BEIJING, Nov. 23 (Xinhua) -- China's bond yields edged up on the whole in October, showed a monthly report released by China Central Depository & Clearing Co., Ltd. (CCDC), one of the central securities depositories in China, on Monday.

-- Bond yield curves move upward from September

As the report tells, China's bond yield curves shifted up in October. Specifically, the average yields of T-bonds, policy bank bonds, enterprise bonds (AAA) and short and medium-term notes (AAA) of key maturities (excluding the overnight yield) reached 2.7560 percent, 2.8544 percent, 3.3334 percent and 3.2699 percent, up by 11.75 basis points (bps), 9.94 bps, 0.19 bps and 3.00 bps respectively compared to the end of September.

-- Yields of T-bonds mostly up m-o-m, with 5Y & 10Y T-bond yields up notably

In October, yield of 1-year T-bond decreased 2 bps to 2.31 percent from the end of September while yields of 5-year, 10-year, 15-year and 30-year T-bonds rose 13 bps, 10 bps, 6 bps and 7 bps month on month to 2.8438 percent, 2.9732 percent, 3.32 percent and 3.498 percent respectively.

-- ChinaBond New Composite Net Price Index down moderately

ChinaBond New Composite Net Price Index dropped from 100.9659 at the end of September to 100.6342 by the end of October, down 0.3285 percent. The ChinaBond New Composite Total Return Index decreased from 209. 8546 at the end of September to 209.7583 at the end of October, down 0.0459 percent.

-- Bond market turnover up 31.44 percent y-o-y in October

In October, CCDC recorded 72.79 trillion yuan of bond turnover, up 31.44 percent year on year. Specifically, cash bond turnover stood at 9.31 trillion yuan while that of repos was 62.71 trillion yuan.

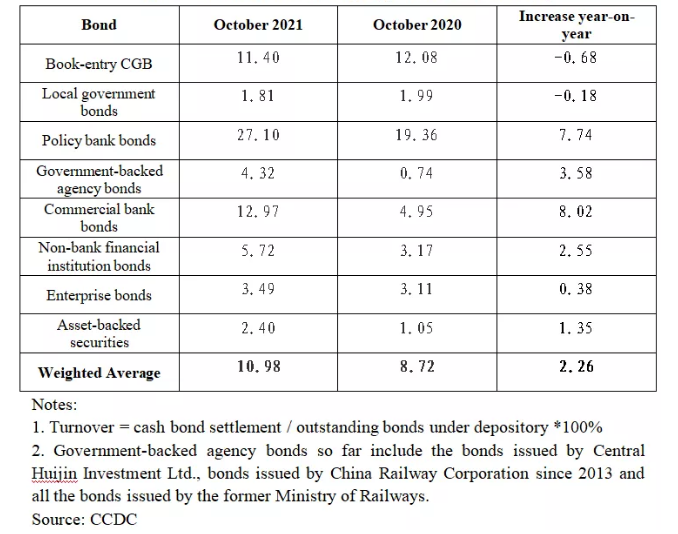

The most active trading parties for cash bonds registered at CCDC were commercial banks, securities firms and unincorporated products, with their turnover at 8.39 trillion yuan, 6.74 trillion yuan and 2.57 trillion yuan respectively. The average turnover ratio registered at CCDC was 10.98 percent. The actively-traded bonds were policy bank bonds, commercial bank bonds and book-entry T-bonds, with turnover rate at 27.10 percent, 12.97 percent and 11.40 percent respectively.

Table: Turnover of bonds by type in Oct. (%)

-- Outstanding bonds with central securities depositories by end October

By the end of October, outstanding bonds under custody with CCDC amounted to 84.56 trillion yuan, up 12.63 percent year on year. Those under custody with Shanghai Clearing House (SHCH) reached 14.74 trillion yuan, up 7.33 percent year on year. Those under custody with China Securities Depository and Clearing Co., Ltd. (CSDC) were 15.68 trillion yuan, up 17.79 percent year on year.

In October, CCDC registered a total bond issuance of 2.01 trillion yuan, and the top three types of bonds by issuance volume were local government bonds, T-bonds and policy bank bonds. Specifically, issues of local government bonds, T-bonds and policy bank bonds were 868.86 billion yuan, 626.7 billion yuan and 328.52 billion, accounting for 43.20 percent, 31.16 percent and 16.34 percent of the comparable total.

-- Foreign investors continue to add bond holdings in October

By the end of October, bonds held by foreign investors under custody of CCDC grew to 3.52 trillion yuan, up by 31.09 percent year on year and an increase of 22.6 billion yuan over September, marking the 35th consecutive monthly rise by foreign investors.

Among foreign institutions with bond holdings under custody with CCDC, 73.83 percent of them completed their bond transactions via China Interbank Bond Market Direct (CIBM Direct) and 26.17 percent of them entered via Bond Connect. T-bonds, policy bank bonds and commercial bank bonds were the top three bonds by value held by foreign institutional investors by the end of October.

CCDC is one of the central securities depositories in China responsible for registration, custody, and settlement services of T-bonds, local government bonds, central bank bills, policy bank bonds, financial bonds, bonds issued by government-backed agencies, enterprise bonds referring to bonds issued by state-owned or controlled enterprises, and credit asset-backed securities. (Edited by Duan Jing with Xinhua Silk Road, duanjing@xinhua.org)

A single purchase

A single purchase