). In the Mediterranean and Black Sea area the rate for 135,000mt CPC/Mediterranean TD6 route held resolute around the WS87.5 level for the (showing a daily TCE of about $23,299 round-trip). In the Middle East Gulf, the mark for 140,000mt Middle East Gulf to the Mediterranean (via the Suez Canal) closed 2.06 points higher that this time last week at WS93.28.

Aframax

In the North Sea, the rate for the 80,000mt Cross-UK Continent continued along its current WS120 trajectory (a daily round-trip TCE of $24,448 basis Hound Point to Wilhelmshaven).

In the Mediterranean market, the rate for 80,000mt Cross-Mediterranean dropped consistently across the week by nine points to WS113.5 (based on Ceyhan to Lavera gives a Baltic TCE of $21,435 daily round trip).

Over in the US Gulf region, rates also dipped this week. For the 70,000mt east coast Mexico/US Gulf (TD26) the assessment was 10.93 points lighter that last week at WS101.88 (a daily TCE of $11,786 round trip) and the rate for 70,000mt Covenas/US Gulf (TD9) was 10.32 points down on last Friday's rate at WS100.31 (a round-trip TCE of $11,602/day). The rate for the cross-Atlantic route of 70,000mt US Gulf/UK Continent (TD25) dropped by 2.64 points to WS133.36 (a round trip TCE of $26,445/day basis Houston/Rotterdam).

LNG

The Pacific market has had a particular slow down this last week. Fewer enquires were reported and with the tonnage list steadily increasing there is a lacklustre sentiment going into the final quarter of the year. Rates for spot enquiry have gradually fallen, and there seems no rush to take an axe to levels but the sentiment driving it is steadfastly looking weaker. For Aus-Japan BLNG1 both the 174cbm and 160cbm lost $2,400 giving a close of $77,000 and $63,400, respectively. Across the Atlantic BLNG2 Houston-Cont saw small losses pushing the rates down but both ships hovered around similar open levels. The 174cbm closed at $60,500 while the 160cbm finished at $47,000 giving a steady delta of between $13-14,000 for the more modern ships. BLNG3 Houston-Japan saw the greatest fall this week but intra-Basin activity has been very quiet of late and with more ships this is to be expected. The 174cbm fell by $2,600 while the 160cbm fared worse losing $4,000 with both closing at $80,000 and $63,000, respectively.

Period on the short term has been quiet, with the six-month period fell by the greatest margin for many weeks losing $8,150 to publish at $94,000. Although there has been reports of several longer term enquiry both the one-year period and three-year period fell with the one-year publishing at $78,375 and three-year term at $83,600.

LPG

There are market lulls and then there are summer market lulls. With only one reported fixture out of the MEG this week, rates did very little, shifting only 8 cents to a close of $64.083 up from $64. The TCE earnings as a result remain largely unchanged with a loss of only $915 and a close of $43,243.

Out across the Atlantic, despite more activity, you can count the amount of fixtures on one hand. Rates moved a little more positively, gaining $2.25 for BLPG2 Houston-Flushing and a close of $67, giving a daily TCE earning equivalent of $69,118. BLPG3 Houston-Chiba moved little up only $1.167 to a close of $118,667 and a loss (if minimal) on the TCE brought it to $48,203.

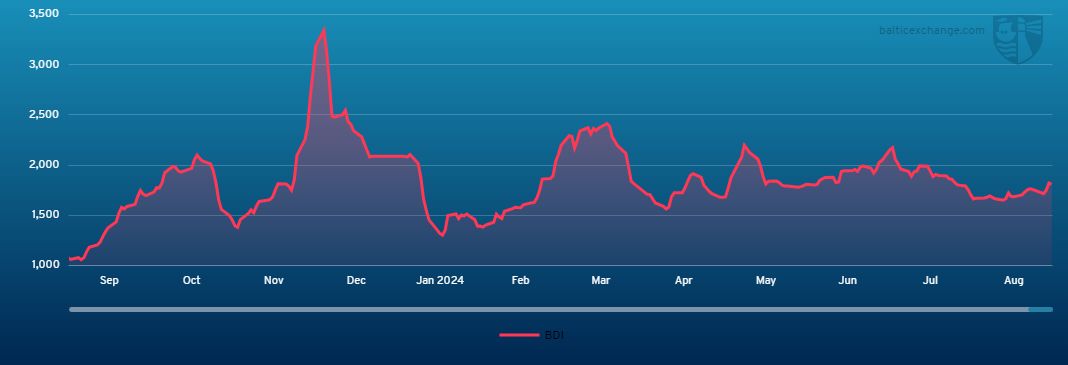

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

Chart shows Baltic Dry Index (BDI) during Sept. 1, 2023 to Aug. 30, 2024

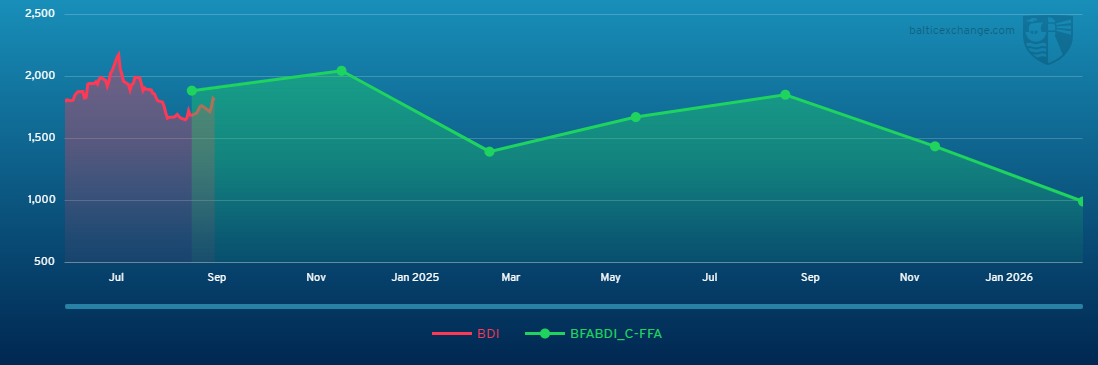

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of time charter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.

(Source: The Baltic Exchange, edited by Niu Huizhe with Xinhua Silk Road, niuhuizhe@xinhua.org)

A single purchase

A single purchase