BEIJING, Jan. 31 (Xinhua) -- The Baltic Exchange has published its weekly report of the dry and tanker markets for January 23-27, 2023 as below:

Capesize

The Capesize timecharter average (5TC) lost more than 50% of its value since the middle of last week. The spot rates in both basins continued their descent throughout the week after the lunar New Year holidays. The 5TC closed the week at $4,433, which reached its lowest level in five months and lower by over $1,200 compared with the same period last year. Both the Brazil to Qingdao run and the west Australia to Qingdao run diminished in contrast to the end of January 2022, settling at $16.883 and $6.30 respectively on Friday. Despite oversupplied tonnage across the board, some observations suggested owners had started to resist with anticipation that perhaps the market was finding a floor.

Panamax

Despite something of a midweek push from first-half February grain demand ex NCSA, it returned an uninspiring week. Quelled by various holidays in Asia, market values eroded further with minimal support seen throughout. However, the week ends on a slightly optimistic note. Transatlantic activity was slow all week and despite some talk that a floor may have been found, committed and ballaster tonnage continued to underpin rates. The standout rate on fronthaul trips was an 82,000dwt delivery Continent via NC South America redelivery Singapore-Japan at $18,250. Asia made for a tediously slow first half of the week, but activity appears to have picked up slightly in the past couple of days and there is talk here of a floor being found. It was a flat week in the FFA market, but it did appear to have lent some support to period appetite. Deals reported included an 81,000dwt achieving $14,500 levels for one year.

Ultramax/Supramax

A rather stagnant week with the Atlantic generally lacking fresh enquiry. Due to the Lunar New Year holidays in Asia, rates struggled to gain much uplift. Pressure remained from key areas in the Atlantic as prompt tonnage remained relatively abundant. In contrast, positive sentiment returned to Southeast Asia with better levels of enquiry. However, this was tempered by a lack of fresh enquiry further north. This lead to tonnage open there to secure employment further south. In the Atlantic, a 56,000dwt fixed delivery Aratu for a trip to Algeria at $10,000. Elsewhere, a 63,000dwt fixed delivery US Gulf trip to the Far East at $16,500. From Asia, a 61,000dwt open Singapore fixed a trip via Indonesia redelivery China at $9,100. A little more activity surfaced from the Indian Ocean and a 61,000dwt fixed delivery Port Elizabeth to the Far East at $14,000 plus $150,000 ballast bonus. With the return to work for many it will be interesting to see the direction of travel in the upcoming week.

Handysize

With many celebrating Lunar New Year, activity was limited in Asia. However, some regions of the Atlantic were showing signs of resistance to further reductions. A 34,000dwt was rumoured to have been fixed for a trip from Necochea to Atlantic Columbia at $10,250. Meanwhile, a 34,000dwt fixed from Klaipeda to Morocco with an intended cargo of grains at $7,250. A 40,000dwt was rumoured to have been placed on subjects for a trip from Santos to West Coast South America in the mid teens, but further details had yet to emerge. In Asia, a 35,000dwt was rumoured to have been placed on subjects for a trip Chiba via South Australia to East Coast India at $6,000 whilst a 38,000dwt fixed from Singapore via Australia to Singapore – Japan Range in the low $6,000s. A 38,000dwt fixed from CJK to South East Asia with an intended cargo of steels in the low $5,000s

Clean

All vessel sizes have been continually pushed down this week in the Middle East Gulf despite activity levels looking better. TC1 has come down 16.25 points to WS110.63 with a vessel widely reported on subs at WS110 at the time of writing. Likewise, a trip west on TC20 has haemorrhaged $320,000 down to $3,190,000. The LR1s have not felt the pressure as much at their larger counterparts. TC5, despite losing 6.43 points this week, has stayed above the WS130 mark. A voyage west on TC8 has remained in the $2,800,000 range. The MRs in the region, which were doing well to be resolute, finally succumbed this week and TC17 had a 54.29 point chunk taken out of it to take the index down to WS195.

West of Suez, LR2s have remained soft this week. TC15 lost $200,000 and is currently pegged at $2,783,333 taking the TCE for this run into negative. TC16 has clung on in the mid WS130s all week.

MRs on the UK-Continent have been continually tested down this week and vessel supply has heavily outweighed demand - including vessels ballasting away from the USA. TC2 dropped 49.16 points to WS150.56 and TC19 similarly shed 57.86 points to WS160.71.

Mediterranean Handymax vessels have continued to tick up this week, up and over the WS200 mark to WS201.56 at present. In North west Europe, after bottoming out at WS150, TC23 has returned back to just under the WS160 mark.

In the Americas, the lid has been kept firmly on top of freight rates. TC14 has dipped down to WS77.08 (-2.92) and unfortunately a round-trip TCE for this run is in negative figures at the moment. TC18 has held stable, only losing an incremental 2.5 points to WS135. A widely reported charter to the Caribbean at $450,000 has pushed the TC21 index down towards this level and its currently pegged at $453,333.

VLCC

The VLCC market remained relatively static on the face of it this week. This was due mainly to the Lunar New Year holiday neutralising any enquiry and fixture volume, except for the US Gulf to China route. 270,000mt Middle East Gulf to China market saw a very slight increase of one point to WS47.73, which shows an actual drop of about $400 per day with a TCE of $17,900 basis the Baltic Exchange’s vessel description. The rate for 280,000mt Middle East Gulf to US Gulf (via the cape/cape routing) is assessed at an unmoved WS35.

In the Atlantic markets the rate for 260,000mt West Africa/China continued to be valued at between WS50-51 (a round-trip TCE of about $22,300 per day, which is $2,000 per day less than a week ago). The rate for 270,000mt US Gulf/China fell by over $258,000 to just above $7.861 million ($24,100 per day round trip TCE).

Suezmax

The Suezmax market was mostly steady this week. The rate for 135,000mt CPC/Augusta eased two points to just above the WS200 mark (a round-trip TCE of about $112,500 per day). In West Africa, for the 130,000mt Nigeria/Rotterdam voyage, rates remained flat at the WS124-125 level (a daily round trip TCE of $51,400, which is $1,000 per day less than a week ago). In the Middle East the rate for 140,000mt Basrah/Lavera dropped three points to WS67.

Aframax

In the North Sea market, rates for the 80,000mt Hound Point/Wilhelmshaven route dropped about three points to the WS160-161 region (a round-trip daily TCE of $55,800). In the Mediterranean, the rate for 80,000mt Ceyhan/Lavera tumbled about 36 points to a little above WS222 (a daily round-trip TCE of $80,000).

Across the Atlantic, a tonnage availability build-up has caused rates to fall in the Stateside Aframax market. The rate for 70,000mt East Coast Mexico/US Gulf shed about 50 points to WS150 (about $32,400 per day round-trip TCE). Meanwhile, the 70,000mt Covenas/US Gulf has fallen about 44 points to a fraction below WS140 (a daily round-trip TCE of $26,000). For the Transatlantic route of 70,000mt US Gulf/Rotterdam, rates were reduced by 23.5 points to WS152 (showing a round trip TCE of $32,400 per day).

LNG

There has been little to note with the Spot LNG market. Some enquiry is reported, but there is more focus on period. This trickles down into the subletting, with ships showing availability for multi-month periods, but with little interest for single voyages. As a result, rates continue to fall. However, they are beginning to settle with all three routes starting to produce a baseline of what owners would likely accept for a theoretical spot voyage. BLNG1g shed $5,183 to close at $74,334. In the Atlantic both BLNG2g and BLNG3g fell between $2,300-$3,300 to close at $55,708 and $71,404 respectively.

The mainstay for LNG vessel owners remains period with interest for multi month/ multi-year deals the main course for the market. Current estimations for a 174k 2-Stroke vsl with 0.085% boil off and delivery one month ahead: $177,000 for 12 months, and $165,250 for three years.

LPG

What a difference a week can make. It had look that amid planned maintenance in the AG, reduced volumes would hamper any rate growth. But with an increase of $16.572 on BLPG1 over the week this wasn’t to be. Levels are still to recover all the losses made over the last few weeks. However, sentiment is improving and with BLPG1 now at $75.143 - and the West market moving upwards as well as tighter tonnage - the possibility of Eastern positioned vessels ballasting across becomes more likely. This will steady the footing of the rising rates.

The West market has seen a big shift over the week with over $15 gained for BLPG3, where we now publish at $126. At the start of the week with fixtures concluded even $20 lower than last publication there hadn’t been much expectation of a rise. After one vessel was fixed away for 15-16 March loading Houston-Chiba at $122 on Wednesday, a flurry of fixtures that followed tightened the list. Finding available tonnage for early March fixing is now difficult. This is now driving sentiment and owners’ expectations. And, with BLPG2 published at $70.6 (a rise of $10.6 from the start of the week), all three routes for LPG have seen good gains.

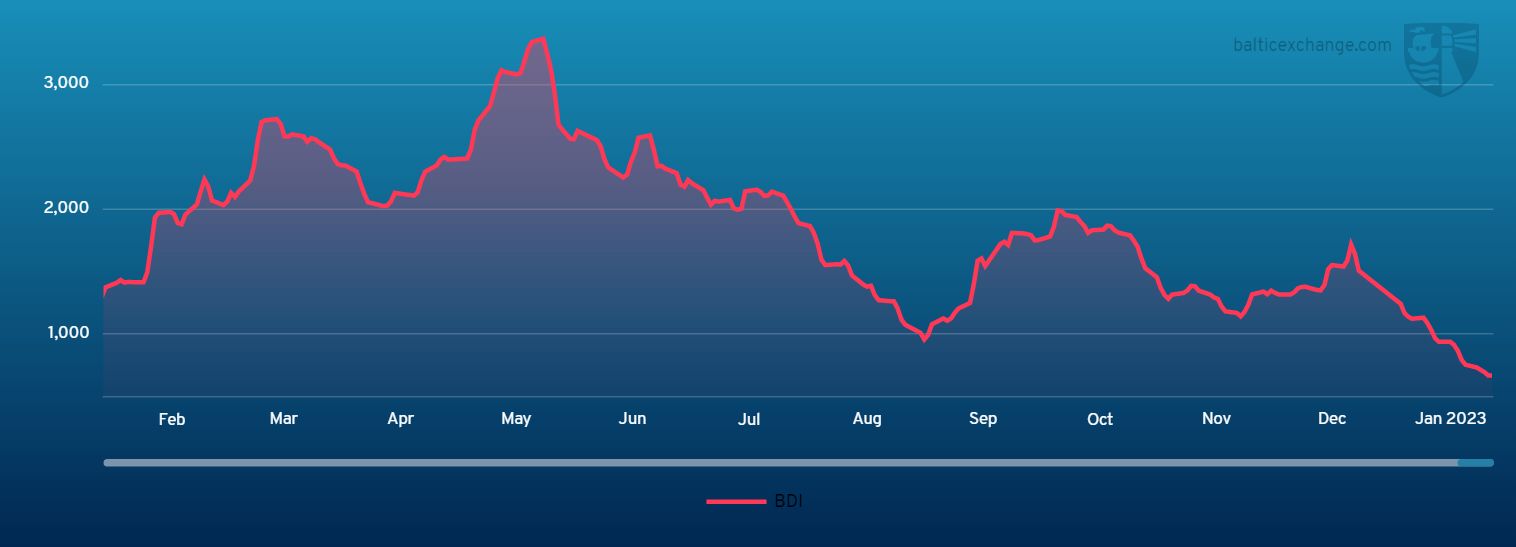

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

Chart shows Baltic Dry Index (BDI) during Jan. 28, 2022 to Jan. 27, 2023

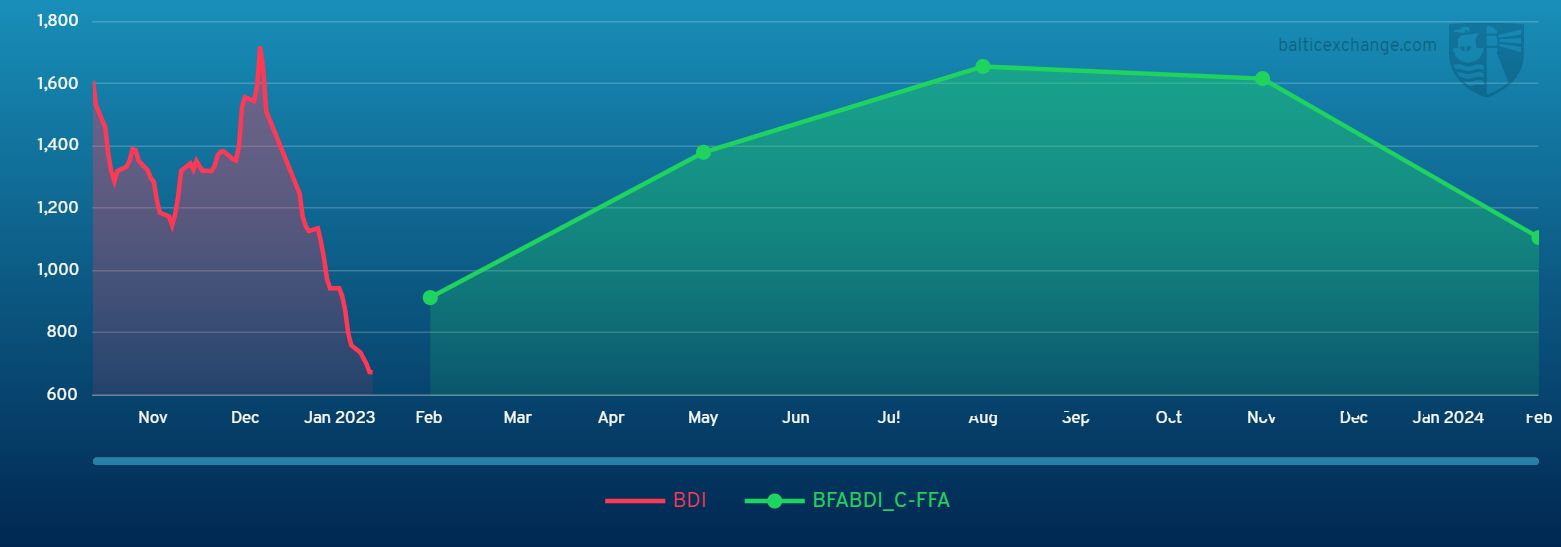

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of time charter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.

(Source: The Baltic Exchange, edited by Niu Huizhe with Xinhua Silk Road, niuhuizhe@xinhua.org)

A single purchase

A single purchase