BEIJING, June 22 (Xinhua) -- The Baltic Exchange has published its weekly report of the dry and tanker markets for June 14-18, 2021 as below:

Capesize

The Capesize market continued the trend from last week, seeing solid improvements throughout the week on all routes - but lost ground in the very last day of the week. The timecharter average was up to the highest of the bulker sectors in midweek, closing at $33,415. The booming C3 Brazil to China and C5 west Australia to China routes continued unabated in the first half of the week, driving the timecharter routes C14 and C10 up accordingly to new highs. A C5 fixture was reportedly done at $11.60 early of the week - followed by talks of $12.40 and $12.50 being paid - but slipped to the initial level when the week ended. Period activity included a 180,000dwt 2012-built delivery in the Far East in August fixing for 12 to 18 months at $32,500. A scrubber-fitted 172,000dwt 2007-built was fixed for one-year trade at $35,000 delivery Luoyu 22/27 June.

Panamax

It proved to be another firm week for the Panamax sector, despite activity cooling down a tick as we approached the weekend. In the Atlantic, the week begun with good levels seen for both mineral and grain transatlantic demand, which gave the necessary support to the rises seen in rates. Midweek saw an upsurge of activity out of EC South America for first half July arrival with a raft of fixtures. Asia started out in a sluggish manner, only to come to life midweek with a surge especially for Japanese coal tenders. With talk of a shortage of stocks in Japan, this led to a hike up in numbers, with an 81,000dwt delivery Japan fixing at $33,000 for a trip via EC Australia redelivery Japan. Demand from Indonesia remained generally thin for most part however rates in the region continued to build all week on the back of sentiment and Atlantic demand.

Ultramax/Supramax

It has been a busy week in all areas with the US Gulf returning very strong fixtures, an Ultramax has been fixed from Mobile via US Gulf to Japan at $47,500. It was reported that Marubeni fixed out an Ultramax for two years at region $21,000 delivery Chittagong and for short period an Ultramax fixed at $31,000, including Nickel Ore. There have been reports of some fixing and failing as the week draws to a close - particularly in Asia - and brokers felt charterers were taking a break at the end of the week. Nevertheless, the general sentiment heard from brokers is that the strong rates are here to stay, at least in the short term.

Handysize

The BHSI continued its progress this week reaching new yearly highs. With positive sentiment in the Atlantic, brokers felt that this might continue for some time. In the US Gulf a 38,000dwt open in the Mississippi fixed for a cargo of grains to the Mediterranean at $22,500. The Indian Ocean and Arabian Gulf regions have also been active with a 38,000dwt being rumoured to have been fixed for a trip to East Coast South America at $33,500. In Asia, a 34,000dwt open in North China was fixed via South Korea to the Philippines at $19,250. Period has been active with a 38,000dwt open in the US Gulf fixing for a minimum of 12 months with worldwide redelivery at about $20.000 and a 32,000dwt in the Western Mediterranean fixed for four to six months with Atlantic Redelivery at $22,000. However, the vessel is unable to call either the USA or Canada.

VLCC

In the Middle East the market for 280,000mt to US Gulf (routing via the Cape/Cape) continues to be assessed around the WS18 mark while rates for 270,000mt to China have remained steady at just above WS31 (a round-trip TCE of minus $4.5k/day). In the Atlantic, rates for 260,000mt West Africa to China remained flat at WS32.5 (minus $2.1k/day TCE) and 270,000mt US Gulf to China has stuck at around the $4.035k level (a TCE of about $1.3k/day).

Suezmax

In the 130,000mt Nigeria/UK Continent market rates have improved by two points to the WS49.5 level (a round-trip TCE of about minus $1.3k/day), with Spanish charterers taking a TMS Tankers vessel at WS50 for a voyage Nigeria/Spain. This slight firming has had a knock-on effect in the 135,000mt Black Sea/Med market where rates have moved up a point to WS58.5-59 level (a round-trip TCE of about minus $5.4k/day, although reported fixtures here have been scarce. The market for 140,000mt Basrah/Med has gained seven points to WS29.5 after ENI went on subs at WS30.

Aframax

In the Mediterranean, the market has been steady and rates for 80,000mt Ceyhan/Lavera remain at WS90 (showing a round-trip TCE of about $3k/day). In Northern Europe the market for 80,000mt Cross-North Sea got pushed up three points to WS94-95 level (about minus $1.1k/day TCE round trip), while in the 100,000mt Baltic/UK Continent market a similar increase was seen with rates now at the WS66.5 level (a round trip TCE of minus $600/day). Across the Atlantic the market has continued along the latest floor as rates for 70,000mt Caribbean/US Gulf and East Coast Mexico/US Gulf have remained steady around the WS80 mark again (a TCE of about minus $2.6k/day and minus $2kpd round trip respectively). The 70,000mt US Gulf/UK Continent market remains between WS70 and WS72.5 (which shows a TCE of about minus $1.3k basis a roundtrip, turning positive basis single trip economics).

Clean

In the Middle East Gulf it has been an uneventful week on both LR2s and LR1s with the rates static. The market for 75,000mt to Japan has settled in the mid WS70s, while on the 55,000mt size, rates have likewise been flat at just below WS90. The MRs have remained under downward pressure and rates for 35,000mt in to East Africa have drifted down from mid WS150s at the start of the week to WS150, with the market even assessed now at just below this level. For owners trading MRs from the Continent it has been a lacklustre week, with rates for 37,000mt to USAC largely unchanged at around WS110 region. However, there are a number of cargoes outstanding as owners have been holding back hoping for further upside. A Brofjorden cargo, which pays a premium over ARA load, is said to have been fixed at WS117.5. The 38,000mt backhaul market from US Gulf to UKC started the week at WS90 but charterers have successfully been chipping away at rates and the market here has now eased to close to mid WS80s. Runs to Brazil have been less affected with the market steady in the very low WS130s. For owners plying the 30,000mt clean trade in the Mediterranean, it has been another frustrating week with rates slipping almost five points to WS120 with a Canaries discharge covered at WS125.

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

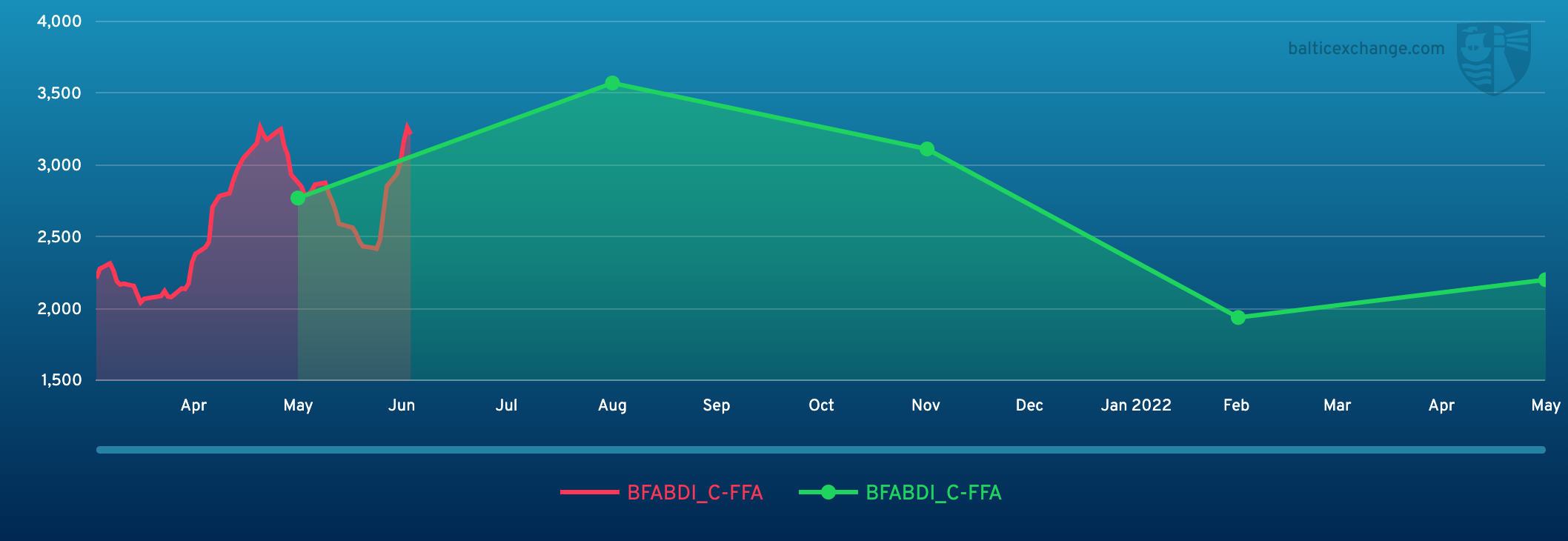

Chart shows Baltic Dry Index (BDI) during June 19, 2020 to June 18, 2021

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of timecharter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.

(Source: The Baltic Exchange, edited by Niu Huizhe with Xinhua Silk Road, niuhuizhe@xinhua.org)

A single purchase

A single purchase