BEIJING, Sept. 19 (Xinhua) -- The Baltic Exchange has published its weekly report of the dry and tanker markets for September 12-16, 2022 as below:

Capesize

The Capesize market made a revival this week, taking fortunes out of the red by rising the tide on values to be closer to the low-teens level on the 5TC. Far from being into smooth-sailing territory yet, the market doesn’t seem quite ready to embrace ever strengthening levels as Friday’s index dampened values down 981 to $12,599. The revival in rates has involved most sectors of the market as a surge of cargoes came to market as charterers feared a last chance saloon situation before rates did a common Capesize blast off. The Transatlantic C8 rose 223 week on week to close at $12,417. The Pacific region had to contend with Typhoon Muifa this week as it caused disruption to vessel schedules off the coast of China, particularly Shanghai. The Transpacific C10 closed the week of Friday down 3,327 to $12,559. The sentiment in the Capesize market has clearly improved with many optimistic for further lifts from here.

Panamax

The Panamax market began the week on a firm footing with the continued bullish trend carrying on from the back of last week's push. The Atlantic was mostly EC South America centric with both September and October arrivals getting snapped up in the early part of the week. Similarly in Asia, with support for both NoPac grains and Australia minerals, this gave some impetus to the market Monday/Tuesday. With healthy Indonesia demand continuing in Southeast Asia positions, there was good demand from all angles. However, come midweek, with a host of fixing and failing in both basins owing to an FFA sell off, the market appeared exposed once more with tonnage count building again in the Atlantic. Meanwhile, something of a stand-off ensued in the Pacific with neither side willing to concede. Period activity increased early part on the back of a firm spot market with a smattering of short period deals around the $17-18,000 mark.

Ultramax/Supramax

It has been mixed fortunes as stronger rates were seen in Asia at the beginning of the week. However, as the week closed some participants said pressure eased a little as limited fresh enquiry entered the market. The opposite might be said for the Atlantic, which saw positive momentum gain from key areas such as the US Gulf as the week progressed. Little period activity surfaced but a 63,500dwt open Black Sea was heard to have been fixed for one year in the low $16,000s. From the Atlantic, stronger cargo flow saw a 57,000dwt covering a trip delivery US Gulf redelivery India in the mid $20,000s. Elsewhere, a 55,000dwt was heard to have been fixed for a trip from the Mediterranean to the US Gulf in the low $20,000s. From Asia, a 58,000dwt open Singapore fixed a trip via Indonesia redelivery Philippines at $20,000. A 57,000dwt also open Singapore fixed a trip via Indonesia redelivery China in the low $19,000s.

Handysize

A week of positivity across both basins. East Coast South America continued to make large gains as sources spoke of more enquiry and a lack of prompt tonnage being significant factors. A 36,000dwt was rumoured to have been fixed for a trip from Recalada to North Brazil at $19,000 in the early part of the week and levels are believed to be in the low $20,000’s as the week drew to a close. The US Gulf also saw more activity, with a 39,000dwt being fixed from Port Canaveral to the UK-Continent range with an intended cargo of wood pellets at $17,000. In the Mediterranean, a 35,000dwt fixed from Iskenderun to West Africa with an intended cargo of steels at $17,000. In Asia, there were small gains in most regions with sources saying they had seen more enquiry this week. A 28,000dwt fixing from Singapore via Western Australia to Japan was fixed at $17,500.

Clean

Middle East Gulf LR CPP freight climbed early on and then began to fall after plateauing this week. TC1 peaked at WS293.13 after a widely reported fixture was done at WS295 and the index then dropped back down to the WS287.5 level. Similarly, a run west on an LR2, TC20 capped out at the $5,600,000 level then dropped to $5,450,000. The LR1s also followed suit this week with TC5 climbing to just over the WS240 mark midweek then dropping back down into the high WS230s. On a voyage to the UK-continent, TC8 hopped up to the $4,700,000 mark to then resettle at $4,600,000. The MRs of TC17, by comparison, have come off significantly. This is a result of tonnage availability increasing across the week, the index lost 106.66 points to end up at WS411.67.

In the West, the LR2s have seen some good activity this week. TC15 has added $104,167, bringing the index up to $4,487,500 by the end of the week. The LR1s of TC16 have been relatively subdued and the benchmark lost 8.93 points to WS216.43.

MRs on the UK-Continent saw consistent fixing activity this week pushing fixing rates upwards. TC2 surged 51.11 points to WS284.44 and likewise TC19 appreciated to WS293.57 (+52.5).

In the US-Gulf, the MRs were fiery early in the week with sentiment and activity driving rates upwards only to then recorrect back down. TC14 settled at WS287.5 end of the week after reaching WS305. Similarly, TC18 reached WS408.33 to then end up at WS388.33. At these levels TC14 is achieving a round-trip TCE of over $30,000 /day and TC18 $48,000 /day.

Handymax’s in the Mediterranean saw a resurgence this week with TC6 gaining 30.63 points to WS218.13. In the Baltic TC9 dropped to WS326.79 (-14.64).

VLCC

VLCC rates turned around this week by recovering all the recent lost ground and continuing to head upwards. For the 270,000mt Middle East Gulf/China route almost 8.5 points was added at the latest assessment of WS88 (a round-trip TCE of $50,600 per day), while the rate for 280,000mt Middle East Gulf/USG (via Cape of Good Hope) gained 4.5 points to WS49.

In the Atlantic, rates for 260,000mt West Africa/China were catapulted 9.5 points up to almost WS89 (about $52,500 per day round-trip TCE). For the 270,000mt US Gulf/China market, rates continued on the upward trajectory and are now $818,750 firmer at $9,937,500 (showing a round-trip TCE of $41,700 per day).

Suezmax

Rates for 135,000mt Black Sea/Augusta picked up this week, gaining almost 6.5 points to a shade over WS182.5 (a round-trip TCE of $74,500 per day). For the 130,000mt Nigeria/UKC trip rates climbed nearly 10 points to in excess of WS135 (a round-trip TCE of about $39,000 per day). In the Middle East, the rate for 140,000mt Basrah/West Mediterranean continued to hover around the WS64-65 level.

Aframax

The Mediterranean market continued to slide downwards early in the week. However, it is now starting to show signs of recovery. The rate for 80,000mt Ceyhan/West Mediterranean dipped to about WS145 early on, and is now assessed at about WS149 (a round-trip TCE of $27,100 per day) – still showing a nett loss of 6.5 points week-on-week. In Northern Europe, the market eased with the rate for 80,000mt Hound Point/UK Continent slipping three points to just below WS151 (a daily round-trip TCE of $30,300) and the rate for 100,000mt Primorsk/UK Cont route coming down 2.5 points to between WS177-180 region (a round trip TCE of $47,800 per day).

Across the Atlantic, the market has bounced back after stagnating. The rate for 70,000mt EC Mexico/US Gulf rose 28 points to WS 285 (a round-trip TCE of $66,200 per day). For the 70,000mt Caribbean/US Gulf trip the rate improved 25.5 points to between WS265-267.5 (a daily round-trip TCE of $54,900). For the Transatlantic route of 70,000mt US Gulf/UK Continent, the rate climbed 15 points to WS225 ($41,500 per day round-tip TCE).

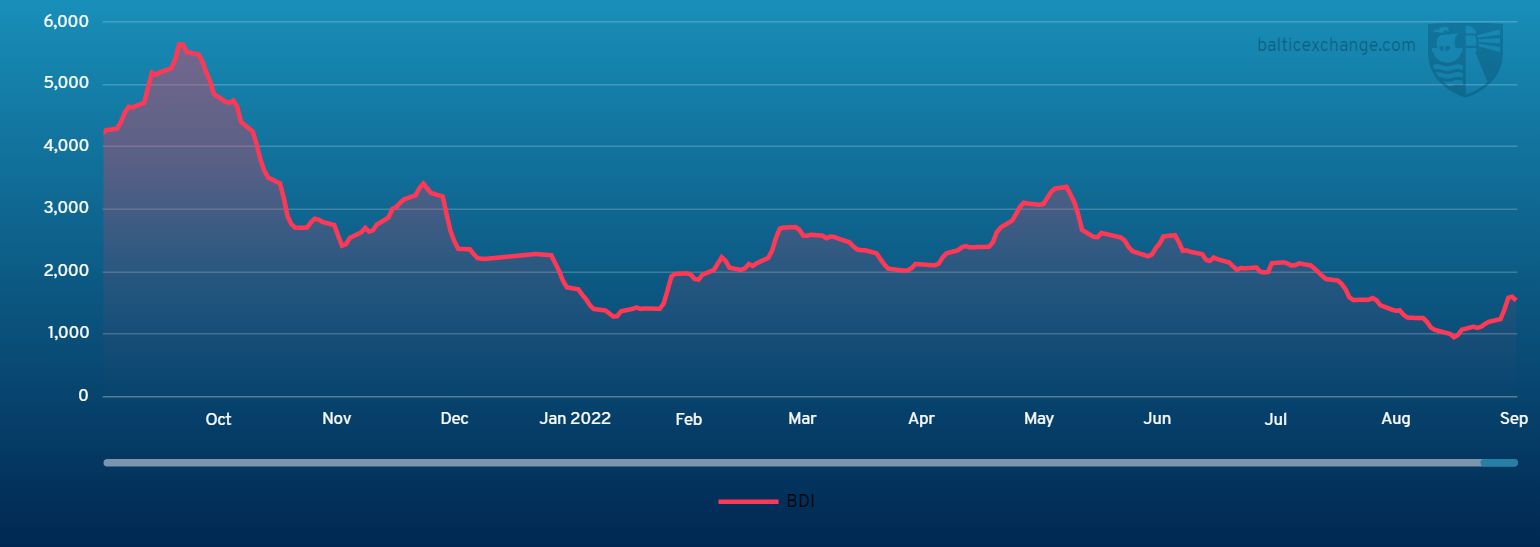

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

Chart shows Baltic Dry Index (BDI) during September 17, 2021 to September 16, 2022

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of time charter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.

(Source: The Baltic Exchange, edited by Niu Huizhe with Xinhua Silk Road, niuhuizhe@xinhua.org)

A single purchase

A single purchase