BEIJING, July 4 (Xinhua) -- The Baltic Exchange has published its weekly report of the dry and tanker markets for June 27-July 1, 2022 as below:

Capesize

A mild week for the Capesize sector saw rates trundling sideways with small pockets of encouragement. However, there was nothing to initiate a push out of the recent trading range as the 5TC softened 130 week-on-week to settle at $19,745. A brief lift midweek gave some suggestion that a strengthening of sentiment in the Atlantic was imminent. But by Friday this spark looks to have been snuffed out as the Transatlantic C8 settled down slightly at $26,167. Market views on the Atlantic situation have been mixed as some stronger fixtures were heard, but these were expected to have had a premium paid for their shorter duration. Out of Brazil market chatter was lively midweek about several Newcastlemax iron ore cargoes fixed. Nevertheless, subsequent information poured cold water on this with a claim the information was inaccurate. The Brazil to China C3 market closed the week down 0.106 at $30.40. The Pacific region was said to be seeing an increase in tonnage levels, which saw the market lose momentum and drop slightly. West Australia to China C5 closed at $11.535 with the Transpacific C10 finished up at $14,841, a significant discount to the Atlantic basin. Now into Q3, trade volumes should be increasing. But with European summer almost upon us, the market appears unmotivated to push in any direction.

Panamax

For the third successive week corrections were seen in the Panamax market. Muted demand was again met by a sea of prompt tonnage along with an increasing ballaster count. Both basins lacked any meaningful replenishment of fresh cargoes, eating into rates already under pressure. The Atlantic appeared predominantly grain centric with little mineral activity of note, typically a 76,000dwt delivery Gibraltar achieved $21,000 for a trip via NC South America redelivery Cape Passero. Asia, once again, saw a relative rise in volume week-on-week ex Indonesia. However, this appeared to have very little impact with ships returning to the market as owners locked in these quick trips. An 82,000dwt delivery South China agreed $20,500 for a trip via Indonesia redelivery South Korea. It was a limited week of period activity again. However an 82,000dwt delivery South China achieved $21,000 for five to seven months employment.

Ultramax/Supramax

A rather dull week for the sector as most areas lacked fresh impetus and a build up of prompt tonnage. As the week ended, however, some saw a bit of resistance to the malaise from key areas. This included the US Gulf, where owners became reluctant to reposition to the Continent area. Similarly, from South East Asia, activity seemingly increased but little fixing surfaced. Period activity was limited but a 60,900dwt open Arabian Gulf was heard fixed in the mid $30,000s for three to five months trading. From the Atlantic, a 55,000dwt fixed delivery West Mediterranean trip via East Mediterranean redelivery US Gulf at $23,000. From the South, a 58,000dwt was fixed for a South American coastal run in the mid $30,000s. From Asia, at the beginning of the week a 50,000dwt open Singapore was heard fixed for an Indonesia to China run in the mid $18,000s. By contrast, a 56,000dwt open Singapore was heard fixed in the mid $20,000s for a similar run. Further north there was limited fresh enquiry. However, a 64,000dwt open Japan fixed a NoPac round redelivery Southeast Asia at $31,000.

Handysize

With largely negative sentiment in both basins, in which brokers described a lack of fresh enquiry as a main contributing factor, levels have softened across the board except for requirements from China to the Atlantic. These have remained stable with a 38,000dwt fixing from South China to the Mediterranean at $36,000. A 38,000dwt fixed from Singapore via Australia to China’s Taiwan with an intended cargo of salt at $23,000. A 36,000dwt fixed from Gresik via Western Australia to China with an intended cargo of Salt at $25,000. In the Atlantic, a 39,000dwt fixed from Vila Do Conde to Iceland with an intended cargo of Alumina at $25,000. Meanwhile, a 32,000dwt fixed from Paranagua to the Black Sea with an intended cargo of sugar at $23,000. In the US Gulf, a 39,000dwt was fixed for a trip from SW Pass to the Turkish Mediterranean at $19,000.

Clean

LRs in the Middle East Gulf have been subject to more freight rate reductions this week. TC1 has dropped 54.29 points to WS225.71 and TC5 similarly has lost WS52.14 to WS296.43. On the MRs TC17 has had a rebound after bottoming out at WS470 midweek, it now sits at WS513.33 ($47k / day round trip TCE). In the West, the LR2s of TC15 have fluctuated up and down this week. And, after peaking at $4.6m on Wednesday, have resettled at $4.44m for now. The LR1s on TC16 stabilised after dropping from WS250 to WS235. There are reports of that being repeated a few times this week. The TCE for this run still holding in the low $30,000s / day.

On the UK-Continent the MRs have finally come under pressure and freight has consistently been chipped away at this week. TC2 dropped 23.06 points to WS330 ($28.5k /day round trip TCE) and TC19 followed suit losing 23.57 points to WS338.57.

The USG MR market has continued its resurgence this week, sentiment has remained strong and activity levels consistent. TC14 has risen to WS275 (+WS28.75) and TC18 has also hiked up WS43.33 to WS390 ($43k / day round trip TCE). The MRA TCE rose from 45,837 to 47,829.

On the Handymax, TC6 has taken a hit this week from low activity levels. The Index has dropped 41.87 points from WS510 to WS468.13 with reports of WS460 on subs for a Cross Mediterranean voyage at the time of writing. In the Baltic, TC9 has remained steady this week ticking up and incremental 8.57 points to WS511.43. Handymax TCEs shouldn’t be ignored at the moment and are still just under $85k / day round trip TCE level in the Mediterranean (TC6) and around $57k / day round trip TCE in the Baltic (TC9).

VLCC

VLCC rates rose again this week. 280,000mt Middle East Gulf/USG (via Cape of Good Hope) is assessed four points higher at WS33 while rates for 270,000mt Middle East Gulf/China were up another five points to almost WS55 (a round trip TCE of minus $10,600 per day). In the Atlantic, rates for 260,000mt West Africa/China saw a similar rise, improving by five points to just shy of WS56.5 (minus $8,200 per day round-trip TCE). However, the rate for 270,000mt US Gulf/China voyage remained static at $6,162,500 (a round-voyage TCE of minus $15,900 per day).

Suezmax

Rates for 135,000mt Black Sea/Augusta remained the same again this week at the WS128-129 level (a round-trip TCE of $23,800 per day). The 130,000mt Nigeria/UKC route, meanwhile, saw rates dip six points early on in the week and recovering to almost WS120 on Thursday (a round-trip TCE of about $18,400 per day). In the Middle East, rates for the 140,000mt Basrah/West Mediterranean fell seven points to WS57 with very little activity reported.

Aframax

The 80,000mt Ceyhan/Mediterranean market faced further downward pressure this week and rates were pushed down 16 points to just below WS165 (a round-trip TCE of about $24,200 per day). Northern European activity tailed off and, as a result, rates for 80,000mt Hound Point/UK Continent lost 17 points to WS170 (a daily round-trip TCE of $32,600). The 100,000mt Primorsk/UK Cont route showed an improvement of 11 points to WS186.5 (a round-trip TCE of $41,500/day).

Across the Atlantic, the markets touched bottom and are bouncing back before the long weekend incorporating Independence Day. Rates for the 70,000mt EC Mexico/US Gulf route rocketed almost 39 points to between WS195/197.5 (a round-trip TCE of $23,800 per day) and for 70,000mt Caribbean/US Gulf the rate shot up 33 points to just shy of WS190 (a round-trip TCE of about $19,100 per day). For the transatlantic trip of 70,000mt US Gulf/UK Continent, rates were boosted by 30 points to almost WS183 ($18,100 per day round-tip TCE).

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

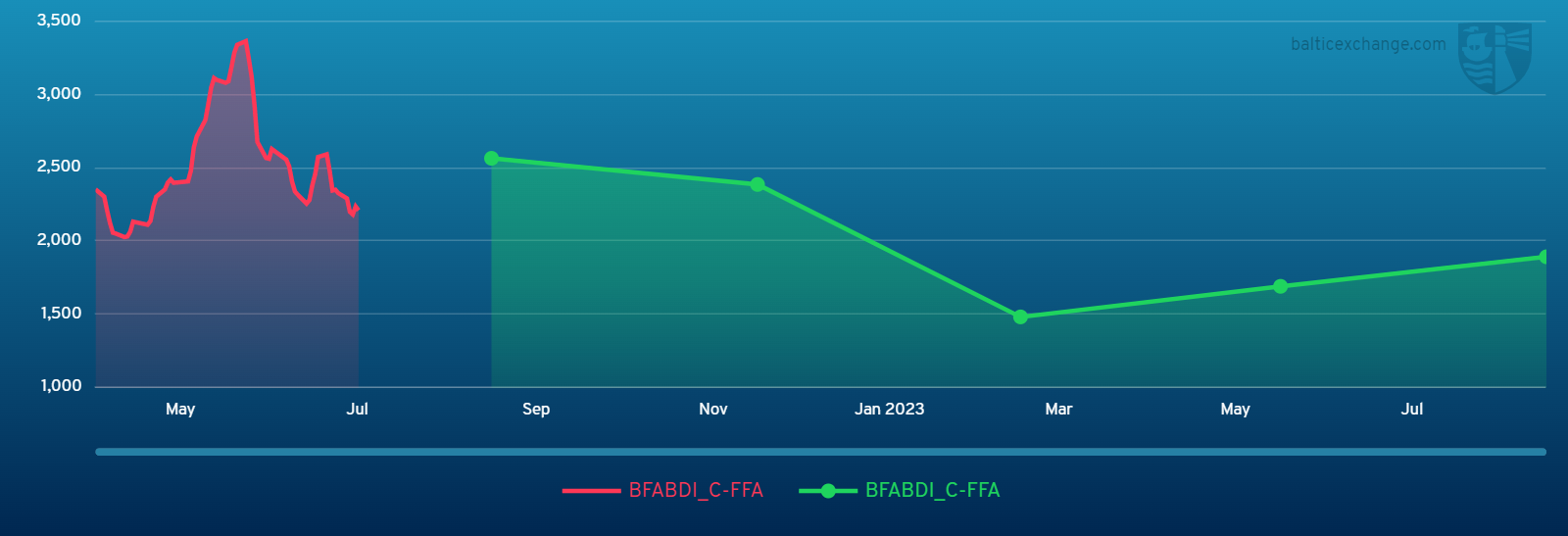

Chart shows Baltic Dry Index (BDI) during July 1, 2021 to July 1, 2022

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of time charter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.

(Source: The Baltic Exchange, edited by Niu Huizhe with Xinhua Silk Road, niuhuizhe@xinhua.org)

A single purchase

A single purchase