BEIJING, June 13 (Xinhua) -- The Baltic Exchange has published its weekly report of the dry and tanker markets for June 6-10, 2022 as below:

Capesize

The Capesize market softened this week as global market concerns kept the headwinds coming. The softening of values was felt across all Capesize 5TC routes as the index lowered throughout the week by 4,609 to $19,665. Friday saw a slight uptick in value but little could be read into it at this stage. The impact of sharply rising fuel prices countered much of the slide in rate levels on voyage routes as the main Capesize volume routes Brazil to China C3 and West Australia to China C5 settled at $31.37 and $12.495 respectively. While some routes like Indonesian to India for coal remain relatively busy the overall fixture volume in the Pacific remains insufficient to push the market. There are said to be some pockets of resistance emerging from owners in the Pacific. The ballaster lineup is heard to be well-stocked currently. This is keeping the Atlantic routes well tonnaged which lessens the possibility for any dramatic sparks in value. With the large Posidonia event currently being held in Greece, this week's attention is surely distracted, while next week it should be back to all hands on deck.

Panamax

Another week interrupted by holidays in Asia and Europe, combined with many market players in Greece for Posidonia, that has led to a rather lacklustre seven days with falling sentiment, rising tonnage lists and subsequently falling rates across the board. The BPI lost 222 points over the week to close at 2,629 and the P5TC weighted average lost $2,001 to close at $23,662. Owners in the east were holding firm at the start of the week, however by the week end trips for Indonesia / India were lower than last done with owners reducing offers to find cover. As the week progressed there were increasing cargoes for NoPac on forward dates but this did not offer much prompt support. The Atlantic was likewise under pressure with a rising tonnage list competing for limited Transatlantic and ECSA business further eroding rates for the latter. There was a period fixture with a 2010, 82,000dwt fixed for 12 months at $29,000. However it was reported that period enquiry has weakened amid losses on the FFA market over the week, despite a small rally at the close.

Ultramax/Supramax

With many people away from their desks due to Posidonia the market in many areas saw a change in direction as rates from key areas such as the US Gulf and East Coast South America fell away. From Asia limited fresh enquiry also appeared from the south but further north limited support remained for backhaul runs. Period activity was limited, but a 64,000dwt was heard fixed for one year delivery China at $31,000 with redelivery worldwide. In the Atlantic, from the Continent a 63,000dwt was fixed for a scrap run to the East Mediterranean in the low $19,000s. From the South Atlantic. Ultramax size was fixing very low $20,000s plus around $1 million ballast bonus. From Asia, a 61,000dwt open Manila fixed a trip via Indonesia redelivery West Coast India at $35,000. Whilst for Pacific rounds a Supramax was heard to have fixed around $30,000 for an Australian round voyage.

Handysize

With Posidonia and holidays this week, activity was limited and sentiment was negative. In East Coast South America due to a lack of enquiry, levels have dropped considerably with a 38,000dwt fixing from Recalada to the Continent at $26,500, and 34,000dwt fixing from Fazendinha to Morocco with an intended cargo of grains at $22,000. There is a similar story in the US Gulf and a 33,000dwt fixed from South West Pass to Morocco at $16,000. A 34,000dwt was rumoured to have been placed on subjects for a trip from South West Pass to East Coast Mexico at $13,500. A 32,000dwt was fixed from Port Arthur to West Coast Central America with an intended cargo of petcoke at $18,000. In Asia, levels have also softened, with a 32,000dwt fixed from CJK to South East Asia at $23,000. A 38,000dwt open Laem Chabang was rumoured to have fixed via Australia to South East Asia at $28,500.

Clean

LR's in the Middle East Gulf saw a welcome upturn after several weeks of being under pressure. TC1 75k Middle East Gulf / Japan has gained 24.29 points to WS215 and its round trip TCE back up to over $20,000/day. TC5 55k Middle East Gulf / Japan also saw a similar rise of 27.86 points to WS258.57. An LR1 trip west (TC8) ticked over the $60pmt by the end of the week settling at $62.29pmt ($4.04m). TC17 35kt Middle East Gulf / East Africa has consistently traded upwards coming up 55 points to WS213.33. The far east MR market has also been extremely busy this week.

In the west the LR2's have jumped as a mid-week cargo widely reported fixed a $4m for a Med/East, has helped lead the index up to $4.18m (+$650k) taking the round trip TCE back into the black ($3,000 /day) by time of writing. The LR1's of TC16 remained stable creeping up from WS235 to WS240 levels over the week.

MR's in Northwest Europe have been the talk of the town this week, peaking at their highest level since April 2020 from a notable lack of tonnage. TC2 37k UK-Continent / US Atlantic Coast hiked 69.44 points to WS394.72 and TC19 37k UK-Continent / West Africa followed suit to WS404.29 (+71.43).

In the USG, freight rates have dropped significantly this week. TC14 38k US Gulf / UK-Continent has lost 68.57 points WS177.86. TC18 38k US Gulf / Brazil has followed suit dropping 92.14 points to WS250. The MR Atlantic basket TCE dropped from $43,513/day to $38,042/day. On the Handymax, open cross Mediterranean enquiry slowed towards the end of the week, the TC6 index dropped 6.25 points to WS408.75. In the Baltic TC9 held around the mid WS420's all week.

VLCC

VLCC rates were flat this week, with 280,000mt Middle East Gulf/USG (via Cape of Good Hope) being assessed at WS25.5 while rates for the 270,000mt Middle East Gulf/China trip were up a meagre 0.5 points to just shy of WS45 (a round trip TCE of minus $22,200/day). In the Atlantic, markets the rate for 260,000mt West Africa/China were steady at the WS45.5 mark (minus $20,800/day round-trip TCE), while the rate for 270,000mt US Gulf/China voyage remained unchanged at $5.37m (a round voyage TCE of minus $23,400/day).

Suezmax

Rates for the 135,000mt Black Sea/Augusta were steady this week at close to WS112.5 (a round-trip TCE of $10,700/day), while the 130,000mt Nigeria/UKC route saw rates climb 2.5 points to a shade above WS93 (a round-trip TCE of about $1,700/day). In the Middle East rates for the 140,000mt Basrah/West Mediterranean rose a modest 1.5 points to almost WS55.

Aframax

The 80,000mt Ceyhan/Mediterranean market saw a rebound this week, with rates improving 14 points to WS132.5/135 level (a round-trip TCE of about $8,00/day). In Northern Europe rates remained flat at about WS140 for the 80,000mt Hound Point/UK Continent trip (a daily round trip TCE of $9,800) and at WS165 for the 100,000mt Primorsk/UK Continent route (which shows a round trip TCE of $28,500/day) Across the Atlantic, the markets were ever so slightly firmer for the week. Rates for 70,000mt EC Mexico/US Gulf route rose 2 points to WS180 (a round-trip TCE of $15,900/day) and for the 70,000mt Caribbean/US Gulf route gained 2.5 points to WS175 (a round-trip TCE of Atlantic trip of 70,000mt US Gulf/UK Continent, rates increased 3.5 points to almost WS170 ($11,800/day round-tip TCE).

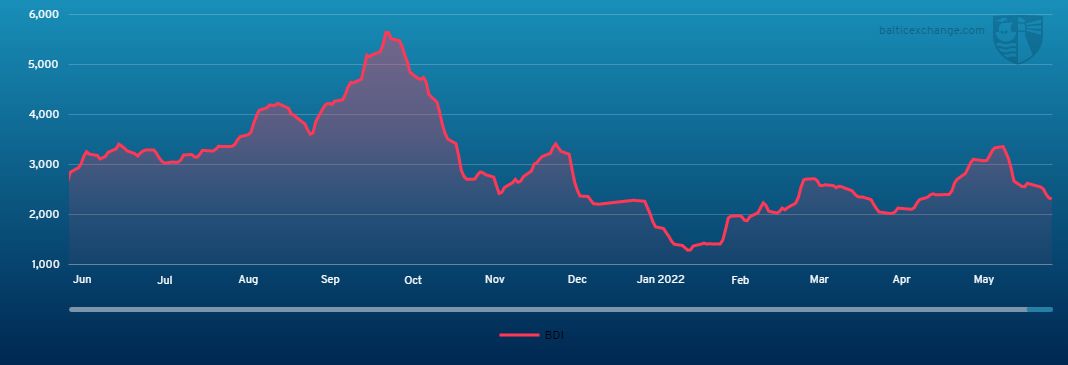

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

Chart shows Baltic Dry Index (BDI) during June 10, 2021 to June 10, 2022

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of time charter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.

(Source: The Baltic Exchange, edited by Niu Huizhe with Xinhua Silk Road, niuhuizhe@xinhua.org)

A single purchase

A single purchase