BEIJING, Sept. 5 (Xinhua) -- The Baltic Exchange has published its weekly report of the dry and tanker markets for August 29-September 2, 2022 as below:

Capesize

The Capesize market continues to struggle as demand for iron ore remains weak. Vessels in the Atlantic have had difficulties finding cargo, while those available have been fought over with prices diving as a result. The Transatlantic C8 bottomed out this week at $944 as much speculation swirled as to how low the route may go. The C8 closed the week at $2,367. As several Capesize vessels have gone into hot layup at strategic locations, scrubber-fitted vessels have continued to trade as normal due to the high and low sulphur bunker spread commanding a strong premium. In the Pacific, cargo flow has been patchy yet has improved towards the end of the week. This has seen West Australia to China C5 lift to settle at $8.885, while the Transpacific C10 closed at $10,445. The Capesize 5TC marked at $2,505 on Wednesday which was close to an all-time low. A small reprieve as additional West Australia and Brazil cargo has lifted the index up to $6,076 by week’s end. However, the market is far from fully resuscitated as trading levels still flirt slightly above operating expense levels.

Panamax

It has proved to be a tale of two halves for the Panamax market. The week followed on from the previous with fundamentals unchanged and an ever-growing tonnage count, which led to nearby and committed tonnage discounting heavily in order to get fixed. But by midweek there were signs of a turnaround in fortunes. As FFA values rose, dragging with it some resistance from owners, better bids followed and levels in some parts saw obvious improvements. East Coast South America returned an APS plus ballast bonus market and rates improved on this basis. Figures of $15,000 + $500,000 were around average for the early part, with talk of bids now being around the $16,000 + $600,000 mark for slightly earlier than index laycan. Asia was largely Indonesia centric. Typhoon Hinnamnor had a slight impact in the North of the region. Rates on the Indonesia round trip returned a mean average of $13,500 on the week with a decent level of fixing.

Ultramax/Supramax

The US Gulf was said to have seen the tonnage list grow. An Ultramax was rumoured to have been placed on subjects for a trip from SW Pass to Singapore-Japan range in the high teens, but further information is yet to surface. In East Coast South America, an Ultramax was rumoured to have been placed on subjects for transatlantic business at around $28,000. In Asia, a 63,000dwt was fixed from North China via Indonesia to West Coast India at $15,500. A 58,000dwt open in South East Asia was fixed via Indonesia to China at $17,000. In the Arabian Gulf, a 56,000dwt open in Dammam was fixed via the Arabian Gulf to Bangladesh in the high teens, but further details are yet to emerge. A 63,000dwt was fixed for four to seven months with redelivery Arabian Gulf-Japan range at $19,000.

Handysize

A turbulent week across all regions, with a general lack of fresh enquiry still a major factor in what has been a negative market in recent weeks. In The US Gulf, numbers have fallen with a 36,000dwt fixing for a trip from Panama City, Florida to Denmark at $15,750. Meanwhile, a 34,000dwt was rumoured to have been placed on subjects for a trip from Galveston to Puerto Cabello at around $12,000. In East Coast South America a 38,000dwt was rumoured to have been placed on subjects for a trip from Recalada to West Coast South America at around $26,000. The Continent has also softened with a 34,000dwt fixing from Skaw via the Lower Baltic to West Africa at $13,250. In Asia, a 35,000dwt fixed from Laem Chabang via Indonesia to East Coast India at $18,000. A 34,000dwt open in Chittagong was fixed for three to five months at $18,850 with worldwide redelivery.

Clean

It’s been a bit of a mixed week for CPP vessels with the BCTI falling by 93 points to 1,192. In the Middle East Gulf, LR2s of TC1, 75k Middle East Gulf / Japan managed to hold on to the gains of previous weeks finishing marginally up 2.5 points to WS74.88. LR1s also held their ground and TC5 55k Middle East Gulf / Japan climbed to WS305, up 5.71 points.

On MRs, TC17, 35kt Middle East Gulf / East Africa continued to strengthen this week with rates climbing 96.66 points to WS515.83 (A TCE of US$56,965 pd). West of Suez on the LR2s, TC15, the 80k Mediterranean / Japan run continued its strong climb from US$3.916m to increase by $300k and finishing the week at US$4.216m, resulting in a TCE of $18,890 /day.

The LR1s of TC16, 60k Amsterdam / Offshore Lomé, has increased by 8.57 points to WS237, a TCE of US$38,355. On the UK-Continent, MRs of TC2 and TC19 have both eased off with the gains from previous weeks being reversed as TC2 came off 16.11 points to finish at WS208.33. TC19 lost 13.11 to finish at WS218.93.

The USG MR market has seen steady increases with TC14, 38k US Gulf / UK-Continent up 3.33 points to WS147.5 and TC18, the MR US Gulf / Brazil trip, also gained 4.17 points to WS214.17.

The MR Atlantic basket TCE rose from $18,979/day to $19,330/day. TC9, 30kt Primorsk / Le Havre, saw a drop off in demand, falling 70.71 points from WS455 to WS384.29 at the end of the week, a TCE of US$39,041pd. In the Mediterranean TC6, 30kt Skikda / Lavera, also softened throughout the week losing 51.25 points to finish the week at WS163.13, a TCE of US$10,277.

VLCC

Across the VLCC market, rates softened. But from highs of WS80.18 for a VLCC Middle East Gulf/China, dropping to WS75.73 at weeks close (a round-trip TCE of $35,013 per day). A similar fall elsewhere in the East ate into earnings. But with 270,000mt Middle East Gulf to Singapore falling by WS4.77 to finish at WS77, a round-trip TCE of $38,421 per day is still respectable.

The Atlantic was not spared and rates fell as well. West Africa/China saw WS4.91 points off. In weaker markets there was a significant drop, but with WS75.86 published at the end of last week (a round-trip TCE of $36,468) there are still good earnings. USG/China remained relatively flat and lost some steam from a high of $8,900,000 to $8,775,000 (a TCE round trip of $29,907 per day).

Suezmax

A correction in the 135,000mt Black Sea/Augusta market was expected last week after the previous weeks rise. But a minor adjustment from WS197.78 to WS192.89 (a loss of only WS 4.89 points and a TCE per day round trip earning of $79,379) shows the market remains steady. The West African/Continent market saw a fall as well, from WS132.27 and finishing at WS128.41, but this was not as great a fall as the Middle East. Overall TCE earnings remained steady and actually finished up $37 per day at $32,770 per day round trip.

Middle East Gulf/Med has been flat with little movement on rates. As the week progressed there was a slight rise of WS1.44 to finish at WS64.63. This pushed TCE earnings positive again at a round trip per day of $998.

Aframax

A correction in the 80,000mt North Sea/Continent route saw rates lose over WS5 points settling at WS188.75 (a TCE round trip earning of $52,202). Despite the fall in the North Sea, the 100,000mt Baltic/UK-Cont market remained flat shaving just over half a WS point throughout the week ending at WS206.56 (a TCE round trip of $59,820 per day).

The biggest movers were by far in the Americas where 70,000mt USG/ARA lost over WS22 points. A big drop indeed, but even finishing at WS208.57 the TCE earnings on a round trip lost just shy of $5,500 per day. This makes it still a respectable $34,123. The Caribbean/USG market saw a bigger shift, shaving over WS40 points ending at WS240.31 at the tail end of last week. But the biggest loser by far was in the 70,000mt market ex-E.C Mexico where big movements down (a loss of WS60.31 points) were seen in the first part of last week. Things levelled out, closing at WS253.44 (a TCE round trip earning of $51,653 per day).

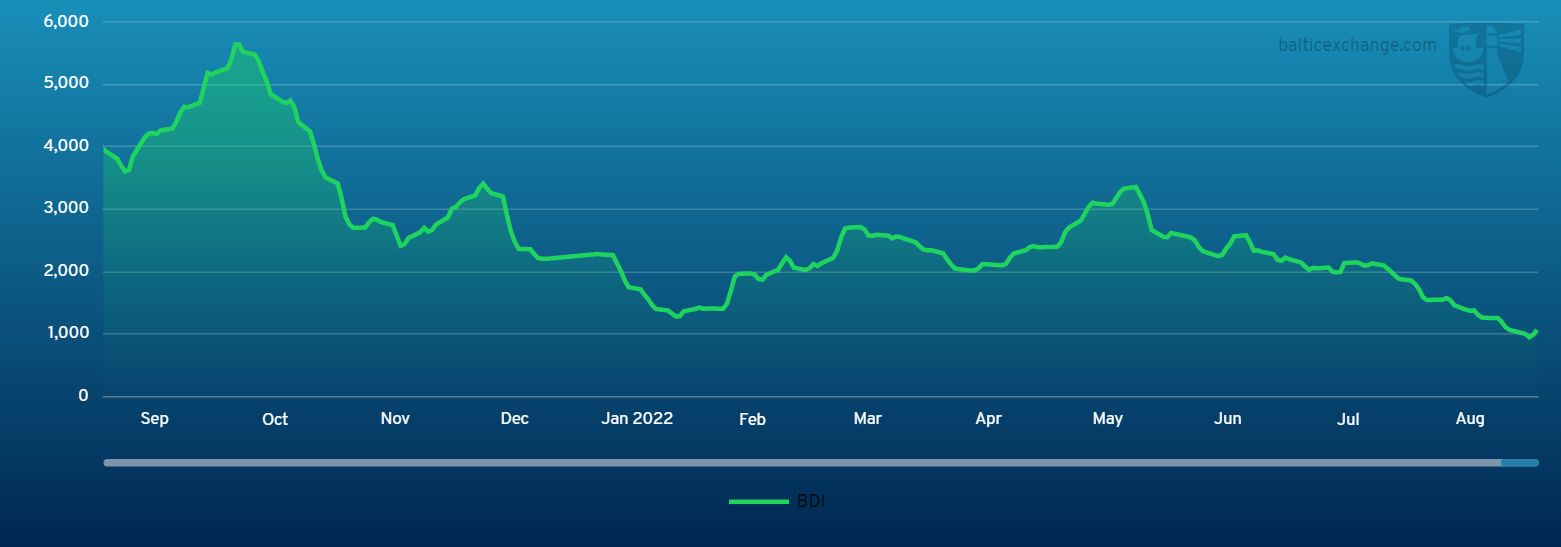

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

Chart shows Baltic Dry Index (BDI) during September 3, 2021 to September 2, 2022

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of time charter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.

(Source: The Baltic Exchange, edited by Niu Huizhe with Xinhua Silk Road, niuhuizhe@xinhua.org)

A single purchase

A single purchase