BEIJING, Jan. 26 (Xinhua) -- The Baltic Exchange has published its weekly report of the dry and tanker markets for Jan. 17-21, 2022 as below:

Capesize

There was little support to be found for the Capesize market over the last week as dwindling rates and rising bunker prices slashed earnings for owners with the 5TC Weighted Average dropping to $7,390. The Pacific had little further left to drop as the transpacific C10 was priced at sub operating expense levels of $4,200. The Atlantic basin has fared slightly better, yet very few fixtures were heard. The Transatlantic C8 lowered $8,100 over the week to settle at $11,200. Fronthaul business was more difficult to place over the week as shorter duration variants were seen to lower their values quicker, while longer haul trips proved more resistant to the negative sentiment. The negative sentiment ultimately proved too much for the C9 route and by the end of the week closed at $27,950, down $7,825. The high price of fuel bunkers is coming at an inopportune time as they now take a large portion of voyage rate value having a detrimental effect on voyage rates. Both the West Australia to Qingdao C5 at $6.786 and the Brazil to China C3 at $17.28 came under heavy pressure.

Panamax

It was a further week in the doldrums for the Panamax market, as thin cargo volumes versus a long tonnage count continued to negatively impact the market. A distinct lack of mineral requirements in the North Atlantic only hindered matters. A 81,000dwt settling for $18,500 for a NC South America Atlantic round, whilst in the South - despite reasonable demand - rates continued to ease with an armada of ballasting tonnage for charterers to pick from. Asia mirrored the Atlantic with a supply/demand imbalance. Minerals from Australia were perhaps the exception, but this did little to dent the tonnage count that existed and ultimately rates continued to ease further. Thursday came news of the lifting of the Indonesia coal export ban and sentiment flipped a little largely on the back of FFA’s improving. However, some felt it would be a while before any positive impact may be seen in the market with physical fundamentals principally unchanged.

Ultramax/Supramax

Negative sentiment generally was in the driving seat as most areas in the sector saw rates decline. There was a limited amount of period activity. A 60,000dwt open Portugal was fixed for 11-13 months trading redelivery Atlantic at $25,000 with an option of worldwide redelivery paying $750,000 bonus. The Atlantic remained subdued with limited fresh enquiry from key areas such as the US Gulf and East Coast South America. A 61,000dwt fixed from the US Gulf for a trip to the Red Sea at $41,000. From the West Mediterranean, a 50,000dwt was fixed at $26,000 for redelivery West Coast India. With the export ban of coal from Indonesia being lifted at the end of the week, there remained a substantial amount of prompt tonnage in South East Asia again keeping rates low as the week closed. Further north saw Ultramax size seeing in the low $20,000s for NoPac round voyages. Most eyes are fixed on the upcoming week to see if a change in direction will take place.

Handysize

Another week of negativity with a lack of fresh enquiry in most areas. Period activity was limited but a 38,000dwt open Japan fixed three to five months trading redelivery worldwide at $25,000 whilst from South East Asia a 34,000dwt again fixed three to five months trading at $21,000. In the Atlantic, a 38,000dwt open Skaw fixed via the Baltic to North Coast South America at $17,500. A 33,000dwt open Denmark fixed from La Pallice to Abidjan with an intended cargo of wheat at $20,000. A 39,000dwt open in Karmoy fixed a trip to West Coast India-Arabian Gulf range at 27,500. A 28,000dwt fixed from the Black Sea to East Coast Central America at $17,000 with an intended cargo of steels. A 39,000dwt open in the US Gulf was fixed to the Continent with an intended cargo of wood pellets at $23,000. From Asia a 33,000dwt open China was linked to a trip via Australia redelivery Arabian Gulf at $19,000.

Clean

In the Middle East Gulf the LR2s of TC1 are currently sat at WS77.86 (-WS10) - a round trip TCE of $2,093 per day - with WS75 reported on subjects at time of writing. The LR1s have held stable thus far at around WS97.5 for TC5 55,000 Middle East Gulf to Japan, a round-trip TCE of $2,045 per day. On the MRs TC17 rose optimistically this week to WS191.25 (+WS10.42). West of Suez, the LR2s, TC15 80,000 Mediterranean to Japan has risen incrementally off the back of improved activity and by the end of the week was around the $1.87 million mark.

On the LR1s, TC16, 60,000 Amsterdam to Offshore Lomé also had an upturn - rising 4.64 points to WS105, a round-trip TCE of $5,736 per day.

On the UK-Continent, lighter MR activity has led to tonnage supply rising and freight levels coming under pressure during the week. TC2 37,000 UK-Continent to US Atlantic Coast is currently pegged at WS130 (-WS8.89). TC19 37,000 Amsterdam to Lagos has dropped in parallel and lost another WS10.5 points to WS134.64 (a round trip TCE of $5,092 per day). In the Americas, both MR routes have suffered this week. However, the high bunker prices may have created a floor for freight rates for the moment. TC14 38,000 US Gulf to UK-Continent is now at WS 89.29 (-WS6.07) and TC18 38,000 from US Gulf to Brazil WS 134.29 (+WS10). The MR Atlantic basket TCE dropped from $9,735 per day to $6,780 per day. The Baltic Handymax market, meanwhile, has seen less activity than previous weeks. The TC9 30,000 Baltic to UK-Continent is now at WS175 (-WS15). In the Mediterranean, softening pressure has continued and the Handymax rates have again traded off further. TC6 30,000 Skikda to Lavera has dropped from WS17.19 to WS 152.19.

VLCC

This sector sunk a little further this week. For 280,000mt Middle East Gulf to USG (via Cape of Good Hope) the market is assessed half a point lower at the WS17.5-18 level. Weakness was also been seen in the 270,000mt Middle East Gulf to China route where rates have slipped a point to WS35.5 region (which shows a round trip TCE of minus $6,300 per day). In the Atlantic region the market has similarly fallen with the rate for 260,000mt West Africa to China a point lower at the WS37-37.5 mark (a round-trip TCE of minus $3,000 per day). The 270,000mt USG to China, meanwhile, is now rated over $43,000 less than a week ago at $4.68 million (a round-trip TCE of minus $2,400 per day)

Suezmax

The rate for 130,000mt Nigeria to UKC has recovered some of the recent lost ground, climbing four points to the WS57-57.5 level (a round-trip TCE of minus $1,300 per day). The 135,000mt Black Sea to Augusta gained five points to the WS67 region (a round-trip TCE of minus $3,600 per day). The 140,000mt Basrah to West Mediterranean market saw reports of Exxon, Iplom and Tupras fixing in the low to mid WS30s and the latest rate assessment is down half a point week-on-week at WS32.

Aframax

The 80,000mt Ceyhan to Mediterranean market continued its upward trajectory early on. But, by the end of the week, it took a stumble with rates coming back down to the WS100 mark - off three points from last week. This shows a round-trip TCE of $5,700 per day). In Northern Europe rates for 80,000mt Hound Point to UKC plateaued at just below WS95 (a round-trip TCE of minus $3,700 per day) while 100,000mt Baltic to UKC rates fell another eight points to WS90 (a TCE of $11,200 per day). Across the other side of the Atlantic, rates were slightly firmer on the whole. 70,000mt US Gulf to UK-Continent recovered five points to almost WS105 (a round-trip TCE of $5,400 per day). Meanwhile, in the local markets, the 70,000mt Covenas to US Gulf trip is assessed 1.5 points higher than a week ago at WS97 (minus $230 per day round-tip TCE) and 70,000mt EC Mexico to US Gulf rates remained steady again at just shy of WS100 ($2,000 per day round-trip TCE).

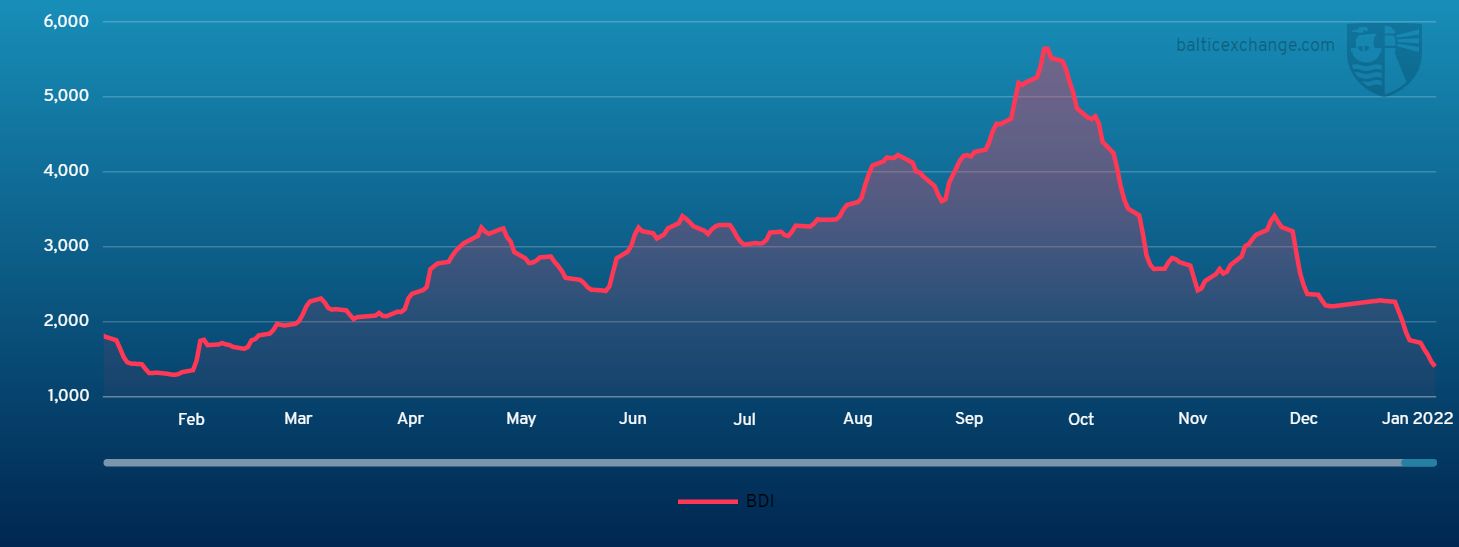

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

Chart shows Baltic Dry Index (BDI) during Jan.22, 2021 to Jan.21, 2022

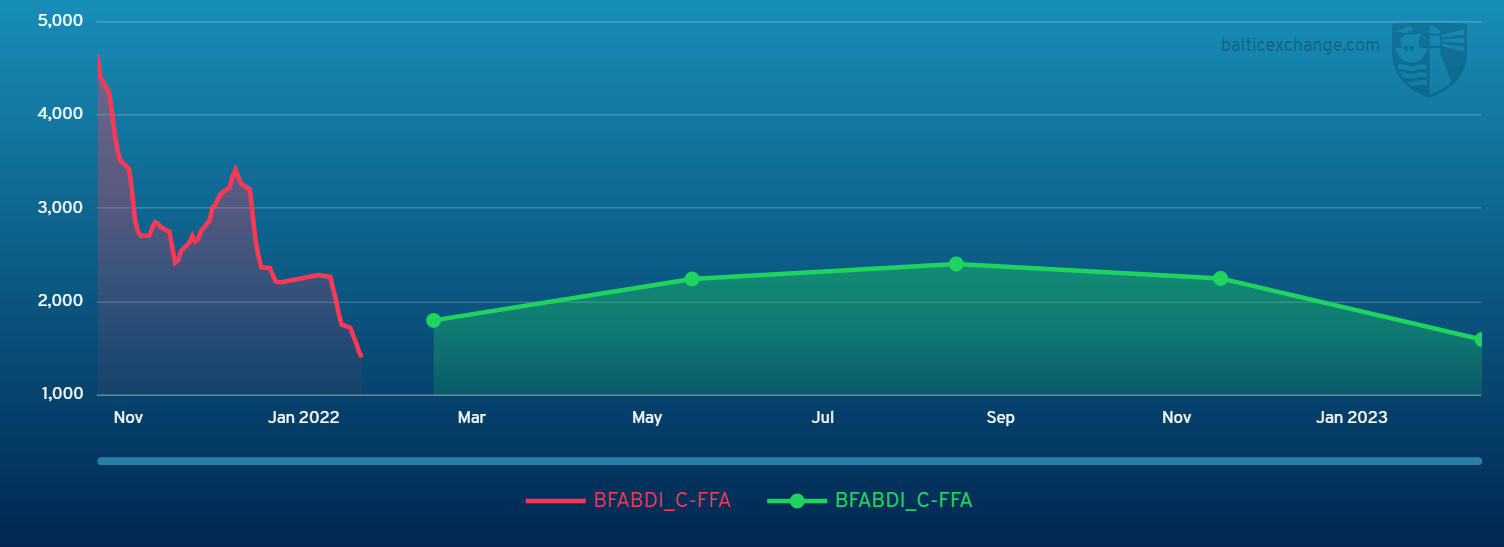

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of time charter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.

(Source: The Baltic Exchange, edited by Niu Huizhe with Xinhua Silk Road, niuhuizhe@xinhua.org)

A single purchase

A single purchase