BEIJING, Feb. 18 (Xinhua) -- The Baltic Exchange has published its weekly report of the dry and tanker markets for February 8-12, 2021 as below:

Capesize

The market was predictably quiet by the end of the week with many traders absent for the beginning of Chinese New Year. The Capesize 5TC registered a token drop of eight to settle at $10,304 as minimal trading was heard. It's said to be a different story on the derivatives market where rumblings of an upturn in sentiment was heard from several sources. The smaller bulk vessel classes are running counter to the Capesize decline. So much so it was heard Panamax cargoes this week were being combined to be loaded on a Capesize. The market had a fairly constant downward slide in values over the past week and yet the trans-Atlantic C8, which ended at $15,010 still trades at a significant premium to the trans-Pacific at $6,227. This highlights the more precarious trading situation in the Atlantic as tonnage remains tight, yet fixtures continue to tick over. This is not the usual for the Capesize market at this time of the year, which might have some traders questioning their position for the coming months. The West Australia to China ore route C5 settled the week at $5.827 while the Brazil to China C3 closed the week at $14.906.

Panamax

It was an energetic week with EC South America claiming the headlines for the first half of the week due to increased demand from the grain houses for March arrivals. Index type tonnage fixing at around $16,750 was achieved several times basis delivery Singapore via EC South America redelivery Singapore-Japan. At the same time, good demand continued in north Atlantic in the background against a shortage of tonnage. Some fixtures for Baltic trading, which includes breaching INL, were rumoured to have concluded at astonishing rates which have yet to be confirmed. For trips to the Far East, an 82000dwt delivery Gibraltar achieved $33,000 via US Gulf redelivery China. In large parts of Asia, it was a shortened week. But sentiment remained firm with all three major loading origins showing healthy demand. This was aided by strong support from the Americas and a robust period time charter market. An 82,000dwt vessel delivery Japan fixed $14,000 for a round trip via Australia, whilst an 81,000dwt delivery North China agreed $14,250 for one years time charter.

Ultramax/Supramax

Despite the Chinese New Year celebrations taking place at the end of the week, the market remained in a positive trajectory with the BSI closing at 1,217. Period activity continued, with a 58,000dwt open Indian Ocean fixing four to six months at $16,000 whilst from the Atlantic a 63,000dwt open in the US Gulf was fixed for three to five months trading at $21,000. Rates for single trips from the Atlantic remained firm - especially from the US Gulf - with an Ultramax fixing at $32,000 for a trip from US Gulf to Spain. The Continent was stable, a 61,000dwt fixing a scrap run to the Mediterranean at $18,000. From Asia, despite the impending holidays there was still demand and a 58,000dwt open Fangcheng was heard to have fixed two to three laden legs at $11,000. Rates from the Indian Ocean were still strong as a 63,000dwt fixed delivery south east Africa for a trip to China in the upper $15,000s plus a ballast bonus in the high $500,000s.

Handysize

Another strong week with improved levels on all the routes. For vessels open in Continent-Med range there was not much difference in rates going to US Gulf and east coast South America. Whilst in South America, brokers saw north Brazil delivery paying a premium over south Brazil delivery with the market continuing to be firm. Currently the US Gulf HS4 had the highest value among all routes and showed no signs of slowing down. A 37,000dwt open in Houston in mid February was fixed for a trip to Cristobal at $17,500. A 38,000dwt open in east coast Central America was fixed into the Black Sea at $19,500 and a 30,000dwt open north coast South America was fixed for a trip to Indonesia over $20,000. In the east, the celebration of lunar New Year kicked off early in the middle of the week in various countries. There was limited activity reported but the relevant Pacific routes still showed positive movement. A 35,000dwt was booked for four to six months at $10,250 with delivery in Guangzhou and worldwide redelivery.

VLCC

The Chinese New Year Holiday has kept this sector quiet this week. In the Middle East region, there was no shift in the assessment of 280,000mt to US Gulf via the Cape/Cape routing at WS18/18.5 level and the 270,000mt to China market is now rated at WS31.5 - a modest rise of a fraction of a point. In the Atlantic arena, rates for west Africa to China slipped a point to WS32.5, while from US Gulf to China rates eased about $12,000 to $4.225m lump sum.

Suezmax

Black Sea/Med rates have settled at last week's level between WS67.5 & 70 for 135,000mt, while the 130,000mt Nigeria/UK Continent market remains in the doldrums in the low WS50s. Basrah/Med fell back three points to about WS18-19 for 135,000mt.

Aframax

The cross Med market of Ceyhan/Lavera slipped a point to WS75. However, at the time of writing, there is a slightly firmer feel. In northern Europe rates for cross-North Sea rose about a point to WS78/79 level. Baltic/UK-Continent moved up a point over last week to around WS57.5 level although again there is a firmer feel here with WS70 being reported on subjects to a major trader for 100,000mt. On the other side of the Atlantic, Owners have managed to claw back some of the recent point losses with 70,000mt Caribbean/US Gulf and 70,000mt US Gulf/UK Continent both rising six points to WS78.75 and WS77.5 respectively.

Clean

It has been a rather lacklustre and flat week for most routes. Middle East Gulf/Japan LR2 rates generally hovered in the low to mid WS60s basis 75,000mt, whilst the LR1s had a slow week with rates easing 2.5 points to WS80 level. On the MR's a conference rate of WS120 has seemingly been established for 35,000mt AG/East Africa. For Continent/USAC, it has been another disappointing week with rates easing around three points to WS115 and five points lower was achieved on tonnage with last cargo palmoil, basis 37,000mt. However, there is talk now of WS117.5 possibly agreed for 17 February loading. The backhaul trade of 38,000mt from US Gulf to UK-Continent has remained stagnant in the WS75 region and it is a similar story for cargoes to Brazil with rates largely unchanged at WS112.5. One area of optimism for the Owners is in the 30,000mt cross-Mediterranean trade with rates gaining 20 points to WS135/136 after a clear-out of tonnage. There is still outstanding Black Sea enquiry with only limited tonnage availability in eastern Mediterranean.

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

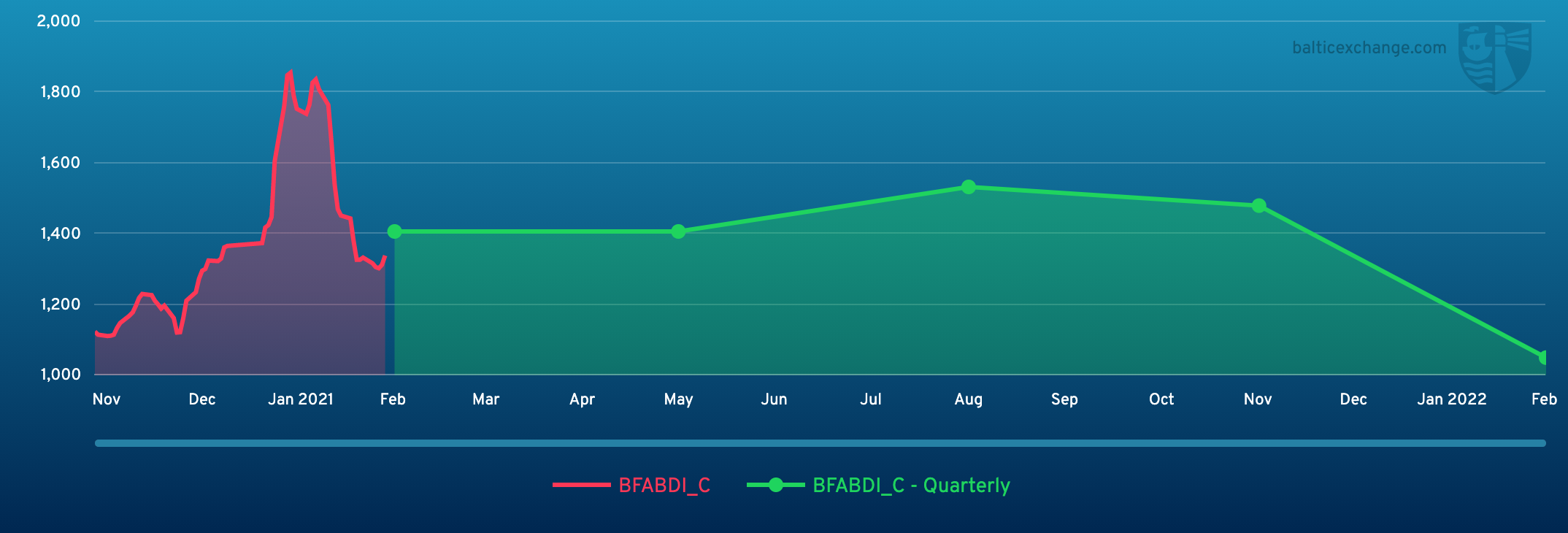

Chart shows Baltic Dry Index (BDI) during Feb. 14, 2020 to Feb. 12, 2021

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of timecharter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.

(Source: The Baltic Exchange, edited by Niu Huizhe with Xinhua Silk Road, niuhuizhe@xinhua.org)

A single purchase

A single purchase