Photo taken on Jan. 2, 2021 shows the light show at the Lujiazui area in east China's Shanghai. (Xinhua/Wang Xiang)

SHANGHAI, July 9 (Xinhua) -- The 15th Shanghai Financial Climate Index, a gauge released on Thursday by China Economic Information Service and Shanghai Financial Association to measure the development of Shanghai's financial industry, increased 5.6 percent on year to 5075.01 points in 2020, pointing to steady growth of local financial industry.

This also indicates that Shanghai has basically built itself into an international financial center that matches China's economic strengths and renminbi's international positioning, and is gaining new tractions to deepen reforms, open wider, and promote upgrades of its financial industry.

-- Pointer to vigorous local financial industry

The Shanghai Financial Climate Index is composed of six tier I indicators, reflecting the real development of Shanghai's financial industry from its financial market, financial institutions, financial talents, financial internationalization, financial innovation and financial ecological environment.

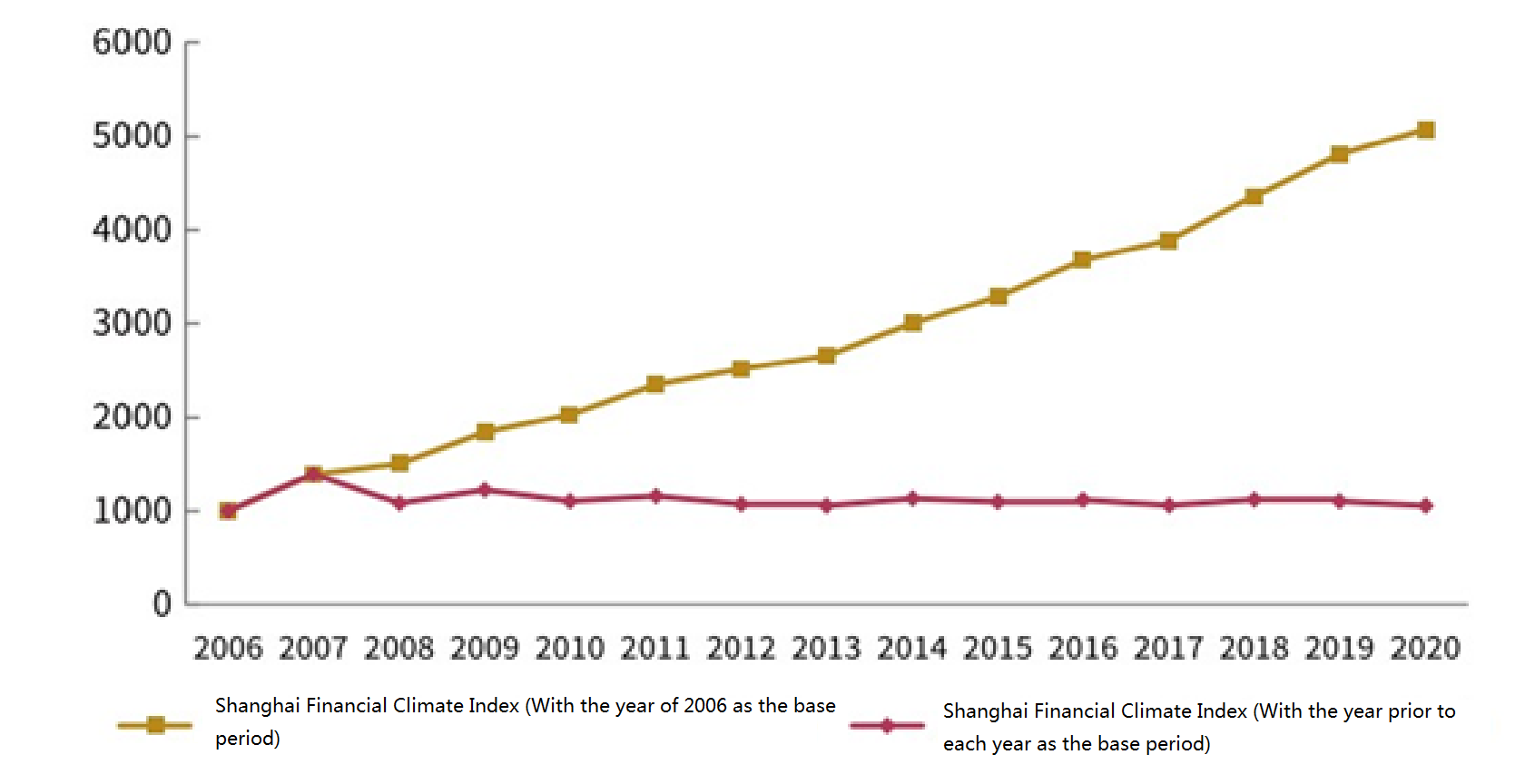

The Shanghai Financial Climate Index expanded 270.09 points on year in 2020 and registered a compound annual growth of 12.3 percent from the figure in 2006, pointing to the long-lasting prosperity of Shanghai's financial industry despite the outbreak of the COVID-19 epidemic.

Among the six tier I indicators, the financial market index outperformed others, up 11.6 percent year on year, followed by growths of indices for financial institutions, financial ecology and environment, financial innovation, financial internationalization and financial talents at 4.4 percent, 3.4 percent, 3.1 percent, 2.1 percent and 1.2 percent respectively.

Photo I: The Shanghai Financial Climate Index in 2006-2020. Notice: The base period of the index is 2006 and the base point of the index is 1,000 points.

To better measure local financial industry morale, the research team also surveyed local financial industry players. The 1,170 recovered questionnaires showed that local financial industry experts considered the city's financial climate as "relatively good" and gave 3.74 and 3.71 points of scores for Shanghai's financial innovation and financial ecological environment, both of which improved sharply from the year prior.

--Popular attraction for Chinese and foreign financial institutions

Behind all of these are the city's continuous efforts in building an international financial center.

By far, the east China-located metropolis has become one of the most popular attractions for Chinese and foreign financial institutions. Shanghai boasts 1,674 financial institutions with relevant business licenses, of which nearly one third are foreign institutions. The world top 10 asset management institutions and over 90 percent of foreign-funded private equity institutions are running businesses in Shanghai.

By the end of 2020, the number of financial technology (fintech) enterprises in Shanghai accounted for over 60 percent of the national total.

With the setup of fintech platforms such as Shanghai Fintech Industry Alliance and Investment Technology League (ITL), artificial intelligence, block chain and other edge-cutting technologies have been widely applied in Shanghai's finance sector, helping it accelerate formation of a local fintech ecosphere.

As also the place where Shanghai Stock Exchange (SSE), Shanghai Futures Exchange (SHFE), and Shanghai Gold Exchange (SGE) are located, the city cheered in 2020 on an all-time-high 2200 trillion yuan of financial market turnover, with those for SSE, SHFE and SGE up 29.4 percent, 35.8 percent and 50.7 percent year on year, respectively.

Apart from these, Shanghai has been a proven model for piloting opening up in financial sector. The SSE's sci-tech innovation board, a Nasdaq-style board better known as the STAR Market in China has made breakthroughs in a series of key rules, such as the issuance and pricing of stocks.

On back of the developed financial system, sound financial ecology and ample innovation opportunities, Shanghai enjoys the world class business environment and has gradually grown to be the favorite destination for global financial talents.

Statistics showed that Shanghai's financial industry employed in total 470,000 people, doubling the figure a decade ago.

With more and more international financial talents gathering here, Shanghai sees local financial ecological environment further optimized, which, in turn, laid a solid foundation for building itself an international financial center.

-- Great potential to create plus version of international financial hub

Previously, the 29th edition of the Global Financial Centres Index 29 (GFCI 29) released in March placed again Shanghai as the third most competitive financial hub worldwide, hinting acknowledgement of its being an international financial center from global investors.

Experts say that compared with the world's leading financial hubs including New York and London, Shanghai has shifted from a follower to a leading runner in terms of competitiveness gauges such as financial market turnover, and boasts great potential to promote business environment and level of internationalization.

Under such circumstances, Shanghai municipal government proposed to craft the city into a plus version of international financial hub and focus more on improving its "soft power".

Building the global asset management center is widely deemed as a necessary step for Shanghai to build the international financial center.

In May this year, the city has released guidelines on accelerating construction of global assets management center in Shanghai, aiming to turn it into a comprehensive and open global assets management center with highly concentrated related factors, high level of internationalization, and relatively complete ecology system by 2025.

Shao Yu, chief economist with Orient Securities reckoned that Shanghai should take advantage of the China (Shanghai) Pilot Free Trade Zone and strive to attract more large Chinese banks to set up wealth management subsidiaries and big international wealth management institutions to start businesses in the Shanghai FTZ.

In its progress towards a high-quality international financial hub, Shanghai needs to deepen financial reform, widen financial opening-up, and speed up establishment of the global RMB assets center in Shanghai in a bid to boost effective distribution of financial resources at home and abroad, suggested Zhou Kunping, senior researcher with Bank of Communications. (Edited by Duan Jing with Xinhua Silk Road, duanjing@xinhua.org)

A single purchase

A single purchase