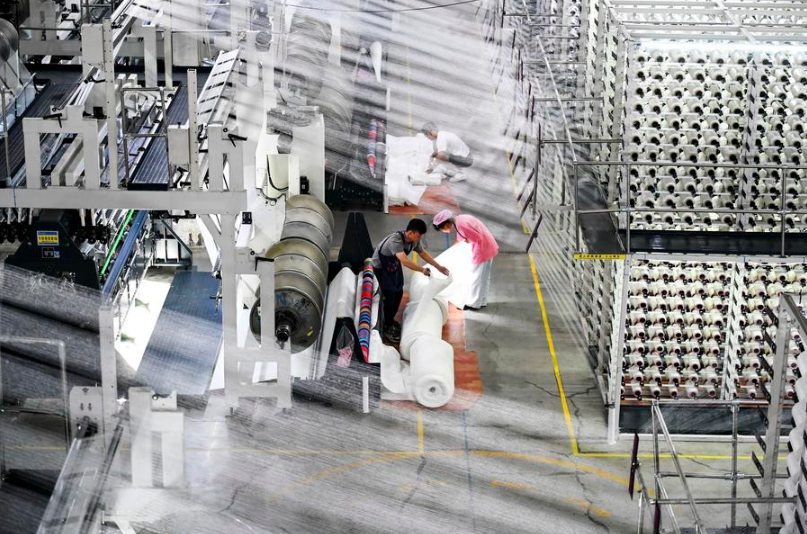

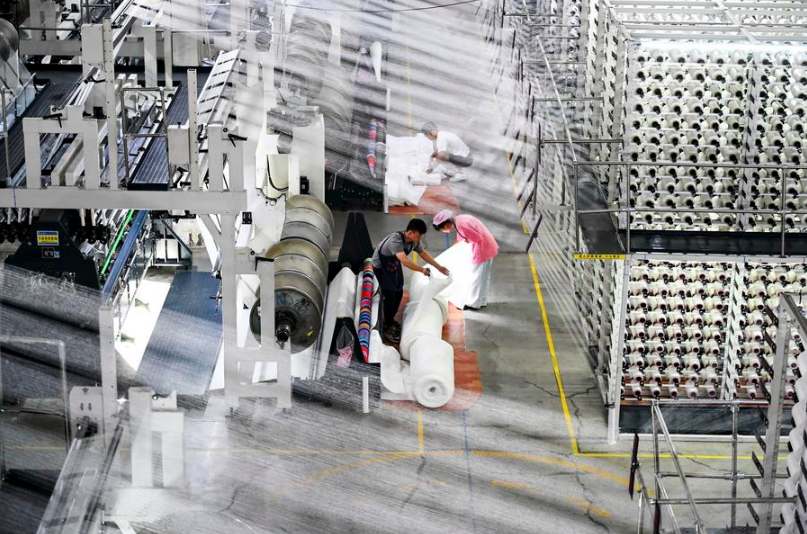

This photo taken on Aug. 20, 2025 shows a scene at the smart workshop of SinceTech, a shoe material textile company, in Jinjiang, southeast China's Fujian Province. (Xinhua/Lin Shanchuan)

BEIJING, Dec. 4 (Xinhua) -- Since November, numerous listed packaging companies have disclosed significant progress in their overseas capacity planning, according to Shanghai Securities News.

Reports indicate that many enterprises are expanding globally to follow the trend of client needs and supply chain shifts. In recent years, the growth rate of overseas business has surpassed domestic growth, and companies are expected to deepen their global footprint in the future.

-- Packaging enterprises accelerate overseas capacity expansion

Recently, the overseas capacity expansion of many domestic listed packaging companies has accelerated, with the Middle East and Southeast Asia becoming popular destinations.

On November 20, Jihong Group announced progress on its packaging production base in the Ras Al Khaimah Economic Zone, the UAE. The company and its partners have invested approximately 45 million U.S. dollars in the base. Currently, the main structure of the factory and external engineering are complete, with interior decoration underway. This marks Jihong Group's first overseas factory.

The base is expected to be completed and put into production by March 2026, said Zhuang Hao, chairman of Jihong Group.

It is noted that Jihong Group launched the construction of this UAE base in late February this year. Once fully operational, the base can produce 24 million standard cases of tobacco packaging, along with an annual output of 35,000 to 50,000 tons of supporting cardboard packaging.

Zhuang stated that this move is not simply about selling packaging products abroad, but gradually realizing a shift from product export to brand expansion. By building a production base in the UAE, the company can leverage the resources of local partners to build a sales network, accelerating the global layout of intelligent manufacturing.

Xiamen Hexing Packaging and Printing Co., Ltd. (HXPP) stated on November 20 that its overseas business is currently focused on Southeast Asia. Next year, the company's project capacities in Thailand, Vietnam, and Indonesia will be further released.

MYS Group stated on November 13 that it has established six production factories across four countries including Vietnam, Thailand, Malaysia, and Mexico, and still has room for capacity utilization. In regions with incremental orders, capacity expansion plans and investment will be arranged specifically targeting downstream market demand and according to client needs, the company said.

Zhejiang Dashengda Packaging Co., Ltd. released an announcement on November 7, disclosing the latest progress on redirecting some raised funds to the "Thailand Packaging Cardboard Production Base Project." The company has completed the equity structure adjustment for the project entity and finalized domestic filings for overseas investment, marking the entry of this 188-million-yuan overseas capacity project into the substantive implementation stage.

Beyond listed companies, on November 13, modern printing and packaging enterprise Lian Sheng announced that its overseas branch broke ground in Vietnam. The new factory will be equipped with a complete corrugated board production line, achieving autonomous production from cardboard and color printing to outer boxes, effectively controlling core supply chain links. The factory is expected to start production in 2026, focusing on serving the local Vietnamese market and neighboring markets like Cambodia.

-- Overseas business growth outpaces domestic growth

A report by Huafu Securities points out that in recent years, Chinese packaging companies have accelerated their global expansion against the backdrop of intensified competition in domestic demand and changes in the international trade environment.

The report categorizes the motives for expansion into "following the trend" to accommodate clients and supply chain transfers, and "active" expansion driven by profit, green initiatives, and intelligent transformation.

MYS Group stated that the logic behind its overseas layout stems from its foundation of long-term clients. Investing in factories across multiple overseas locations is primarily because these places host many customers the company has served for a long time, the company noted.

HXPP also stated that its overseas business advances are based on clear client capacity requirements. The company can provide supporting services to precisely match clients' global collaboration needs. Simultaneously, operational experience from domestic smart factories can be quickly replicated to empower overseas projects.

"Building the packaging production base in the UAE allows for a rapid response to the needs of our overseas packaging clients, effectively improving delivery cycles while reducing logistics costs to provide better and more efficient products and services," Zhuang said.

In fact, Jihong Group has seen a continuous rise in overseas packaging performance in recent years. Overseas revenue for the first three quarters of this year reached 161 million yuan, up 74 percent year on year.

"The UAE packaging factory currently under construction will primarily focus on tobacco labeling business in the early stages, with an expected gross margin of 20 percent to 25 percent, which is an improvement over existing packaging product margins," Zhuang stated.

A report by Changjiang Securities indicates that, based on the 2025 semi-annual reports, the growth rate of overseas business for packaging enterprises is significantly higher than that of domestic business.

Specifically, in the first half of 2025, Yuto Tech saw year-on-year revenue growth of 27.21 percent in overseas markets, while its domestic revenue fell by 1.59 percent. MYS Group saw overseas growth of 39.29 percent versus a domestic decline of 6.27 percent.

CITIC Securities stated that looking toward 2026, innovation and global expansion will be the main themes for the light industry.

In recent years, manufacturing in Southeast Asian countries has continued to develop, leading to an expanding packaging market scale. Data released by market research firm Mordor Intelligence predicts the Vietnamese packaging market will reach 4.14 billion U.S. dollars by 2029, with a compound annual growth rate of 9.73 percent between 2024 and 2029.

(Edited by Tian Shenyoujia with Xinhua Silk Road, tianshenyoga0524@163.com)

A single purchase

A single purchase