BEIJING, April 24 (Xinhua) -- The Baltic Exchange has published its weekly report of the dry and tanker markets for April 18-22, 2022 as below:

Capesize

After several weeks of relatively flat price movement, the Capesize 5TC market has started to show a little positive sentiment with levels pushed to $15,299. Fixture activity on the whole has not been very eventful, yet the Pacific C5 West Australia to Qingdao route was up 0.773 today to $10.741 and has steadily improved over the week. Meanwhile, the cargo to vessel ratio in the Atlantic is said to have tightened - especially for prompt positions. The transatlantic C8 has risen 2,250 week on week, to settle now at $11,625. Further south in the Atlantic from Brazil, the voyage route C3 Brazil to China currently prices at $26.04 as activity is ticking over although is largely underwhelming. The Capesize market is definitely improving in sentiment, which is a welcome sight for many. However, with the lockdown situation in Shanghai, the Capesize main destination market is unable to fire on all cylinders placing somewhat of a cap on trade at this time.

Panamax

It was a limited week of trading due to Easter holidays in many regions. A gradual decline across all rates in the Atlantic this week was caused by minimal fresh demand with wide disparity between the bid/offer spread throughout the week. Those owners forced to fix prior to the weekend reluctantly reduced offers with Charterers seemingly holding firm. Typically, the transatlantic round trips hovered around the $27,000 mark with several deals concluded at or around this level. Asia similarly returned a lethargic week overall, with something of a split two-tier market. The Southern region was largely under pressure, with many smaller/overage ships discounting rates for the limited Indonesia coal trips. Further North, there were glimpses of support found ex NoPac as well as the coal trips ex Australia to India, highlighted by an 82,000dwt delivery China agreeing a rate of $25,000 for a NoPac trip and a 74,000dwt delivery China fixing $15,500 for a trip via Indonesia redelivery Vietnam.

Ultramax/Supramax

With many countries enjoying Easter celebrations, the information flow was rather slow. However, key areas saw increased positive sentiment with demand returning from the US Gulf and Asia. Period cover was sought and an Ultramax open China was fixed for four to six months trading at around $34,000. In the Atlantic, the main focus was from the US Gulf which saw increased fresh enquiry. A 63,000dwt fixed Delivery SW Pass trip to Egypt at $45,000. Elsewhere, a 55,000dwt open West Africa was fixed via South Africa redelivery China at $28,750. Stronger demand in Asia helped rates. A 61,000dwt fixed delivery Kosichang trip via Indonesia redelivery Cambodia at $32,000. Brokers said further north there had been an increased level of NoPac business. However, fixtures were kept under wraps. A rather flat week in the Indian Ocean, but a 56,000dwt was fixed delivery Fujairah trip via Arabian Gulf redelivery Bangladesh at $38,000.

Handysize

It was a short week for many, but the BHSI made some positive gains after a period of negativity. Brokers spoke of more enquiry in East Coast South America in recent days. A 33,000dwt fixed from Vitoria to East Coast Mexico at $35,000 and a 40,000dwt was rumoured to have been placed on subjects for a trip from Recalada to Algeria at $40,000. In the US Gulf a 38,000dwt was fixed from the US Gulf to Spain in the upper $20,000s. In Asia, a 28,000dwt open in North China was rumoured to have been placed on subjects for a trip to Southeast Asia with an intended cargo of steels at $21,000. A 35,000dwt open in Southeast Asia fixed a trip to US West Coast in the Low $30,000s. Period was also active with a 28,000dwt open in Japan in early May fixing four to six months at $25,000.

Clean

An upturn in freight this week in the Middle East Gulf. The LR2s of TC1 75k Middle East Gulf / Japan came up 10.71 points to WS148.57. The LR1s also jumped and TC5 55k Middle East Gulf / Japan is currently WS193.57 (+29.64) and a trip west (TC8) has breached the $3m mark, now up to around $3.2m and looks to be firm at time of writing.

The MRs of TC17 35kt Middle East Gulf / East Africa were very active this week and rates have ticked up again. The index is currently WS327.08, up 16.25 points and a TCE of 26,000 $/day. West of Suez, on the LR2s, TC15 80k Mediterranean / Japan has retested up after a period of relatively unclear activity. A couple of voyages fixed at $2.9m this week. The LR1s of TC16 60k Amsterdam / Offshore Lomé have also rallied and hit WS175 this week.

On the UK-Continent, MRs have seen incremental softening. Both TC2 and TC19 have come down around 8.5 points to WS205.28 and WS215.71 respectively with the delta between the two routes stable at its usual 10 points. The USG MR market has fallen this week almost to mirror the extraordinary rise it took before the long easter weekend. TC14 38k US Gulf / UK-Continent slumped 82.86 points to WS185.71 and TC18 the MR US Gulf / Brazil trip also had a large chunk taken out of it and is now marked at WS235.71 (-77.86). The MR Atlantic basket TCE dropped from $36,085/day to $20,959/day. TC9 30kt Primorsk / Le Havre has been relatively stable for the most part, only losing 6.43 points to WS313.57. In the Mediterranean TC6 30kt Skikda / Lavera’s downward trend continued to WS371.88 (-20 points) but it is still rendering a round trip TCE of just over $60,000 / day at present.

VLCC

A shortened week has seen tonnage lists built and sentiment has weakened. For 280,000mt Middle East Gulf / USG (via Cape of Good Hope) the rate has fallen almost two points and is now assessed at WS30. Meanwhile, in the 270,000mt Middle East Gulf/China market, rates have also eased two points to around the WS50 mark (a round trip TCE of minus $1,800 per day), with Unipec reported taking a Maran vessel and a VL8 Pool ship at WS50.

In the Atlantic region, demand has reduced and rates came under pressure. For the 260,000mt West Africa / China route, where there has been limited fixture activity this week, rates fell from low-mid WS60s last week, through the WS60 mark earlier this week and are now assessed at WS57 ($7,000 per day round-trip TCE). In the 270,000mt US Gulf / China market, rates suffered a similar fate having fallen back through the $7m mark to now be assessed at $6,775,000 (a round voyage TCE of $3,900 per day).

Suezmax

Rates for the 135,000mt Novorossiysk / Augusta eased 25 points since Tuesday and are now assessed at just under WS270 (a round-trip TCE of $127,100 per day). After the recent upward pressure caused by the US Gulf and Caribbean markets eased, rates for 130,000mt Nigeria/UKC have dropped about 40 points this week to WS122.5 /123 level (a round-trip TCE of $22,000 per day). For the 140,000mt Basrah / West Mediterranean route the rates have slipped from Tuesday’s WS62.5 to the latest assessment at WS56, as Turkish refiners were reported to have fixed a modern Greek vessel at WS55 for a voyage to Turkey.

Aframax

The 80,000mt Ceyhan / Mediterranean market fell hard, losing over 60 points this week to WS172.5 (a round-trip TCE of $28,600 per day). In Northern Europe the rate for 80,000mt Hound Point / UK Continent shed 13 points since Tuesday to WS168 (round-trip TCE of $28,700 per day).

In the Baltic Sea markets, as the Ukraine crisis continues, Russian cargo owners are still having to seek buyers from countries such as India and China. One Russian charterer reported fixing an overaged Greek vessel at $12m from Ust Luga to North China. For the 100,000mt Primorsk / UK Cont trip, demand for tonnage has understandably significantly reduced. Tied with less of a need for ice-class Aframaxes and a building position list, sentiment has pushed rates back down through the WS600 mark and the latest assessment is at WS573.75 (a round voyage TCE of $261,400 per day).

Across the Atlantic, the market has also turned downwards with rates for the shorter-haul 70,000mt EC Mexico / US Gulf route falling 12.5 points since Tuesday to WS240 (a round-trip TCE of $40,900 per day). For the 70,000mt Caribbean/US Gulf trip, rates slipped eight points this week to WS233 (a round-trip TCE of $35,400 per day). In the 70,000mt US Gulf/UK Continent market, rates shifted 12.5 points lower to WS204 ($26,300 per day round-tip TCE).

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

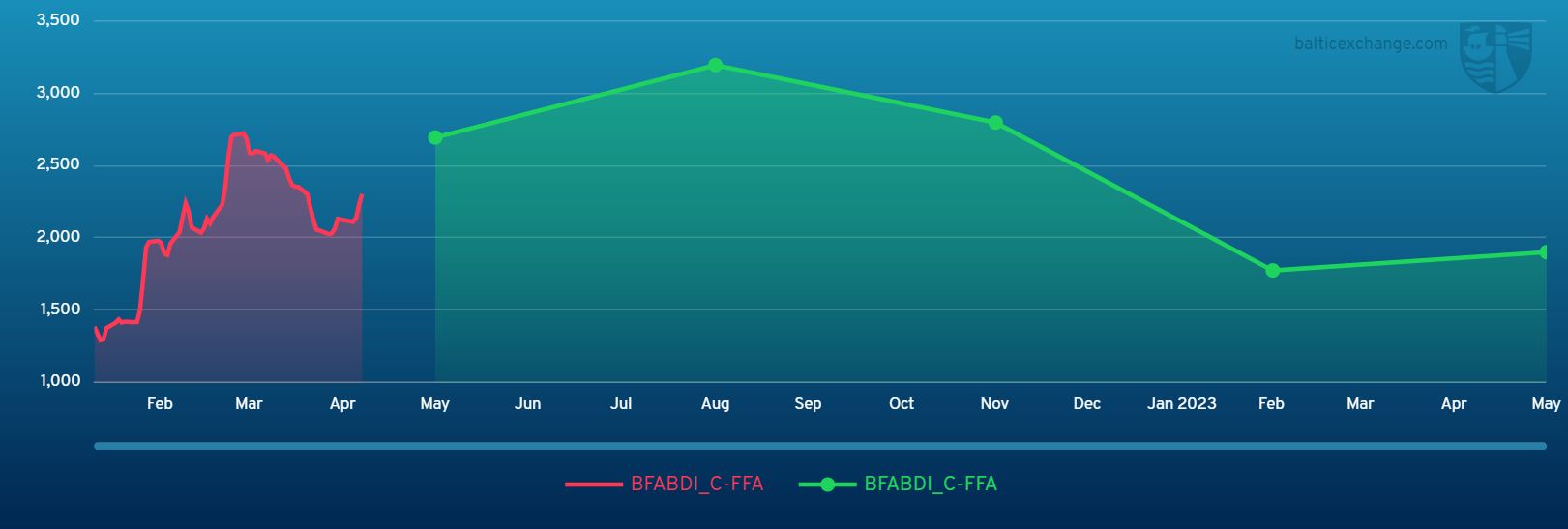

Chart shows Baltic Dry Index (BDI) during April 23, 2021 to April 22, 2022

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of time charter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.

(Source: The Baltic Exchange, edited by Niu Huizhe with Xinhua Silk Road, niuhuizhe@xinhua.org)

A single purchase

A single purchase