Photo taken on Nov. 15, 2021 shows a scene at the opening ceremony of the Beijing Stock Exchange, in Beijing, capital of China. (Xinhua/Li Xin)

BEIJING, Dec. 23 (Xinhua) -- In 2021, China's all-around capital market reform contributed notably to the country's translating its recovery resilience into concrete dividends for global investors to share.

With a series of institutional reform measures in place, China's capital market became more law-based, transparent, vibrant and flexible in 2021, attracting an increasing crowd of foreign investors to seek fortune from China's stock and bond markets.

-- High quality reform empowering high quality economic development

According to China's 14th Five-Year Plan outlines, formulating and optimizing basic rules, enriching multi-layer market system, improving the proportion of direct financing especially the equity financing, and enhancing investor protection regulations are requirements for capital market reform so as to better serve economic growth of higher quality.

In 2021, China carried out capital market reforms such as founding the Beijing Stock Exchange (BSE) dedicated to serving innovative small- and medium-sized enterprises (SME) and also piloting registration-based initial public offering (IPO) rules, renewing green-bond backed projects catalogue, cancelling compulsory ratings for certain corporate bond products, and promulgating special document to crack down illegal securities activities, painting gradually the new blueprints of capital market in accordance with requirements of the outlines.

Upon debut of the BSE, China pilots registration-based IPO rules on one more board apart from the sci-tech innovation board, better known as STAR market of Shanghai Stock Exchange (SSE) and ChiNext market of Shenzhen Stock Exchange (SZSE), moving closer to the full-scale application of registration-based IPO rules.

With the BSE, STAR market and ChiNext market altogether, registration-based IPO rules grant more companies access to robust financing with improved efficiency than the past and along with their high levels of R&D expenditures in general, the three boards, which are typically embodiment of "hard technology" and "innovation and business startup", prove to be factual supporters of higher quality growth in China.

By November 30, STAR market had 362 listed companies, with 147 ones going public in the first 11 months of 2021, which have surpassed the total of 2020. Meanwhile, 175 firms got listed on ChiNext market, accounting for as high as 84.13 percent of the comparable total on SZSE from January to November, 2021.

The birth of BSE also fills in the blank with its distinct positioning of financing specialized, characteristic and innovative SMEs in China. Aside from setting lower requirements on market capitalization and financial indicators of listed companies than other exchanges, BSE adds new dimensions to evaluate innovative SMEs such as growth potential and R&D capability so as to support inclusively development of these innovation-oriented SMEs.

By December 14, the BSE has been operating for one month, hailing 82 listed companies in total, of which nearly 90 percent of them came from advanced manufacturing, modern services, high-tech services and strategically emerging industries and 17 ones are specialized and innovative "little giant" companies.

Together with the SSE, SZSE, and regional equity trading markets, establishment of BSE helps form a coordinated, complementary and interconnected multi-layer markets system to jointly serve China's real economy and sci-tech and innovation-driven economic development.

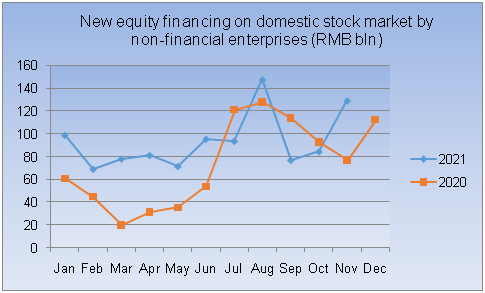

By far, China's stock market reforms have transformed into hefty financing to the real economy entities. Statistics with Chinese central bank, the People's Bank of China (PBOC) showed that non-financial enterprises' equity financing on domestic stock market grossed 1.03 trillion yuan in the first 11 months of 2021, already exceeding the annual aggregate of 892.4 billion yuan in 2020.

Data source: PBOC

On the country's bond market, China's newly-amended 2021 version of green bond-backed projects catalogue, effective from July 1, 2021 is expected to fully exploit the role of green finance in economic structural reform, propelling sustainable development and facilitating realization of the carbon peaking and carbon neutrality goals.

The new version unifies green bond-related Chinese regulators' assessing standards of green projects to reduce issuance, trading and management costs of green bond and further narrows down the gap with comparable international standards.

After exceeding 500 billion yuan in 2020, China's green bond issues are likely to top the figure again in 2021. Statistics with Wind showed that green bond issues have exceeded 400 billion yuan in the first three quarters of 2021, indicating vigorous supports to green development in the country.

In addition to these, China attached unprecedentedly great importance to investor protection to optimize the capital market environment in 2021.

For the first time in history, the General Office of the Communist Party of China (CPC) Central Committee and the General Office of the State Council jointly released a document on hammering illegal securities activities in early July, 2021, reflecting their putting high premium on cracking down illegal activities on securities market, protecting rights and interests of investors and safeguarding the steady and healthy development of capital market.

The document optimizes the top design of China's capital market and aims to improve quality of listed firms over the long run, good for all-around deepening of reform and better display of the capital market functions.

When China's financial market pursues opening up of higher quality, corresponding regulation and supervision are necessarily inevitable. China Securities Regulatory Commission once conveyed a clear attitude towards this, meaning that with the access at the front end loosened, the regulation enforcement following the accession has to be tightened.

Nothing but a better capital market environment can help China draw in more foreign capitals to boost interaction with the world economy, experts said.

-- Sharing growth dividends with the world

China's capital market also prospers on reform and opening up.

In recent years, China has mapped out multiple capital market reform and opening up measures to propel institutional innovation, serve innovative SMEs and startups, incubate of innovation drivers and guide and cultivate long-term and value-based investment concepts. At the same time, these measures also facilitate global investors to purchase Renminbi-denominated assets to share dividends arisen from China's economic growth.

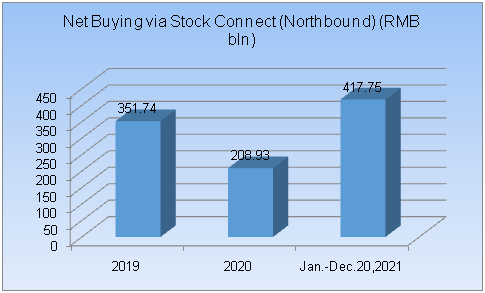

Active northbound trading and adding A-share holdings by foreign investors under the Stock Connect scheme, the major channel for overseas investors to invest in China's A-share market, are the miniature of China's capital market opening and reform achievements in 2021.

By December 20, northbound trading under the Stock Connect program between the Chinese mainland and Hong Kong recorded all-time high 26.95 trillion yuan of turnover and channeled inward historically high 417.75 billion yuan of global capital in 2021, hinting solid confidence in the Chinese economy and growth prospects of its capital market.

Data source: Public data

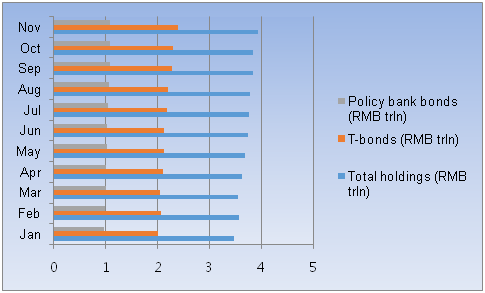

In addition to seeking fortune on A-share market, foreign investors sustained their paces of purchasing RMB-denominated bonds on the bond market in China, especially since outbreak of the COVID-19 epidemic and when China's economic recovery maintained relatively stable in 2021.

Statistics with PBOC Shanghai Head Office showed that foreign institutions added 80.7 billion yuan of RMB-denominated bonds in November 2021, raising their total RMB-denominated bond holdings on China's interbank bond market to 3.93 trillion yuan, an increase of 0.68 trillion yuan from the end of 2020.

Data source: PBOC Shanghai Head Office

Just as the Chinese saying goes, "If you open the door wider to welcome guests, more and more guests will pay visits to you."

Standing at the starting line of the 14th Five-Year Plan period, China is determined to bring its capital market further on the road of high quality reform and opening up to usher in a new chapter of facilitating high quality economic growth and embrace incoming global investors. (Contributed by Duan Jing with Xinhua Silk Road, duanjing@xinhua.org)

A single purchase

A single purchase