BEIJING, Nov. 14 (Xinhua) -- The Baltic Exchange has published its weekly report of the dry and tanker markets for November 7-11, 2022 as below:

Capesize

Activity in the Capesize market had the 5TC pushing in value over a few days in midweek. However, pessimism prevailed as the rates dropped down to close the week -895, settling at $12,807. Some chatter in the market expects an improvement in rates to end the year, although this is yet to eventuate. Charterers out of Brazil and the Atlantic were constantly seen to lower past last done, while market cargoes are said to be dwindling in the region. The Transatlantic C8 commands a premium over the Transpacific C10 yet the gap narrowed significantly this week as they stand at $16,889 and $12,636 respectively. Flurries of West Australia to China C5 fixing was heard midweek. The reasoning behind the activity was not heard - although miners were noticeably quieter in the later part of the week. Coming closer to the Christmas period owners will be very aware of the potential seasonal low period that looms in Q1. On more than one occasion this period has surprised with reasonable activity. However, all are likely preparing for more of the same from this market unless some fresh stimulus is forthcoming.

Panamax

The Panamax market sell-off continued in a similar vein to the previous week, with all sector indices continuing to lose ground. Activity in the north Atlantic - particularly mineral trades - were minimal. Meanwhile, activity from South America to the Far East confined mostly for end November arrivals. Rates hovered in the region of $18,000 and $800,000, and $19,000 and $900,000 for 82,000dwt types. This returned very much a positional market. In the Pacific, traded volumes were relatively thin for the longer trips NoPac. Trips to Japan returned a mixture of rates but ended softer overall. A glut of fixing ex Indonesian to China was witnessed midweek, predominantly on smaller/older type tonnage at discounted levels. It was low teens for the first half of the week, but closer to $10,000 and edging lower by week end. Period fixing remained scarce, but there were reports midweek of an 82,000dwt concluding at $17,000 for four to six months.

Ultramax/Supramax

A rather poor week for the sector as pressure remained in many areas with a lack of fresh cargo and a build-up of tonnage. This was particularly seen in the Asian arena with little fresh enquiry from Indonesia, whilst further north charterers remained firmly in the driving seat. Little period activity surfaced, although a 58,000dwt open Baltic was fixed for four to six months trading redelivery worldwide at $16,500. A 60,000dwt open Kosichang also fixed for 16 to 18 months trading at $13,250. As the week progressed, in the Atlantic the only bright spot was the US Gulf with increased demand. A 63,000dwt fixing a trip to China at $30,000. Further north, a 56,000dwt was fixed from US east coast to Continent-UK at $23,000. From Asia there was little joy. On the backhaul runs a supramax was heard to have fixed a trip from China to the Mediterranean in the mid $8,000s. From the south a 58,000dwt fixed delivery South China trip via Indonesia redelivery Thailand at $8,000.

Handysize

Like the larger sisters the Handy sector also lost traction generally, although some felt that the Asian arena may have found a plateau. Little excitement on the period front, but a 38,000dwt open Mediterranean was heard to have fixed one year at $14,500 at the beginning of the week. The Atlantic lacked fresh impetus. From South America, a 37,000dwt was heard fixed delivery Santos for a Transatlantic run to the East Mediterranean at $21,000. Also, a 38,000dwt fixed delivery Pecem to the US Gulf at $24,250. Elsewhere, a 37,000dwt fixed from the Continent to the Mediterranean at $12,000. From Asia, a 38,000dwt was heard fixed delivery Singapore trip via Australia redelivery Far East in the mid $9,000s. From the Indian Ocean region a 37,000dwt fixed delivery Damman trip to South Africa at $13,000. Eyes were firmly fixed on the upcoming week to see if this trend continues.

Clean

The Middle East Gulf has been stable this week with some minimal fluctuations. On the LR2s TC1 bottomed out at WS161 midweek, down from WS179, and has then resurged back up to WS165.63 with end of week reports of WS170 and WS172.5 on subjects at the time of writing. A trip to the UK-Continent, TC20, has ticked down from $3,930,000 to $3,800,000 across the week. Meanwhile on the LR1s TC5 has held in the WS212.5-WS215 range all week and a voyage west has been pegged at the $3,500,000-$3,550,000 mark.

AG MR freight levels have also been stationary, seeing the TC17 index only losing an incremental 5.72 points to WS372.14.

West of Suez LR2 activity has again been muted this week and TC15 has dropped again, settling at $3,225,000 (-$133,333). By comparison the LR1s have been active and TC16 has climbed 14.28 points to WS220.71.

On the UK-Continent MR freight levels began a rush upwards from a burst of activity early in the week - only to halt just as quickly. TC2 rapidly climbed up to WS315 and has then recorrected down to WS306.11. Similarly, TC19 rose up to WS324 and has then resettled back down to WS314.64.

In the US Gulf MRs have been inactive and there has been plenty of available tonnage. Subsequently, TC14 lost 11.25 points to WS158.75 and TC18 dropped from WS269.17 to WS258.75. A run down to the Caribbean, TC21, also shed a little over $26,000 to $656,667.

The MR Atlantic Triangulation Basket TCE lost $2,602 from $36,375 to $33,373.

On the Handymax, both the Mediterranean and Baltic have seen significant improvements. TC6 has jumped 111.25 points to WS350 from decreased vessel availability and TC9 continued traction up to WS494.29 (+WS63.22).

VLCC

The VLCC market remained firm this week. 270,000 mt Middle East Gulf to China gained a further six points to just over WS113 (a daily TCE round trip of $79,700). The 280,000mt Middle-East Gulf to US Gulf (via the cape/cape routing) trip is assessed 2.5 points higher than last week at WS62.

In the Atlantic region, the rate for 260,000mt from West Africa to China climbed another six points to around the WS112.5-113 level (a round-trip TCE Earning of $79,800 per day) and 270,000mt US Gulf/China marginally slipped by $18,750 to $12.99 million ($69,200 per day round trip TCE, about $100 per day less than last Friday).

Suezmax

The Suezmax market in the West rebounded with rates recovering all recent lost ground and continuing on an upward trend. For the 135,000mt CPC/Augusta trip, support came from the Aframax market with Suezmax vessels able to fix Aframax cargoes - in particular from the Black Sea. This enabled Suezmax rates to gain 15 points to WS215 (a TCE showing a daily return of $95,200). In West Africa, the 130,000mt to Rotterdam voyage saw rates climb 7.5 points to between WS190-192.5 (a daily TCE round-trip of $70,500). The 140,000mt Basrah/Lavera market eased slightly, by about 1.5 points, to WS93.

Aframax

The Aframax market in the US-Caribbean region fell again this week with the rate for 70,000mt Covenas/US Gulf losing six points to the WS375 region ($93,300per day round-trip TCE). Meanwhile, the 70,000mt East Coast Mexico/US Gulf trip dropped only 1.5 points to the very low WS390s (a round-trip TCE of about $107,200, about $600 per day lower than a week ago).

For the longer-haul 70,000mt US Gulf/Rotterdam voyage the rate shed 14 points to WS286 (a TCE of $61,800 per day round-trip).

Across the Atlantic, 80,000mt Hound Point/Wilhelmshaven is now assessed a firmer 3.5 points higher than last week at WS220 (a daily TCE of $77,100 round-trip). In the Mediterranean, which became very busy in the early part of the week, a firm sentiment remains as the position list is looking tight. The 80,000mt Ceyhan/Lavera route ascended 21 points to the WS260-262.5 region (showing a daily round-trip TCE of $78,900).

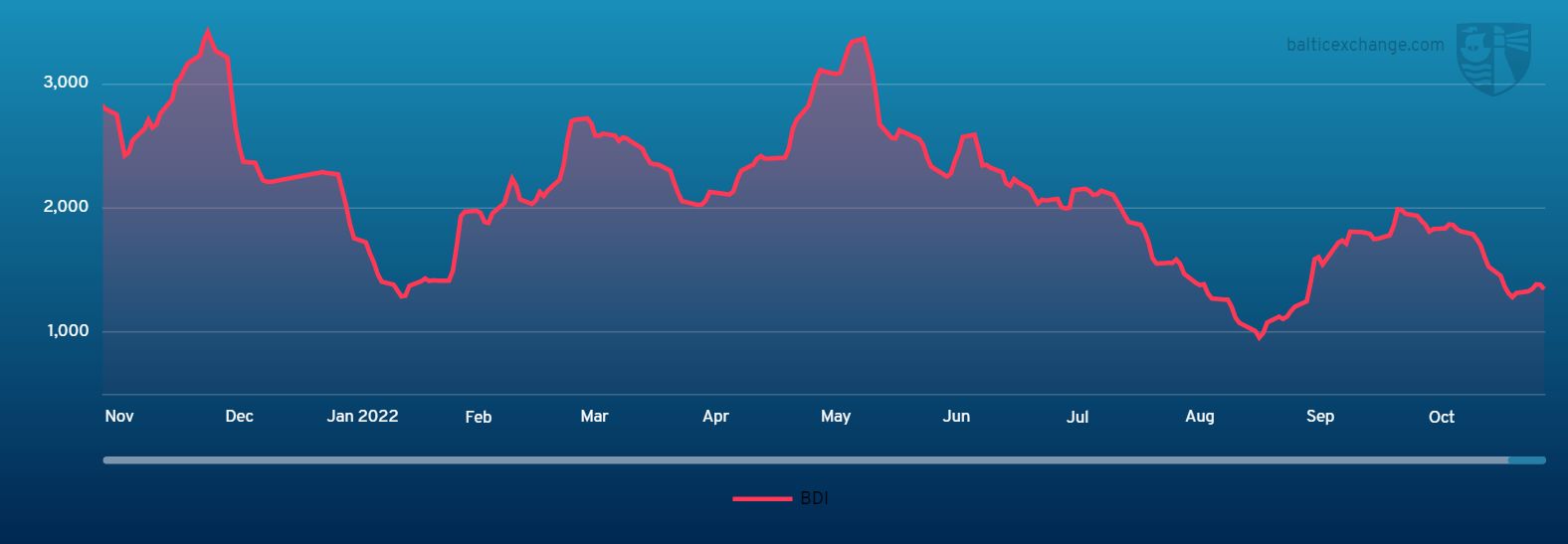

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

Chart shows Baltic Dry Index (BDI) during Nov.11, 2021 to Nov.11, 2022

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of time charter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.

(Source: The Baltic Exchange, edited by Niu Huizhe with Xinhua Silk Road, niuhuizhe@xinhua.org)

A single purchase

A single purchase