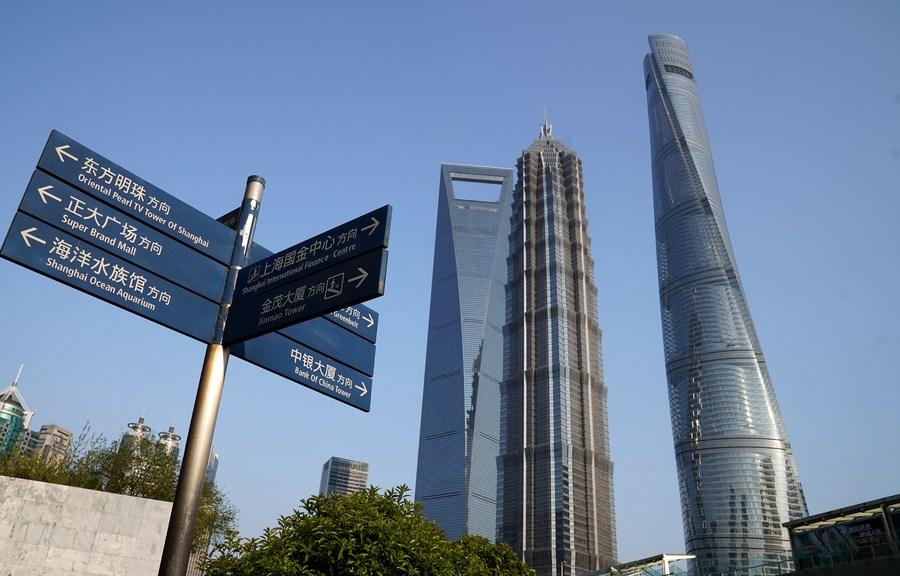

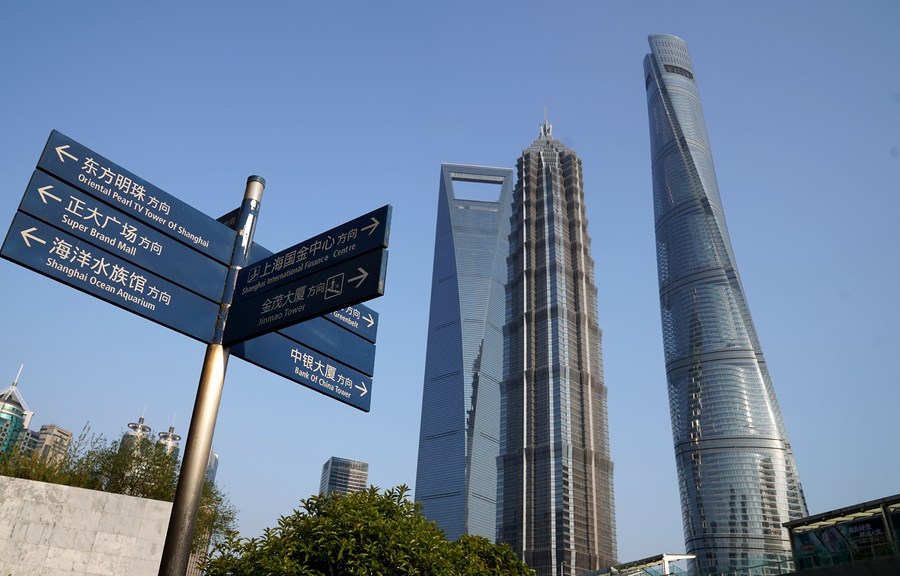

Photo taken on April 9, 2020 shows the Lujiazui area in Shanghai, east China. (Xinhua/Chen Fei)

BEIJING, July 10 (Xinhua) -- Chinese non-financial institutions raised more funds through debt financing instruments in the interbank bond market in the first half of 2022.

Net financing through debt financing instruments reached about 1.1 trillion yuan (163.94 billion U.S. dollars) in the first half of 2022, an increase of 500 billion yuan from the same period last year, data from the National Association of Financial Market Institutional Investors showed.

In the first half, non-financial institutions issued 4.73 trillion yuan of debt financing instruments in the interbank bond market, up 6 percent year on year.

Since the beginning of this year, the interbank bond market has stepped up support for the financing of private enterprises.

The market in the first half of 2022 supported Chinese major logistics firms SF Express, Deppon Express, Yunda Express, and YTO Express to issue total debt financing instruments of 5 billion yuan, to supplement their operating funds and optimize debt structure.

Debt financing instruments involve a variety of negotiable securities for non-financial enterprises that want to raise capital, including short-term commercial paper, medium term note, private placement note, and super short-term commercial paper.

A single purchase

A single purchase