BEIJING, Nov. 3 (Xinhua) -- The Baltic Exchange has published its weekly report of the dry and tanker markets for October 26-30, 2020 as below:

DRY MARKET

CAPESIZE

The Capesize market was grasping for a bullish story this week as a possible mid-week rally fell flat. Following that, rates collapsed down to $15,550 on the Capesize 5TC, a drop of $3,199 for the week. Positive news of Vale’s increased production in the last quarter comes as little comfort to owners who this week saw the Brazil to China C3 index plummet $2.33 to close the week at $15,095. The fronthaul market continues to be lukewarm on activity with earnings now gravitating close to the $30,000 mark. In the Pacific the major miners have been active throughout the week as they now are focusing on mid-November laycans. The C5 West Australia to China route did take a battering late in the week and is now trading close to the low of its recent trading range from the past few months at $7.10. The close of the week was timid with little activity. Several small sparks of resistance by owners were heard which may place some support under this current level as thoughts of an imminent rally do not seem on the cards.

PANAMAX

The market in the Atlantic seems to have been driven by the need for tonnage to load in the Baltic for various destinations. With the shorter voyages commanding a premium, it gave a lift for the longer trans-Atlantic and front haul trips. There was good activity for US Gulf loading, but South America still lacked much fresh cargo, overall it remains to be seen if the sentiment pushes into next week. Conversely the Pacific lost value every day this week, with some suggesting the lack of coal cargoes and poor ECSA market is discouraging ballasting. Tonnage is beginning to look a little oversupplied: round voyages in the Pacific now seem to pay in the $9,000’s on smaller tonnage with a higher level for the Kamsarmaxes.

SUPRAMAX

A rather subdued week overall with rates in the Atlantic generally on a negative slide. However, the US Gulf remained steady with a 58,000dwt fixing an inter Caribbean trip redelivery east coast Mexico in the mid $12,000s. Limited fresh enquiry from both the Continent and the Mediterranean saw tonnage availability increase, but earlier in the week a 57,000dwt open Turkey was linked to a fronthaul in the upper $23,000s. There was limited activity from east coast south America with the Ultramax size seeing in the low-mid teens for transatlantic runs. From Asia, it was a mixed bag. Indonesian coal stems remained steady. A scrubber fitted 60,000dwt fixed delivery south China via Indonesia redelivery west coast India in the mid $9,000s. From north Asia, a 60,000dwt was fixed delivery CJK for a north Pacific round redelivery Singapore-Japan at $10,000. The Indian Ocean was also quieter than of late, a 58,000dwt fixing a trip from Red Sea to west coast India at $15,000.

HANDY

Overall it was a lacklustre week with the Atlantic market being slightly quieter than usual. There appeared to be a thin volume of fixing despite brokers suggesting the Continent region is remaining firm. Meanwhile, east coast South America remained flat throughout the week whilst the US Gulf market declined further. A 34,000dwt was fixed from the US Gulf to UK-Continent at mid-high $11,000s, and a 39,000dwt was booked for moving petcoke from the Gulf to Israel at $15,000. A 34,000dwt open Morocco was fixed for a trip via Sweden to Sea of Marmara at a rate close to $14,000 with scrap cargo. A 38,000dwt was fixed from east coast South America to east coast Mexico with pig iron at $10,000. In the Pacific, a 34,000dwt open north China was fixed for a trip to Bangladesh at high $7,000s.

TANKER MARKET

VLCC

Another difficult week for owners saw rates fail to gain any traction. There was talk midweek of 280,000mt fixed west at WS17.5, but thereafter the market Middle East Gulf to US Gulf via the Cape/Cape routing softened and is now assessed at a shade above WS15. In the 270,000mt to China trade, the week started with rates around WS28.5, but have now eased around three points. In addition, a run to Taiwan went at WS23 and Korean charterers fixed 274,000mt cargo at WS20.75 although this was on ex-drydock tonnage. In the Atlantic, rates for 260,000mt West Africa to China dipped below WS30, with WS 28.5 the low, and a replacement cargo was fixed at WS30, one point higher than the ship being replaced. In the US Gulf, rates for 270,000mt to China were steady in the $4.6m region.

SUEZMAX

Rates for 135,000mt Black Sea/Med have generally been hovering between WS45/47.5 level while levels for 130,000mt from Nigeria to UK-Continent have been flat at between the WS30 and WS32.5 mark. In the Middle East market rates for 140,000mt Basrah/Med nudged up with Turkish charterers agreeing WS20. However, this subsequently failed with own tonnage reprogrammed and the market is now assessed at just above WS18, and seemingly still under downward pressure.

AFRAMAX

The start of the week saw a number of prompt liftings from Libya, with a high of WS97.5. Other vessels were also taken in mid/high WS80s. However, the excitement was short lived with last seen from Libya being concluded at WS72.5. For Ceyhan loading, rates moved up around six points to WS67.5 with Black Sea loadings at similar numbers. In Northern Europe rates remained flat with 80,000mt Cross-North Sea in the WS72.5-75 region, although WS82.5 was paid by Chevron, albeit for loading from the expensive port of Sullom Voe. In the 100,000mt Baltic/UKC trade the market was steady at between WS42.5/43. Across the Atlantic, there was little change with rates for 70,000mt Carib/US Gulf pegged at WS45, while 70,000mt US Gulf/UK-Continent eased 2.5 points to WS40.

CLEAN

It has been another unproductive week for owners. In the 75,000mt Middle East Gulf/Japan trade, rates have stagnated in the very high WS50s. In the LR1 trade the market eased around four points with Chevron able to cover a 55,000mt naphtha cargo at WS57.5. In the 37,000mt UK-Continent/USAC trade, it was a tale of two halves. In the early part of the week rates climbed to the WS85/90 region before falling back to the low WS70s with a West Africa run fixed at only WS82.5. There is a sense of déjà vu in the backhaul trade for 38,000mt from US Gulf to UK-Continent with rates flat at low/mid WS50s and Brazil discharge down 2.5 points on the week at WS72.5. The start of the week saw rates in the cross-Med trade nudge up to WS80 before easing back modestly to around the WS77.25 level.

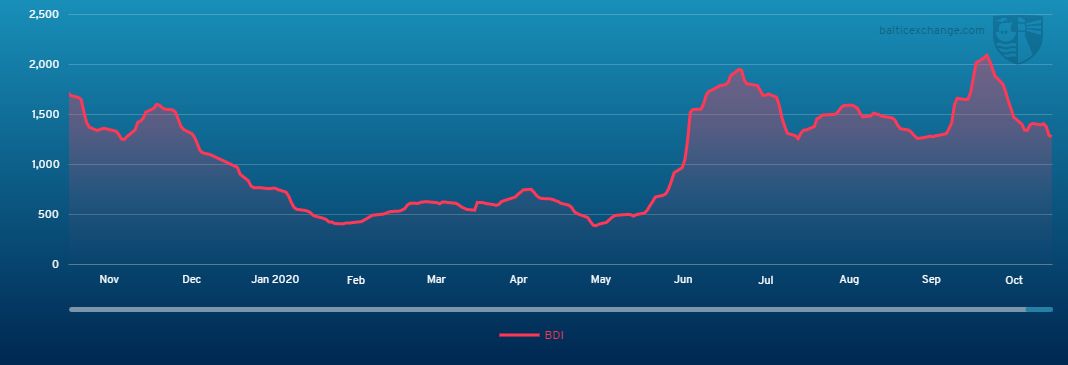

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

Chart shows Baltic Dry Index (BDI) during Nov.1, 2019 to Oct.30, 2020

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of timecharter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.

(Source: The Baltic Exchange, edited by Niu Huizhe with Xinhua Silk Road, niuhuizhe@xinhua.org)

A single purchase

A single purchase