BEIJING, Feb. 8 (Xinhua) -- The Baltic Exchange has published its weekly report of the dry and tanker markets for Jan. 31-Feb.4, 2022 as below:

Capesize

The Capesize market traded sideways this week as the 5TC closed at $10,302, an improvement of 1,384 over the week. Lunar New Year holidays ensured the market was more subdued with holidays across Asia. Fixture activity looked to increase towards the end of the week. However, this was mainly based around the usual trade routes of West Australia to China C5, which closed at $7.164, and Brazil to China C3 which settled at $20.26. For the low earnings inherent in the voyage rates, they are relatively highly priced. This is due to the increased influence that bunker fuels are having on the market. Energy demand globally is seeing owners pay substantially more to fuel their vessels as Low Sulphur Bunker Fuel prices now well over $700 per mt. With all traders due back from holidays next week many will be looking for winds to drive the Capesize market out of its current doldrums.

Panamax

January came and went in a blink it seems. A month for many to perhaps forget, with the BPI 5 timecharter average yielding a $9,411 correction month-on-month. This week, blighted by Lunar holidays, continued the theme. The Atlantic witnessed minimal demand seeing a further decline in rates, although sentiment and general feel improved Thursday/Friday. However, suppressed all week by an increasing tonnage count of ballasters and early ships - especially in the North Continent - the market for transatlantic and fronthaul trips from the Americas remained largely APS delivery basis. This highlighted the depressive nature of the market. An 82,000dwt delivery APS EC South America agreed $22,750 for a trip to the Mediterranean. Asia, meanwhile, unsurprisingly proved to be fairly subdued with so many players absent from the market for the first half of the week. However, a handful of deals did occur and an 81,000dwt fixed at $20,000 for a trip via Indonesia redelivery Philippines.

Ultramax/Supramax

A mixed bag during the past week, no doubt being affected by the Lunar Holidays in Asia. However, as the week drew to a close positive sentiment was seemingly returning. Little period action surfaced, but some brokers commented that demand from operators for tonnage was strong. In the Atlantic a rather sideways week from key areas such as the US Gulf. A 55,000dwt fixing a transatlantic run at $14,000, whilst for trips to the Far East a 54,000dwt fixed in the mid $20,000s. More activity was seen from the Mediterranean, changing owners' expectations. A 55,000dwt fixing a trip from the East Mediterranean to West Africa at around $21,000. From Asia there was limited action, but interest was seen in the Indian Ocean. A 63,000dwt fixing a trip delivery Port Elisabeth redelivery China at $25,250 plus $525,000 ballast bonus. Meanwhile, a 58,000dwt was heard fixed delivery South Africa for a trip to India at $23,000 plus $305,000 ballast bonus.

Handysize

The first glimmers of recovery in some regions were seen as the week ended with some expecting to see an upturn as the Lunar New Year celebrations came to a close. East Coast South America saw a 32,000dwt fixing for Nueva Palmira to the Continent at $24,000 with an intended cargo of woodpulp. The US Gulf, by contrast, remained soft. A 39,000dwt fixed from South West Pass to Turkey at $14,000. A 38,000dwt was rumoured fixed for a similar run to Ireland at around $13,000. Sentiment firmed elsewhere as the week closed. A 30,000dwt fixing a trip delivery Morocco redelivery Bangladesh at $19,000. From Asia, activity was limited due to the long holiday. However, a 38,000dwt was rumoured to have been fixed for a trip from CJK via Vostochny back to China at $12,000. Despite this, sentiment from the region generally remained flat.

Clean

There was little activity in the East this week on both LRs and MRs as a combination of high bunker prices, lack of enquiries and a long tonnage list combined to ensure that charterers remained in control and owners unwilling to fix at low levels. TC5 (AG-Japan) was fixed at W/S 95, giving a TCE equivalent of -$850pd. Further West the story of high bunker prices and long tonnage lists was much the same for vessels waiting in the USG. However, there was slightly better news with TC2 (Cont – USAC) vessels on subs around the WS145 level, up from 126, giving a healthier TCE of $5092pd. But how long this can hold up as ballasters are attracted from the US is anyone's guess.

VLCC

Lunar New Year meant that the first half of the week was very quiet. However, the return to work for the Asian market has barely added any meaningful activity in this sector. Rates for 280,000mt Middle East Gulf/USG (via Cape of Good Hope) remained unmoved at the WS17-17.5 level while the 270,000mt Middle East Gulf/China route slipped 1.5 points to just below WS34 (which shows a round trip TCE of minus $8,300 per day). In the Atlantic region the 260,000mt West Africa/China trip also lost 1.5 points to just under WS35 (a round-trip TCE of minus $6,300 per day) and 270,000mt US Gulf/China is $84,000 weaker at $4.378m (a round-trip TCE of minus $5,700 per day).

Suezmax

The rate for 130,000mt Nigeria/UKC eased three points to WS65 (showing a round-trip TCE of $2,200 per day), with oil company and trader relets leading the way down. For the 135,000mt Black Sea/Augusta route, rates shed two points to WS 72.5 level (round-trip TCE showing minus $640). In the 140,000mt Basrah/West Mediterranean market a few ships were reported on subjects with BP and rates remain static in the WS29-30 range.

Aframax

The 80,000mt Ceyhan/Mediterranean market was modestly weaker, with rates falling back 1.5 points to WS100 which shows a round-trip TCE of $4,900 per day). In Northern Europe rates for 80,000mt Hound Point/UKC were again motionless at WS95 (a round-trip TCE of minus $3,800 per day). In the 100,000mt Baltic/UKC market, rates fell another four points to WS80 (a TCE of $3,900 per day). On the other side of the Atlantic, it was another week of slightly improved rates on the short-haul voyages. A 70,000mt Caribbean/US Gulf was up two points to WS100 (a round-trip TCE of $160 per day) and 70,000mt EC Mexico/US Gulf rates were three points higher than a week ago in the WS102.5-105 region (a TCE of about $2,500 per day round trip). In the US Gulf/UK Continent market the 70,000mt Covenas/US Gulf trip lost a point to WS108 ($5,800 per day round-tip TCE).

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

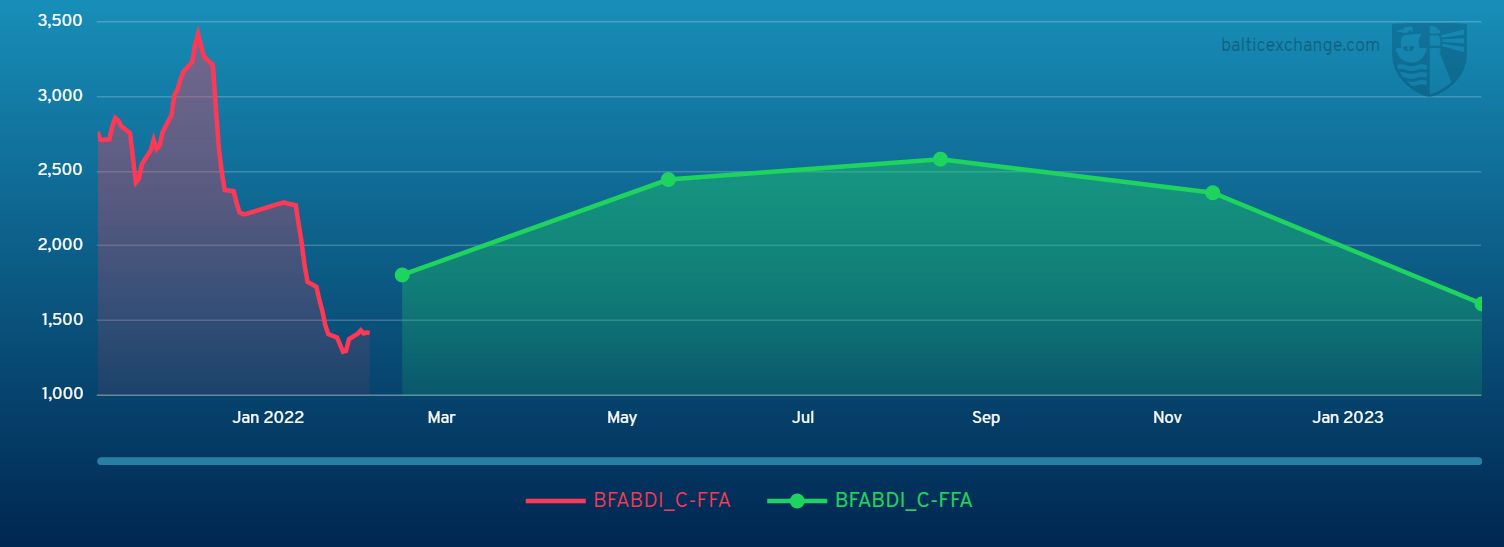

Chart shows Baltic Dry Index (BDI) during Feb.5, 2021 to Feb.4, 2022

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of time charter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.

(Source: The Baltic Exchange, edited by Niu Huizhe with Xinhua Silk Road, niuhuizhe@xinhua.org)

A single purchase

A single purchase