BEIJING, Jan. 9 (Xinhua) -- The Baltic Exchange has published its weekly report of the dry and tanker markets for January 2-6, 2023 as below:

Capesize

The decline in the first week of the year appeared to be no surprise to the market due to the lackluster activity and seasonal headwinds since the holiday season. The average rate of the Capesize 5 timecharter (5TC) routes had its sharpest fall on Tuesday, losing almost 30pct from the last publishing day 10 days ago. Later in the week the market continued falling but at a slower pace and finally lifted $70 on Friday to close the week at $12,543. Compared with the same period last year, the 5TC is about $7,000 or 35pct lower in value. Whilst the Atlantic remained quiet, the west Australia to Qingdao trade was priced below mid $7s throughout the week. Demand and cargo enquiry next week will determine which direction the Capesize is taking before the fast approaching Lunar New Year.

Panamax

Following the Christmas holidays the Panamax market began sedately across the board, followed by rates coming under pressure from the outset. Downward pressure came from a lack of demand in both basins all week, forcing cheaper levels to be conceded by owners. The Atlantic did witness some improved South America activity, but with excess tonnage count rates drifted throughout the week. Following a weak end to 2022 higher ballaster count from Southeast Asia only compounded to the weaker market. And, with Asia massively unsupported, the immediate outlook appeared very bearish - $8,000 was agreed on an 82,000dwt delivery China for a NoPac round trip. Consequently, Aps and ballast bonus deals were the norm ex EC South America to Far East, with varying rates depending on dates. However, $16,500 + $650,00 was agreed a few times for index types/dates. Period activity included a scrubber fitted 81,000dwt delivery China fixed for five to eight months at $16,250.

Ultramax/Supramax

The first week back for many after the holidays gave little cheer to owners as both the Pacific and Atlantic regions suffered with limited fresh enquiry and an abundance of prompt tonnage. The general feeling amongst many players that this trend could continue until after the Lunar New Year, but only time will tell. In the Atlantic activity was seen from the US Gulf, a 57,000dwt fixing a trip to the Mediterranean at $18,000. Elsewhere, a 56,000dwt was fixed from the Mediterranean to West Africa at $10,000. Little action was seen from South America and rates remained under pressure. Asia also saw downward pressure and again pressure focused on the readily available amount of open tonnage. A 61,000dwt fixing for a trip from Kwangyang to the Arabian Gulf at $8,000. Meanwhile, a 53,000dwt open CJK was heard fixed for an Indonesian round voyage at $3,000. It remains to be seen how long it will take to absorb excess tonnage.

Handysize

Sentiment remained negative, despite a return for many after the holiday season, with further losses in both basins. East Coast South America has seen levels tumble due to a lack of enquiry with a 32,000dwt fixing from Fazendinha to the Eastern Mediterranean at $11,000. Meanwhile, a 38,000dwt fixed Santos to Morocco at $15,250. In the Mediterranean, a 36,000dwt fixed basis delivery Canakkale to the Caribbean with an intended cargo of steels at $7,500 for the first 40 days and $10,000 for the balance. An unnamed handysize vessel was linked with fixing a cargo of sulphur from the Baltic to Casablanca at $8,000, but further details had yet to emerge. In Asia, activity was also limited. A 30,000dwt fixing from South East Asia to China at $5,100 and a large handy was rumoured to have been placed on subjects from South Korea via Prince Rupert for a round voyage with wood pellets in the low $7,000s.

Clean

The Middle East Gulf has been tested hard this week with fixing being conducted off market and fixing levels on 2023 flat rates yet to be seen on the LRs. On the MRs, WS355 has been reported on subjects for a TC17 run at the end of the week on 2022 flat rates - converting to approximately WS275 on 2023 flats.

West of Suez, LRs have been notably muted this week with hardly any fixtures reported in the open market. TC16 has lost an incremental 7.87 points to WS253.63 and TC15 dropped $41,000 holding in the mid $4,900,000s.

The UK-Continent MRs have had just enough activity to keep the rates stable. TC2 held at a WS point or two below WS200 and TC19 hovered around the WS215-217.5 region.

The Handymax market in the Mediterranean has been in freefall this week, very little enquiry has led the TC6 index to fall by 57.82 points to WS234.06. Up on the UK-Continent TC23 remains steady at WS250 at the time of writing.

The US Gulf MR markets has suffered the hardest this week, A widely reported USG/Caribs fixture at $550,000 has led the TC21 index down to that level. TC14 has also lost 12.5 WS points to end up at WS112.33 and TC18 came down to WS186.67 (-18.66).

The MR Atlantic Triangulation Basket TCE lost $962 from $29,257 to $28,295.

VLCC

The VLCC market has been on a downward trend this week and 270,000mt Middle East Gulf to China has fallen three points to WS53.27, which translates into a round voyage TCE of $31,800 basis the Baltic Exchange’s vessel description. The 280,000mt Middle East Gulf to US Gulf (via the cape/cape routing) trip is assessed at WS39.67, a drop of two points this week. In the Atlantic region, the rate for 260,000mt West Africa/China is rated three points lower at WS54.59 (a round-trip TCE of about $33,700 per day) and 270,000mt US Gulf/China fell $315,625 to around the $8.43 million level ($35,400 per day round trip TCE).

Suezmax

The Suezmax market fell in all regions this week. Rates for 135,000mt CPC/Augusta fell 15 points to WS173.44 (a round-trip TCE of $94,300 per day), even though Suezmaxes are being utilized on a part cargo basis for Aframax cargoes. For the 130,000mt Nigeria/Rotterdam voyage, rates also plunged 15 points to WS93.5 (a daily round-trip TCE of about $35,000). The 140,000mt Basrah/Lavera market eased about 5.5 points to WS68.5.

Aframax

In the North Sea market, rates for the 80,000mt Hound Point/Wilhelmshaven route have remained flat this week around the WS170 mark (a round-trip daily TCE of $68,000). In the Mediterranean markets, the rate for 80,000mt Ceyhan/Lavera has risen 13 points since the New Year to WS173 (a daily round-trip TCE of $57,100). The Stateside Aframax market has tumbled again after the Festive season and the rate for 70,000mt East Coast Mexico/US Gulf is 54 points lower than at the start of the week at WS143 (about $32,200 per day round-trip TCE), while rates for the 70,000mt Covenas/US Gulf trip collapsed 46 points to just below WS132 (a daily round-trip TCE of $25,900). For the longer-haul 70,000mt US Gulf/Rotterdam voyage, rates have fallen almost 20 points this year to WS176 (showing a round-trip TCE of close to $45,300 per day).

LNG

A relatively warm winter has impacted gas usage, coupled with higher inventory levels, as well as longer tonnage lists (with further shutdowns in Freeport and cancellations elsewhere), spot rates have been put under continued pressure. There have been cargoes offered out, but with a plentiful supply of cold and modern tonnage the rates have been dropping. Out in Australia a drop of over $30,000 has given the BLNG1g R.V rate of $129,779 Aus-Japan, although market reports suggest there have been deals done at less for relet tonnage.

BLNG2g, and BLNG3g haven’t escaped the fall and although BLNG2g US Gulf-Continent was published at $120,160 for a Round Voyage, reports suggest ships offering in at around $100,000 per day. But it hasn’t been an easy call. With few fixtures done there isn’t a clear direction or high degree of conformity of the market levels. As we leave the festive period there could be greater activity, which could arrest the fall in LNG routes. However, a reliance on the widening of the ARB could maintain the bearish sentiment for at least a few more weeks.

There are reports of term deals being fixed for longer term, in excess of six years, with period still showing strength. Current estimations for a 174k 2-Stroke vessel with 0.085pct boil off: $200,250 for 12 months, and $174,750 for three years.

LPG

We start the new year with big adjustments down for all three BLPG routes. The last publication was 23 December, so an adjustment was expected, and we have witnessed a continued downward pressure on rates. BLPG1 currently sits $40 down since the end of 2022, publishing at $79, which is also a drop in TCE daily earnings of $45,000 per day. Fewer fixtures and the holidays created a rather subdued start to the year, but activity is expected to pick up and in a largely sentiment driven market rates should rise as a result.

As expected, BLPG2 and BLPG3 out in the West have dropped considerably since the end of 2022. BLPG3 Houston-Chiba saw the greatest drop losing $53 to publish at $123.429 at the end of the week. This drop saw over $40,000 lost on TCE Earnings on this route alone. But as activity has begun to pick up and charterers still seem keen to fix tonnage, this downward trend could turn around. BLPG2 Houston-Flushing lost the least since publication started in 2023 but managed to still drop $37 on the headline and over $50,000 TCE to finish at $68.4, with a daily TCE earnings of $70,649.

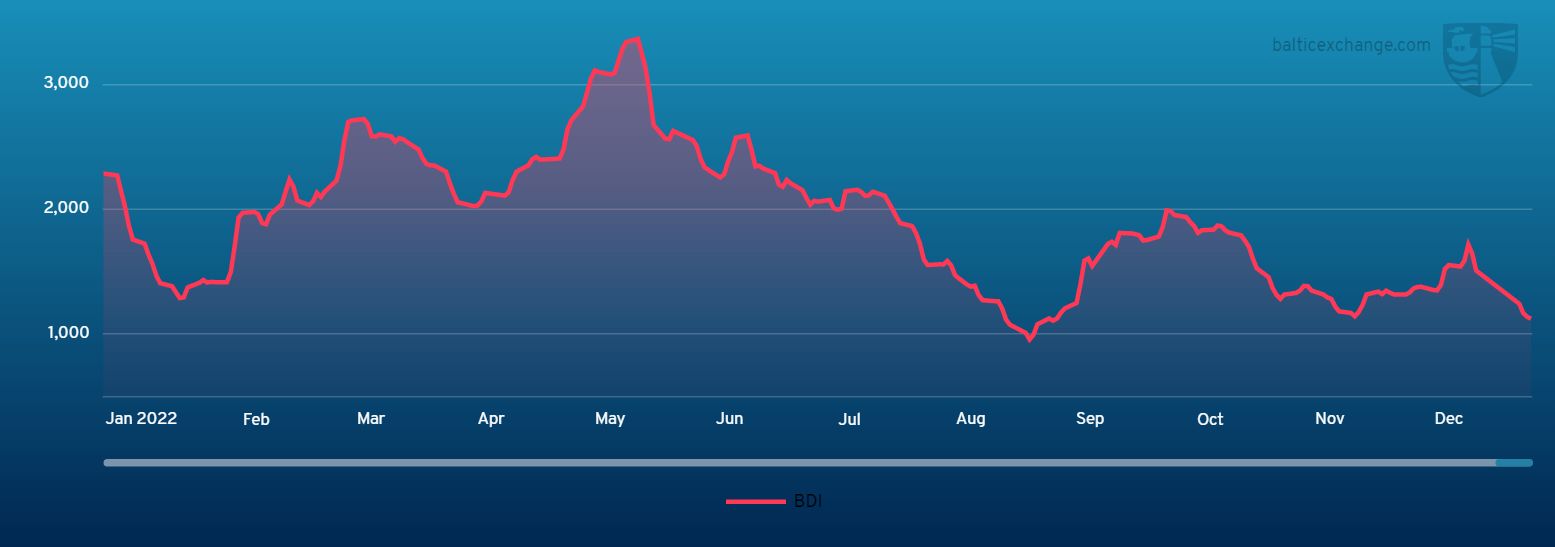

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

Chart shows Baltic Dry Index (BDI) during Jan. 6, 2022 to Jan. 6, 2023

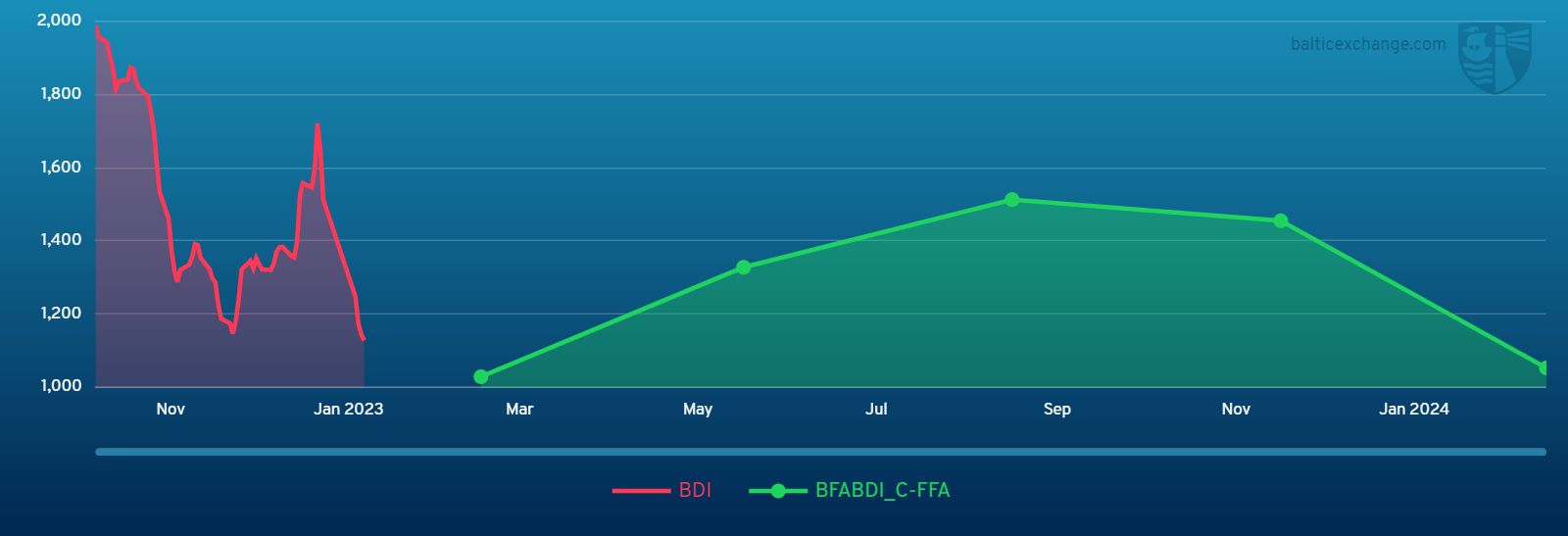

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of time charter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.

(Source: The Baltic Exchange, edited by Niu Huizhe with Xinhua Silk Road, niuhuizhe@xinhua.org)

A single purchase

A single purchase