BEIJING, Nov. 15 (Xinhua) -- The Baltic Exchange has published its weekly report of the dry and tanker markets for Nov.8-12, 2021 as below:

Capesize

The Capesize market rebounded briefly this week to provide some hope of a revival in rates after its recent October fall from heights. Early in the week all routes were seeing gains with the Capesize 5TC pricing up and over the 30k levels before end the week on a down note -298 to settle at $31,811. The Atlantic basin was the first region to wane, although the Transatlantic C8 still demands a premium over other routes at $37,005. With visibility on pricing difficult due to a lack of cargoes and fixing volume in general, several Charterers were able to take advantage fixing at unexpectedly sharp levels. The Pacific basin's positive sentiment looked to be growing initially yet by the week's end the market seemed quieter and levels looked to be weakening slightly. The Transpacific C10 closed down 300 to $33,471 while the voyage route West Australia to China C5 closed down 0.091 at $12.923. Paper derivatives indicate a slight softening of levels from now into Q1, yet with an energy crisis in North Asia and severe weather expected in East Australia there are plenty of factors that may disrupt that view.

Panamax

It proved to be a tumultuous week in the Panamax market, with the stronger optimism seen around on Tuesday quickly eroding away with the week ending on a weaker tone. In the Atlantic, the short Baltic round trips proved mainly well supported with a host of fixtures concluded around the upper $20,000s/low $30,000s levels. However, aside from a small premium paid for early arrival dates ex EC South America, the longer duration trips remained under pressure all week with charterers seen retracting bids or even stepping back as some chased rates lower. Asia too saw further erosion in rates. This was despite some decent level of NoPac support and some Japanese tender cargoes, which gave some North positions a midweek boost. However, with minimal fresh demand elsewhere, trips ex Indonesia and Australia became further discounted. A 79,000dwt delivery China agreeing $19,000 for a trip via Indonesia redelivery South Korea was a good indicator of the market.

Ultramax/Supramax

A rather subdued week overall. However, some areas such as the US Gulf in the Atlantic and north Asia saw a little more resistance to the declines seen elsewhere as of late. Little in the way of period activity surfaced. But a 58,000dwt open Asia was rumoured fixed for one year at $19,000. In the Atlantic, from the US Gulf more cargo enquiry was seen. A 61,000dwt fixing in the mid ish $40,000s for a trip to the Far East. Whilst for transatlantic runs, a 57,000dwt was seeing in the low $30,000s. Limited activity elsewhere, with East Coast South America remaining finely balanced from the East Mediterranean. Little was seen, but a 57,000dwt was heard fixed for a trip delivery Canakkale redelivery Arabian Gulf-India in the mid $30,000s. From Asia, a split scenario as an abundance of prompt tonnage remained in the South whilst further north slightly more enquiry was seen in the market. A 61,000dwt open South Korea fixing a CIS Pacific round at $20,500.

Handysize

The Asia markets have continued to soften and the Atlantic has also joined this negative sentiment, except from East Coast South America, which has made positive gains. A 34,000dwt open in Japan was fixed for a trip to South East Asia at $23,000. A 36,000dwt open in North China was fixed for a trip via Australia to the Continent at $16,000 and a 39,000dwt open in Japan was fixed for a round trip via Australia at $19,750. In Argentina, a 40,000dwt was fixed from Upriver Plate to the Continent at $44,000 and a 38,000dwt open Upriver was fixed to West Coast South America in the high $40,000s. A 37,000dwt open in Mobile was fixed with woodpellets to the UK-Continent at $28,000. A 34,000dwt was fixed from Gibraltar via the Western Mediterranean to Vera Cruz at $31,500. A 38,000dwt open in Brazil was fixed for 12 months period with worldwide redelivery at $24,000.

VLCC

Rates eased again in the Middle East Gulf and Atlantic regions. For the 280,000mt Middle East Gulf to US Gulf (Cape/Cape routing) trip rates are assessed another half a point lower than last week, at just below WS22. Meanwhile the rate for 270,000mt Middle East Gulf to China has repeated the 1.5 point drop this week, to WS43 level (a roundtrip TCE of $1.1k/day). In the Atlantic, rates for 260,000mt West Africa to China similarly fell 1.5 points to WS45 (a TCE of $4.4k/day roundtrip) and 270,000mt US Gulf to China is down $37,500 at $5.425m (a TCE of $7.1k per day roundtrip).

Suezmax

In West Africa the market slipped with the rate for 130,000mt Nigeria/UK Continent down four points to between WS70/72.5 (showing a roundtrip TCE of about $6.12k/day). However, the latest reports detail a continued slide with Exxon taking a 2009 built SCF Surgut at WS70 and the Advantage Start at WS67.5. The market for 135,000mt Black Sea/Med dipped 1.5 points to WS83.5 (a TCE roundtrip of $6.1k per day). The market for 140,000mt Basrah/Lavera has been quiet again this week and rates have eased a further 5.5 points to WS37.5.

Aframax

In the Mediterranean, owners have been able to steady the downward trend by keeping the rate for 80,000mt Ceyhan/Lavera flat at WS126.5 ($15.9k per day TCE roundtrip). In Northern Europe the market for 80,000mt Cross-North Sea has risen by three points to WS130 (a TCE of about 15.2k/day) and 100,000mt Baltic/UK Continent gained a further seven points week-on-week to between WS110/112.5 (a TCE of about $20.8k per day roundtrip). Across the Atlantic, the market for the short local voyages has eased slightly again with the 70,000mt Caribbean/US Gulf rate down two points to WS125 (a TCE of $9.3k/day roundtrip) and 70,000mt East Coast Mexico/US Gulf is a single point lower at just below WS130 ($11.9k/day TCE roundtrip). Going against the negative flow Stateside, the market for the 70,000mt US Gulf/UK Continent voyage rose by five points to WS112 (a TCE of $7.3k/day roundtrip however, basis 1-way economics this improves significantly).

Clean

There was some positive news for Owners of LR1s this week with owners booking modest gains. Reliance took a number of fixtures on TC5 and ST Shipping placed a ship on subs for W115 for early December dates. On MRs there was more positive news with rates climbing in the east, with Trafigura fixing the RITA M for $360k Ulsan to Vietnam. MRs in the Med benefitted from a number of cargoes coming to the market all at once, with eight prompt ships to absorb the demand. Seven of those were currently on subs at the time of writing. Cross med cargoes are currently looking at rates of around W180. However, MRs in the Americas have seen little activity and little to feel cheerful about. Perhaps there is cheer around the corner for Owners with demand from Mexico having the potential to lift that market.

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

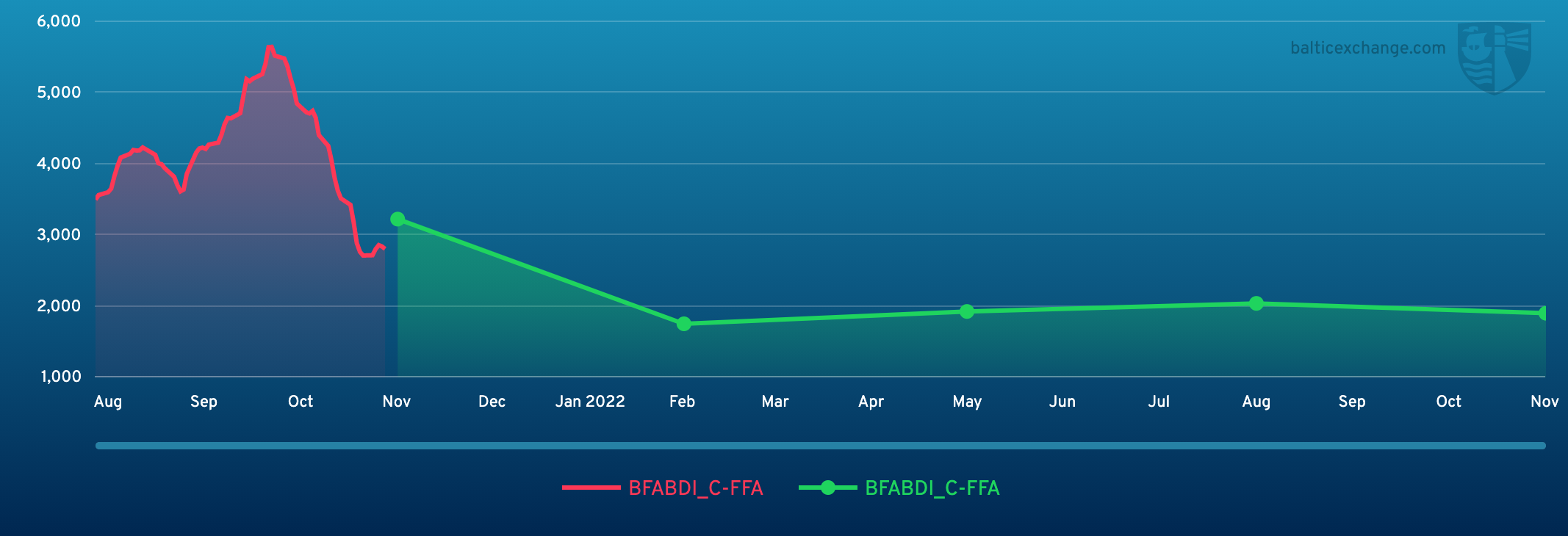

Chart shows Baltic Dry Index (BDI) during Nov.12, 2020 to Nov.12, 2021

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of time charter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.

(Source: The Baltic Exchange, edited by Niu Huizhe with Xinhua Silk Road, niuhuizhe@xinhua.org)

A single purchase

A single purchase