BEIJING, Jan. 19 (Xinhua) -- The Baltic Exchange has published its weekly report of the dry and tanker markets for January 11-15, 2021 as below:

Capesize

The Capesize market surged this past week to a three-month high, as a stronger outlook for the market took hold. Opening the second full week of the year at $21,131 the Capesize 5TC peaked mid-week at $26,489, before closing down to end the week at $23,989. Charterers managed to take back a little influence dipping the index. But fixture activity was certainly weaker at weeks end. The Transpacific C10 settled the week at $21,667, with the West Australia to China C5 dropping 0.522 on Friday to $8.814. For most of the week the C10 was more in line with the Transatlantic C8, which currently stands at $29,475. But it has now realigned closer to the Brazil to China C14 at $18,664. Not often is such a divide seen between the C10 and C14, which can in part be traced back to the velocity of the recent surge. Rates now appear to be calibrating themselves before the next move, whether up or down remains to be seen. It was heard in the market that Brazilian charterer Vale has had a fire at their Pier 4 South terminal at Ponta da Madeira causing scheduled vessels to be redirected. The severity of the fire and any damage is unknown at this stage.

Panamax

Following the frenetic start to the New Year so far, the Panamax market this week appeared somewhat in a state of flux. As FFA values tumbled, the physical sentiment in turn became cautious. And, despite overall fundamentals remaining intact, some of the early tonnage were forced to concede softer numbers. Trans-Atlantic rounds topped the early part of the week in the low $17,000's with robust Baltic demand impacting tonnage count off the continent. However, it had drifted by the end of the week to closer to mid $16,000's. East coast South America started the week strongly but became under pressure midweek as early tonnage build up started to impact. Similarly, in Asia, the NoPac and Australian round trips peaked in the low-mid $13,000's on Wednesday. But with some evident fixing and failing, it had petered out to $12,750 region with the bid/offer spread widening. Period news included $13,500 getting agreed on a couple of occasions for 82,000dwttypes delivery Far East.

Ultramax/Supramax

A robust week for basins, although a lack of fresh enquiry from the US Gulf area saw an easing of rates there. The south Atlantic demand improved and an Ultramax was fixed for east coast South America to China in the low $15,000s, plus low $500,000 ballast bonus. A lack of prompt tonnage from the Continent saw rates improve from both there and the Mediterranean, with scraps runs to the east Mediterranean going in the $20,000s. There were stronger rates from Asia with a good supply of cargo in all areas. The Supramax size saw in the mid teens for trips delivery Singapore via Indonesia to China. From the Indian Ocean there was sustained support a 57,000dwtfixing delivery east coast India redelivery China at $15,000. Period remained active with a 63,000dwtcovering three to five months from the Black Sea at $14,000 and a 63,000dwtopen east India covering three to five months at around $13,500.

Handysize

BHSI moved into positive territory for the first time this week since the start of the year. Overall activity levels where slightly low compared with the larger sizes in the Atlantic but an improvement from the Continent was evident. A 37,000dwtopen spot in north Spain was fixed for a trip with scrap cargoes to east Mediterranean at $11,000 in mid week. But as the week closed, a 34,000dwtopen Immingham mid January was fixed for a similar run at $13,000. In the Pacific, brokers saw more coal movement from CIS and steels from the Republic of Korea/ China to Southeast Asia this week. Two 32,000dwtopen CJK and the Republic of Korearespectively were both fixed for a trip to Southeast Asia at $9,250. A 28,000dwt open Japan, meanwhile, was booked for a similar run at $9,000 level.

VLCC

A general further weakening of rates was seen across this sector. In the Middle East 280,000mt to US Gulf via the Cape/Cape routing is assessed another point down at WS19.5. Meanwhile, 270,000mt to China is now rated five points lower than a week ago at just below WS35. In the Atlantic, rates for 260,000mt West Africa to China fell three points again to WS35 level although overnight reports detail a 2016 built vessel on subjects to Petroineos at WS33. For voyages of 270,000mt US Gulf to China, the market is now being rated at just below $4.5m - another $200k drop from last week.

Suezmax

In the 135,000mt Black Sea/Med market we saw rates continue to hover around the WS58-59 level, while for 130,000mt Nigeria/UK Continent the market remained static at the WS38 mark. In the Middle East, the market for 140,000mt Basrah/Med voyages rose about a point to WS12-13 level. However, a vessel was put on subjects yesterday at WS21 for a trip to the US Gulf and there are two cargoes for Mediterranean discharge being worked at the moment which should lead to a more detectable firming market.

Aframax

Rates for 80,000mt Ceyhan/Lavera were steady at around the WS70 level. In Northern Europe rates for voyages of 80,000mt cross-North Sea remained flat at WS80, while 100,000mt Baltic/UK-Continent saw an improvement of about four points to WS62.5-65 region. On the other side of the Atlantic, owners had a miserable week with rates for 70,000mt Carib to US Gulf falling 8 points to low WS80s. In the 70,000mt US Gulf to UK Continent market rates tumbled 10 points earlier in the week and remain there, for now, at WS65.

Clean

In the Middle East Gulf/Japan trade it has been an uneventful week with rates largely unchanged. The market for 75,000mt is still hovering in the low WS80s. On the LR1s, rates have nudged up around four / five points to sit now at close to WS82.5. Healthy amounts of enquiry in the MR market saw rates for 35,000mt AG/East Africa gaining almost 10 points to WS175 region. In the Atlantic trade, the start of the week saw rates initially maintained at WS 110. However, with plenty of tonnage available, the market slipped to WS 105 level with lower reportedly done on tonnage with last cargo palm oil. The backhaul trade of 38,000mt from US Gulf to UK/Continent saw rates edge up around three points to WS 80 level, while the 38,000mt US Gulf to Brazil run is now at WS112.5 level representing a small gain of 3.5 points. In the 30,000mt cross-Mediterranean trade, owners enjoyed a better week with the market firming 17.5 points to WS102.5 region.

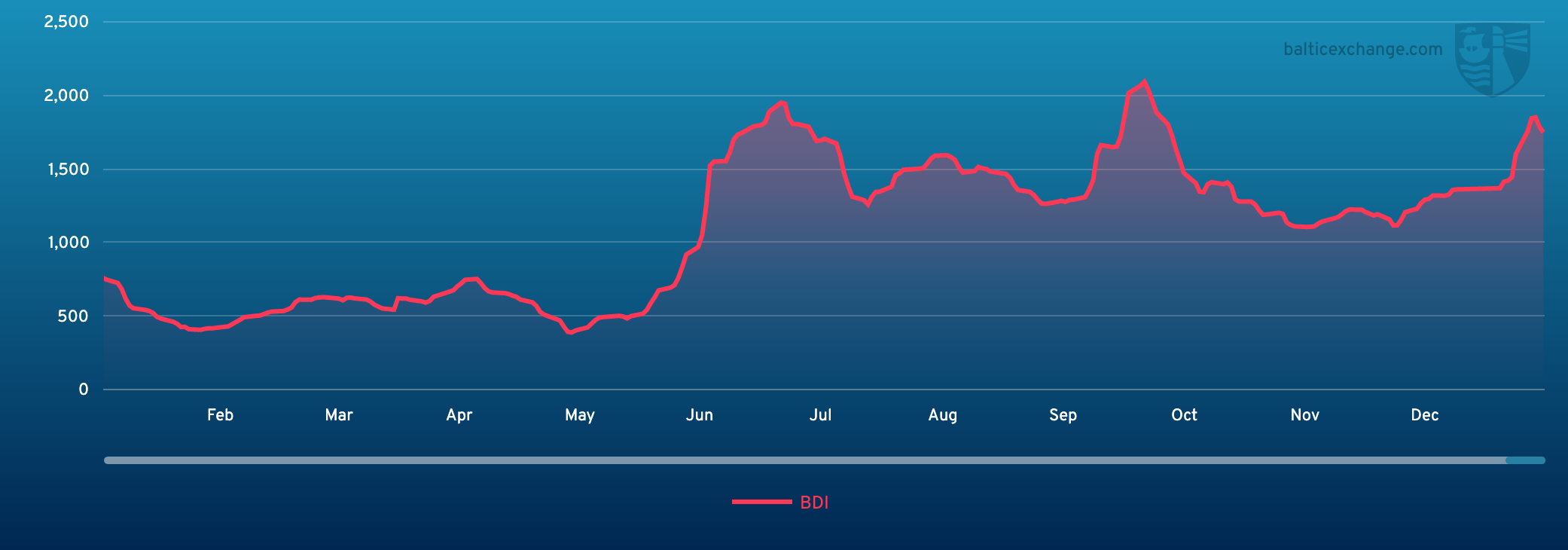

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

Chart shows Baltic Dry Index (BDI) during Jan.16, 2020 to Jan. 15, 2021

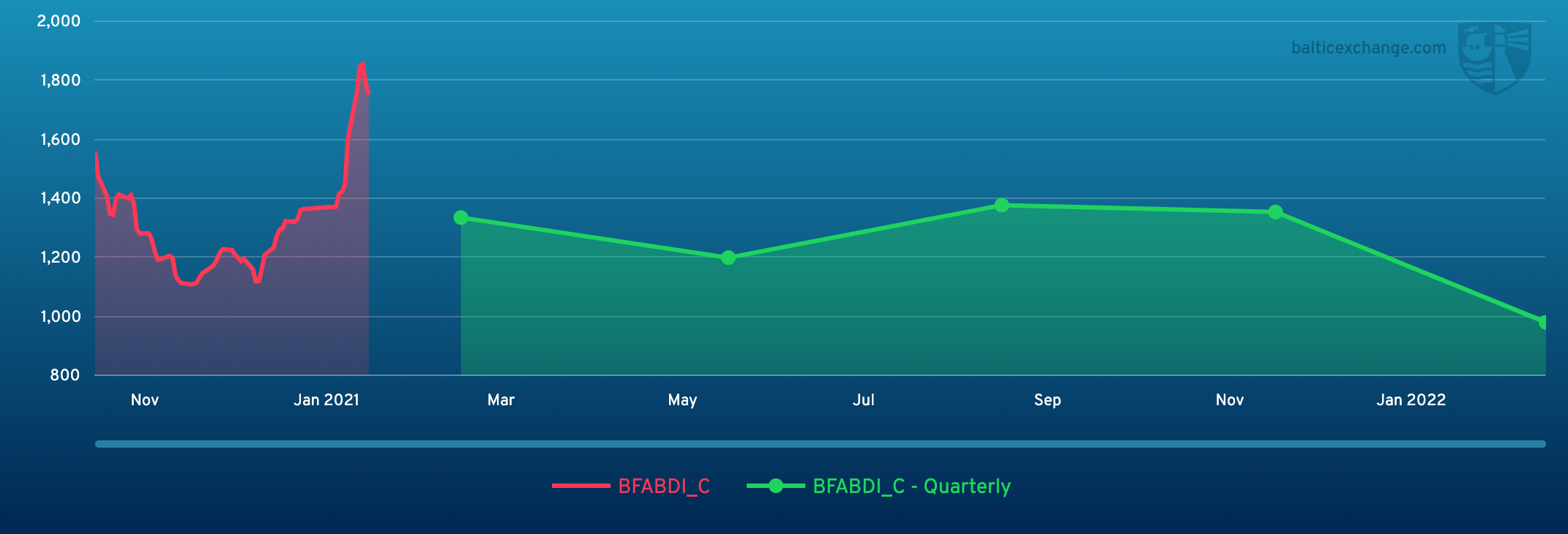

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of timecharter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.

(Source: The Baltic Exchange, edited by Niu Huizhe with Xinhua Silk Road, niuhuizhe@xinhua.org)

A single purchase

A single purchase