BEIJING, May 23 (Xinhua) -- The Baltic Exchange has published its weekly report of the dry and tanker markets for May 16-20, 2022 as below:

Capesize

The Capesize market began the week at the summit of the recent rally. This necessitated a breather before sentiment strengthened, helping it to push up throughout the week and marking new highs for the year. The Capesize 5TC rose $4,805 over the week to close at $37,538. The Pacific region, while easily the premium region to trade currently, was in somewhat of a holding pattern whilst it awaited other regions to catch up. The Transpacific C10 dipped slightly at weeks end to $37,538. In the Atlantic Basin fixing activity increased, admittedly from a very low level, and now looks to have sparked the region to life with some solid gains with the transatlantic lifting a whole $8,900 over the week to $32,150. The region was a mixture of fixtures from less usual routes including Brazil to the Arabian Gulf, South Africa to the Continent and Brazil to the Mediterranean on a base of Brazil to Far East, which all combined into a cocktail of positive drive and sentiment. Whether it's all sustainable is yet to be seen, but finally the Atlantic is strongly back in the mix contributing and not getting splinters sitting on the bench.

Panamax

A flat ending to the week for the Panamax market, with a major shipping function in the west and Asian holidays ultimately impacting markets despite market fundamentals appearing largely positive. The Atlantic saw steady support from the grain trades over the week. And, with mineral demand mostly absent, the transatlantic grain trips lent the most support with approximately $30,000 being the mean average. However, the front haul trips hovered around the $40,000 mark. Rates firmed in Asia as the week progressed, the basin looked largely NoPac centric with solid levels of demand. $30,000 fixed midweek on an 82,000dwt delivery Japan, whilst an 81,000dwt delivery South Korea achieved $30,000 for a trip via EC Australia redelivery India with coal, highlighting a steady rate for this trade too. Despite substantial moves in the FFA market this week period activity remained slow, although there were reports of an 82,00dwt delivery China agreeing close to $27,000 for nine to 11 months trading.

Ultramax/Supramax

Like the other sectors, a split market appeared during the course of the week and the Atlantic slowed down as many travelled to Denmark. By contrast, after the Singapore holiday on Monday, positive sentiment gained as more enquiry came into play. The appetite for period cover increased, brokers said. However, a lot was concluded on private terms. From the Atlantic limited action surfaced. A 55,600dwt open Klaipeda fixed a trip to the East Mediterranean in the mid $20,000s. From Asia, strength remained in backhaul demand. A 56,000dwt fixed delivery Bohai Bay redelivery Mediterranean at $43,500. Pacific-orientated business saw stronger interest. A 61,000dwt fixing delivery Philippines via Indonesia redelivery West Coast India at $40,000. Whilst a 60,000dwt open Busan fixed a NoPac round redelivery Singapore-Japan in the low $30,000s. From the Indian Ocean interest remained. A 56,600dwt fixing delivery Chennai via East Coast India redelivery China at $27,750.

Handysize

A week of limited activity with holidays and the Danish Shipbrokers event, resulting in a split market as the Atlantic softened across all areas. The biggest drops came in the US Gulf, where a 35,000dwt open in Puerto Rico fixed a trip to Morocco at around $30,000. A 39,000dwt was rumoured to have been fixed for a trip from the SW Pass to Atlantic Colombia at $31,500. Elsewhere, a 38,000-dwt open in Iskenderun was fixed for a trip to China at $21,000. Also, a 32,000dwt open in Greece was fixed via Bourgas to Algeria at $20,500 and a 32,00-dwt open in Piraeus fixed a trip to the US Gulf at $25,000 for the first 30 days and $30,000 thereafter. By contrast, Asia saw levels improve with brokers saying levels of enquiry continued to increase. A 32,000dwt open South Korea fixed a trip to South East Asia at $24,000. Period activity saw a 37,0000dwt open South Korea fixing three to five months trading at $35,500.

Clean

LRs in the Middle East Gulf began the week with soft sentiment. However, good activity levels look to have slowed the downturn for the moment. TC1 75,000 Middle East Gulf / Japan, despite losing 20.71 points to WS269.29, is still returning a shade over $50,000 per day, round-trip TCE. TC5 55,000 Middle East Gulf / Japan has not dipped quite to the same extent, only 7.85 points to WS302.85 and LR1 demand west (TC8) has been relatively stable, holding around the $4.8 million mark. TC17 35,000 Middle East Gulf / East Africa has traded sideways / soft this week with reports of owners waiting for June stems emerging. The index has dropped five points to WS385.83.

In the west, the LRs have been flat this week and the prior boost, which was driven by the Arabian Gulf market firming, looks to have lost steam. TC15 has resettled at $4.75 million for the moment and TC16 remained level around WS240 all week.

Activity looks to have been consistent through the week and ship availability balanced for enquiry levels on the MRs in North West Europe. TC2 37,000 UK-Continent / US Atlantic Coast and TC19 37,000 UK-Continent / West Africa have both dropped incrementally, but TC2 is still marked around the mid WS340s and TC19 in the mid WS350s.

In the USG there has been a flurry for fixing this week. And, in combination with other factors such as Panama canal delays, TC14 38,000 US Gulf / UK-Continent has risen 77.85 points to WS247.14 and TC18 38k US Gulf / Brazil climbed 94.29 points to WS314.29 this week.

The MR Atlantic basket TCE rose from $36,771 per day to $47,564 per day. The Handymax TC6 has seen a surge in demand, reflected in the index jumping 61.88 points to WS361.88. In the Baltic, TC9 stayed stable at around WS425 all week.

VLCC

VLCC rates held steady mostly this week. 280,000mt Middle East Gulf/US Gulf (via Cape of Good Hope) is assessed a point higher at WS24, while the 270,000mt Middle East Gulf/China trip remained flat at WS40 (a round-trip TCE of minus $16,800 per day). In the Atlantic arena the rate for 260,000mt West Africa/China stayed at a fraction below WS43.5 (minus $13,000 per day round-trip TCE). Meanwhile, an improvement of $143,750 was seen for the 270,000mt US Gulf/China voyage where the market is now assessed at $5.275m (a round voyage TCE of minus $13,900 per day).

Suezmax

Rates for the 135,000mt Novorossiysk/Augusta fell a further 10 points to between the WS115-117.5 7 region (a round-trip TCE of $20,100 per day), whilst in West Africa the 130,000mt Nigeria/UK-Continent route rates slipped 2.5 points to WS85.5, which shows a round-trip TCE of about $4,300 per day. For the 140,000mt Basrah/West Mediterranean route the rates have dipped a point to just under WS44.

Aframax

The 80,000mt Ceyhan/Mediterranean market shed another 14 points this week to WS127.5 (a round-trip TCE of about $10,900). In Northern Europe the rate for 80,000mt Hound Point/UK-Continent is 3.5 points lower than a week ago at a shade below WS140 (a round-trip TCE of $15,900 per day). In the Baltic Sea the Ukraine crisis, and the resultant Russian sanctions, continued to have an effect on fixture activity on the 100,000mt Primorsk/UK Continent route where the rate is now assessed 39 points lower this week at between WS162.5-165 (a round-voyage TCE of $35,000 per day). The only fixture noted was Litasco reportedly chartering a Greek controlled Aframax at WS165 for the UK Continent option. Across the Atlantic, a different scenario is playing out. After a slow start to the week the market jumped on Thursday. Rates for the shorter-haul 70,000mt EC Mexico/US Gulf route leapt 40 points to above WS182.5 (a round-trip TCE of $22,800 per day) and for the 70,000mt Caribbean/US Gulf trip rates climbed 35 points to over WS173 (a round-trip TCE of about $17,300 per day). For the transatlantic trip of 70,000mt US Gulf/UK Continent, rates were lifted 20 points to just push through the WS157.5 mark ($13,900 per day round-tip TCE).

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

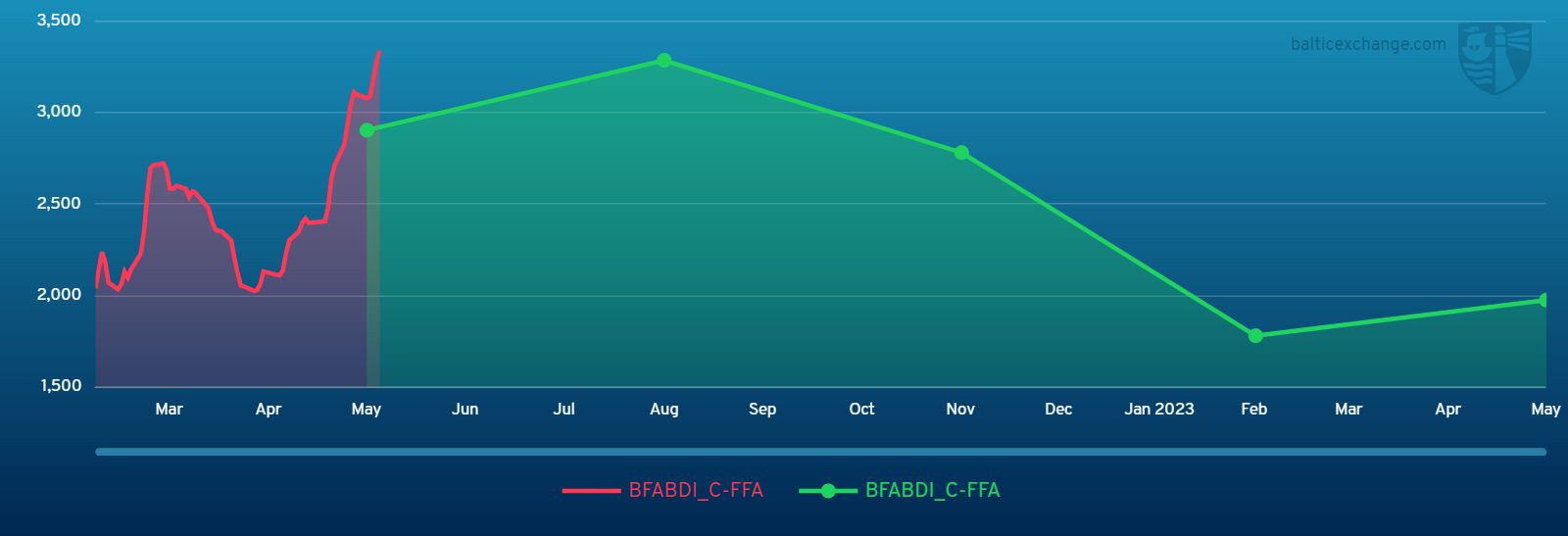

Chart shows Baltic Dry Index (BDI) during May 21, 2021 to May 20, 2022

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of time charter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.

(Source: The Baltic Exchange, edited by Niu Huizhe with Xinhua Silk Road, niuhuizhe@xinhua.org)

A single purchase

A single purchase