BEIJING, Feb. 1 (Xinhua) -- The Baltic Exchange has published its weekly report of the dry and tanker markets for January 25-29, 2021 as below:

Capesize

The Capesize routes endured a week of slippage on rates, bringing the market back down to levels seen at the beginning of the month. Dropping 8,956 over the course of the week the Capesize 5TC settled at $15,675. The Atlantic Basin routes were the big movers with the Transatlantic C8, in particular, coming under fire. It posted down to $23,250 as a lack of cargo took its toll. The Pacific Basin, with an abundance of cargo to go along with available vessels, allowed charterers to continually apply downward pressure with the West Australia to Qingdao C5 dropping 1.728 by weeks end to $6.145. While the market did post down on the last day of the week, there was scattered chatter that the market had bottomed in some regions as the ballaster routes lit up green amongst an otherwise sea of red. This time of the year is usually a seasonal low period for Capesize. However, the market continues to surprise as rates remain elevated. Some would say this bodes well for the remainder of the year.

Panamax

An interesting week in the Panamax market with widely differing opinions of the market in the Atlantic. Activity in Asia started slowly and diminished as the week went on with spot rates coming under pressure. A $13,250 figure was achieved early in the week for a NoPac round trip. However, these levels slowly eroded as both appetite and activity curtailed. News of ships waiting off China with thermal coal being given permission to discharge began to seep through. But this conceivably will only add to tonnage count in the area, potentially further increasing pressure here. In the Atlantic, it also began the week slowly with varying degrees of rates being concluded. It was largely positional in the North with solid support for breaching and ice breaking trades. Further south from EC South America, there was sporadic trading for much of the week. But it appeared to come alive on Thursday with some well-supported fixtures concluded for first half March arrival dates.

Ultramax/Supramax

Another positive week for the sector with demand keeping pace with supply in most areas. Period activity was abundant. A 56,000dwt sizes open in the Indian Ocean seeing $14,000 for three to five months, whilst a 58,000dwt open China fixed at $11,500 for one year. Atlantic rates remained healthy. A 56,000dwt fixing from Norway via the Baltic to the Black Sea in the $16,000s and a 57,000dwt fixing in the low $20,00s for a trip from central Mediterranean via the Black Sea to China. South America remained active, however, information was limited. The Asian arena seemed to have peaked as the week ended. The Ultramax size was fixing in the mid $12,000s for NoPac round voyages. From south east Asia, a 56,000dwt open Manila was fixed for a trip via Indonesia redelivery China at $11,500. Demand remained from the Indian Ocean. A 63,000dwt fixing a trip from west coast India to China in the low $19,000s.

Handysize

The consistent uprising recorded a new high in the Handy sector this week. The BHSI climbed higher up to double the figure published in the same period last year. Throughout the month, the activity level was surged in the Atlantic by Turkish imports of scrap cargoes. Other orders from the Continent also lent further support - especially with end January dates. Both east coast South America and the US Gulf remained, whilst the rates moved sharply higher towards the weekend in the East with all three Pacific routes now being above $10,000. A 37,000dwt delivery in Southwest Pass was fixed for a trip to Algeria at $16,000 in the middle of the week. A 33,000dwt open east Mediterranean was fixed for a trip via the Black Sea to west Mediterranean at $17,250. In the Pacific, a 36,000-dwt open east coast Australia was traded and failed on subjects at approximately $20,000s level for a trip back to Southeast Asia.

VLCC

The VLCC sector saw rates pretty much static this week with 'earnings' ever so slightly up. In the Middle East, 280,000mt to US Gulf via the Cape/Cape routing were unchanged at W18/18.5 level and 270,000mt to China ticked up a single point to WS32.5 level (just about a positive TCE). In the Atlantic region, rates for 260,000mt West Africa to China hovered around WS32.5, whilst rates for 270,000mt US Gulf to China gained close to $80k to settle around $4.3m.

Suezmax

In the 135,000mt Black Sea/Med market we saw rates climb a further seven points to now be assessed around WS70-72.5 level (about $7,000/day). The West African market, meanwhile, again saw the biggest increase where 130,000mt Nigeria/UK Continent rates climbed more than 7.5 points to between 67.5-70 level (about $13,000 per day). In the 140,000mt Basrah/Med market, rates firmed two points to WS20-21 region.

Aframax

Rates for 80,000mt Ceyhan/Lavera increased five points this week to WS77.5-80 level (just over $1,800/day TCE). In Northern Europe, rates for voyages of 80,000mt cross-North Sea remained static at WS77.5 (a TCE of about -$6.5k/day). The 100,000mt Baltic/UK-Continent rates dipped two more points to WS58 (about $1,700 per day). On the other side of the Atlantic, the market eased with rates for 70,000mt Carib to US Gulf falling five points to about WS82.5/85 level (just below $3k/day TCE). For the 70,000mt US Gulf to UK Continent trip, rates fell back three points to a fraction below WS73.

Clean

In the Middle East Gulf/Japan trade, charterers have held the upper hand and owners have seen rates eroded further with 75,000mt to Japan easing around 2.5 points to low WS70s. In the 55,000mt trade, the market is still hovering at, or very close to, mid WS70s. In the 35,000mt AG/East Africa trade, the start of the week saw rates readjust down 8.5 points to WS140. It has continued to soften with the market now at WS 135 and remains under pressure. For owners plying the 37,000 Cont/USAC market, it has been a positive week with the market gaining 15 points to WS130 level. However, with the weak market in the US Gulf, tonnage is ballasting across to the Continent. And, from 10th February onwards, the tonnage list consequently opens out somewhat so the market will need sustained enquiry if rates are to be main maintained here. The backhaul trade of 38,000mt from US Gulf to UK-Continent has been steady at an insipid WS75 region, while the 38,000mt US Gulf to Brazil run has seen four points shaved off the rates, which now sit at WS107.5/108 region. In the 30,000mt cross-Mediterranean trade, a slower week and lack of weather delays saw rates readjust downwards from low WS160s to sit now in the very low WS 150s. Brokers feel there is potential for further softening here.

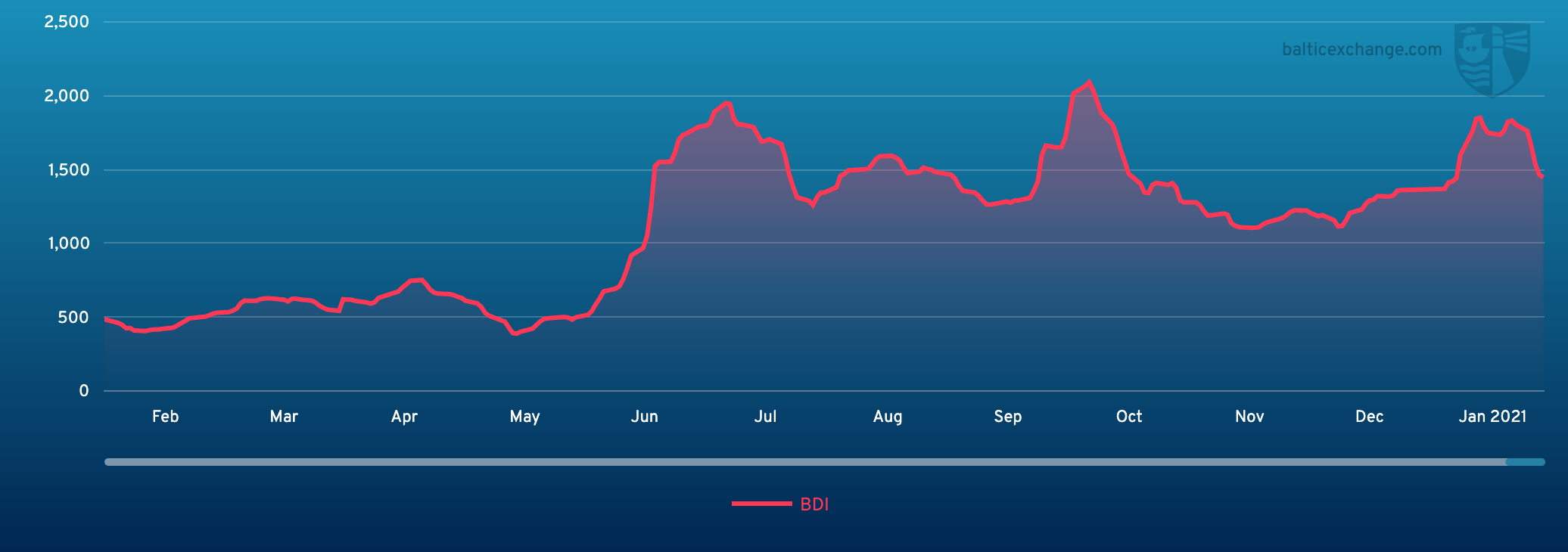

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

Chart shows Baltic Dry Index (BDI) during Jan.31, 2020 to Jan. 29, 2021

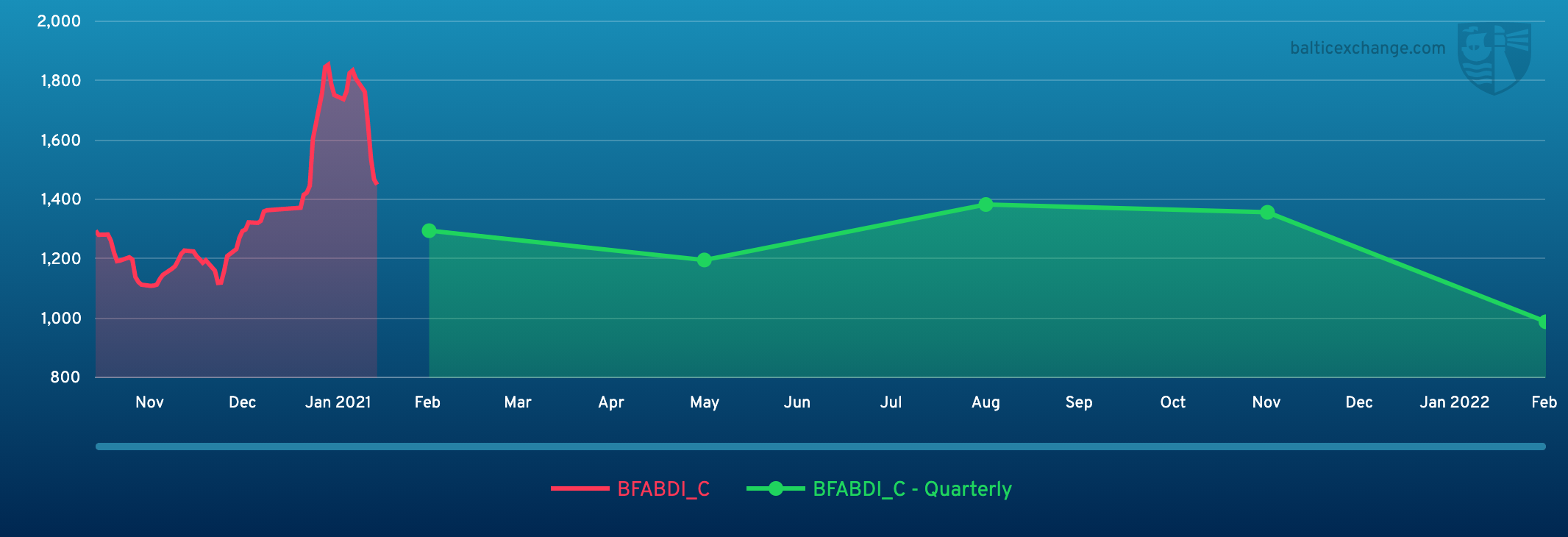

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of timecharter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.

(Source: The Baltic Exchange, edited by Niu Huizhe with Xinhua Silk Road, niuhuizhe@xinhua.org)

A single purchase

A single purchase