BEIJING, April 22 (Xinhua) -- China's banking regulator has taken measures to check on business loans collateralized with real estate to prevent such loans from flowing into the property market, according to an official with the China Banking and Insurance Regulatory Commission (CBIRC).

The banks were asked to monitor the flow of capital and ensure the loans are used in line with the purpose for which the loan was applied and cannot be misappropriated, said Xiao Yuanqi, chief risk officer of the CBIRC.

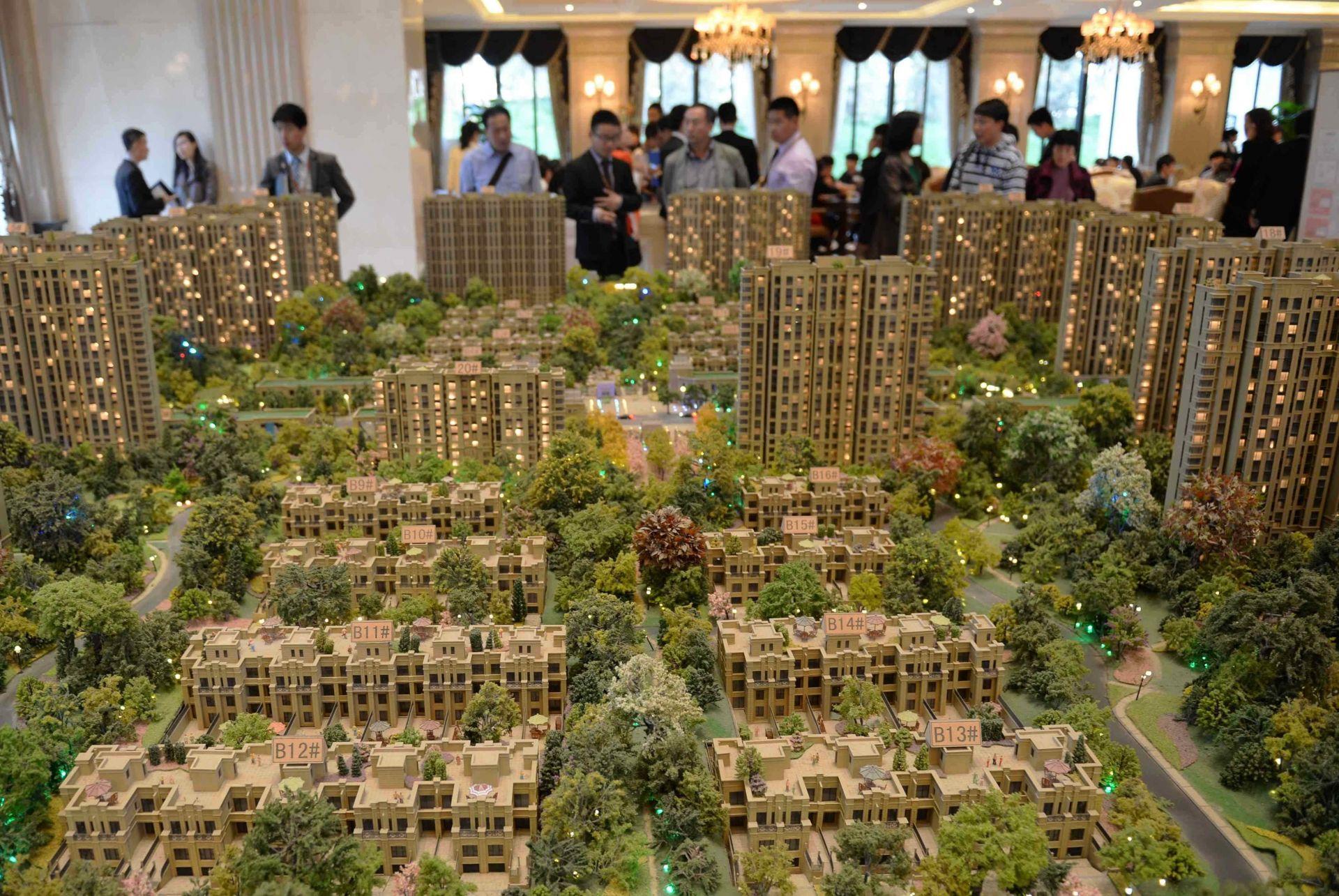

Property prices in southern Chinese city of Shenzhen have seen fast growth recently, raising concerns that some business relief loans might have flown into the real estate market.

The Shenzhen branch of the People's Bank of China issued a notice on Monday to ask banks in the city to look into business loans collateralized with property and whether there are any violations of regulations.

The Political Bureau of the Communist Party of China Central Committee said in a meeting last week that the country's property policy that "houses are not for speculation" will continue, and the country will promote the healthy developement of the property market. Enditem

A single purchase

A single purchase