BEIJING, Aug. 17 (Xinhua) -- The Baltic Exchange has published its weekly report of the dry and tanker markets for Aug.9-13, 2021 as below:

Capesize

The week had a quiet start due to Singapore's National Day on Monday (9 August). By the end of the week both 5TC and BCI reached a new high since mid-May, at 4,766 and $39,526 respectively. The Atlantic appeared to be more active towards the weekend with C3 Brazil to China run jumping from $30,195 at one point to $32,025 on Friday. An early September stem from Tubarao to Qingdao was fixed at $32,500 and a second half September stem from Sudeste to Qingdao was fixed at $33,000. Brazilian activity also added support to C9 rate to record $58,250 on a standard Baltic type from the Continent back to the Far East. On the Pacific side, C5 west Australia to Qingdao went below $14,000 in mid of the week but climbed back to $14,677, whilst the related time charter route was marked at $45,513 by close of the week.

Panamax

A positive week in general with gains in both the Atlantic and Asian basins. A 82,000dwt open in Kosichang being fixed basis Delivery DOP via East Coast south America to Singapore-Japan range for an intended cargo of grains at $34,000. On the Continent a 83,000dwt was rumored to have been fixed for a Baltic to China cargo at around $50,000. In Asia, we see a firm market due to congestion and lack of tonnage, where a 85,000dwt open China was fixed for a trip via Australia to China with Bauxite at $34,800. Period has been active with a 82,000dwt open China prompt fixing six to eight months with worldwide redelivery at $29,000 and a 82, 000dwt open between December 2021 and April 2022 being fixed for two years at $18,250 with worldwide redelivery and a 81,000dwt open Japan fixed for 11 to 13 months redelivery worldwide at $28,000.

Supramax

With the flow of tonnage being affected by new quarantine measures in China, tight supply has led to rates pushing up certainly in the Asian sector whilst demand remained strong from other areas. Period activity evident with a 56,000dwt open Indian Ocean fixing in the low-mid $30,000s for eight to ten months trading. From the Atlantic despite many being away for summer holidays rates held. From South America a 53,000dwt fixing a trip to Chittagong at $30,000 plus $1.4 million ballast bonus. Elsewhere a 52,000dwt open west Africa was heard fixed for a trip to the Black Sea at $30,000. From Asia for NoPac rounds a 63,000dwt was fixed delivery South Korea for a round voyage redelivery south east Asia at $32,500. Whilst further south a 56,000dwt open Thailand was fixed for a trip via Indonesia to China at $40,000. Activity remained from the Indian Ocean with a 61,000dwt open Arabian Gulf fixing a trip to west coast India at $53,000.

Handysize

Due to congestion and quarantine regulations in China, we have seen the Asia markets make strong moves due to a lack of tonnage with a 38,000dwt open in South Korea fixing a steel cargo via Japan to Thailand at $40,000 and another 38,000dwt in South Korea fixing a trip via West Coast Australia to China with a cargo of spodumene at $40,000. The Black Sea rates have also improved with a 40,000dwt fixing a cargo of concentrates to the Far East at $48,000 and a 38,000dwt open at Canakkale fixing a trip to East Coast Mexico at $39,000. In South America, activity has been limited of late but a 32,000dwt open in South Brazil fixed a trip to the Continent at $31,250. This period has been less active but a 34,000dwt open in Turkey was fixed for a minimum three months to a maximum 13 January 2022 with Atlantic redelivery at $32,750.

VLCC

The diabolical market continues with rates in the Middle East for 280,000mt to US Gulf (routing via the Cape/Cape) in the WS18-18.5 region while 270,000mt to China is valued at the WS31 level (showing a round-trip TCE of $-4,200/day). In the Atlantic, rates for 260,000mt West Africa to China are again at the WS33 mark (a TCE of $-800/day round trip) and 270,000mt US Gulf to China saw a drop of $62,500 to $3.95 million (a roundtrip TCE of $1,300/day).

Suezmax

In West Africa there was a little more enquiry than has been typical of late, which caused a modest 1.5 point improvement in rates for the 130,000mt Nigeria/UK Continent market to the WS54 level (a round trip TCE of $1,900/day), while rates for 135,000mt Black Sea/Med rose 1 point to about WS58.5 (a round-trip TCE of about $-5,800/day). The Middle East market remained busy this week and rates for the 140,000mt Basrah/Med trip pegged at the WS26 mark, although it is worth noting that Exxon are reported on subjects with a Delta suezmax 140,000mt at WS27.5 for a trip Basrah/West.

Aframax

In the Mediterranean, the market for 80,000mt Ceyhan/Lavera remains pegged at the WS85-86 mark (showing a round-trip TCE of $2,300/day). In Northern Europe the market for 80,000mt Cross-North Sea remained flat at the WS94 level (a round trip TCE of $-3,400/day) while in the 100,000mt Baltic/UK Continent market rates eased three points to about WS57.5 (a round trip TCE of $-2,100/day).

Across the Atlantic, the Caribbean market remained static with rates for 70,000mt Caribbean/US Gulf at WS75 (a round-trip TCE of $-1,800/day) while the Gulf of Mexico region has seen a tightening position list leading to a slightly more positive sentiment. Rates for 70,000mt East Coast Mexico/US Gulf gained 3.5 points to WS82.5 (a TCE of about $-350/day round trip) and the market for 70,000mt US Gulf/UK Continent improved by 2.5 points to WS69-70 level (showing a round trip TCE of $-1,200/day, which would be positive basis one-way economics).

Clean

The Middle East Gulf has seen continuing healthy activity levels driving freight rates upwards. On the LR2s to Japan TC1 rose 10.41 points to WS103.33, a round-trip TCE of $9,584/day. The LR1's have been particularly busy and TC5 55k Middle East Gulf / Japan now at WS140.36 up WS31.43 points, a round-trip TCE $14,005/day. TC8 Middle East Gulf / UK-Continent also continued to surge and is now marked at $30.92/ton (up $6.38/Ton). MR rates 35k Middle East Gulf / East Africa (TC17) climbed another 13.5 points to WS189, showing a round-trip TCE of $11,257/day.

The Mediterranean Handy market has seen more of the same with rates mainly sideways, only to be tested a little as the week progressed.TC6 30kt Skikda / Lavera ended up at WS116.38 (down WS1.43). The LR2s however, have seen some positivity at the end of the week and TC15, 80k Mediterranean / Japan is up $85,000 to $1.685 million.

Stability prevailing in the Baltic Handy market, rates have held until the end of the week. TC9 30k Baltic / UK-Continent dropped a little to WS143.57 (down WS0.71). On the UK-Continent MR freight levels have degraded through the week, and the TC2 37k UK-Continent / US Atlantic Coast is now at WS110 (down WS24.72), showing a round-trip TCE of $2,264/day. TC19 37k Amsterdam to Lagos also showed a similar decline to WS115.83 (down WS25).

The LR1s on TC16 60k Amsterdam / Offshore Lome have remained relatively unfazed thus far and currently up 1WS to WS81.

A busy start to the week in the Americas pushed a temporary spike in rates that then resettled. TC14 38k US Gulf / UK-Continent route now at WS81.79 (up WS1.08) and TC18 35k from US Gulf / Brazil, after the fluctuation ended up at WS119.58 (up WS2.5).

The MR Atlantic basket TCE dropped from $7803/day to $5709/day.

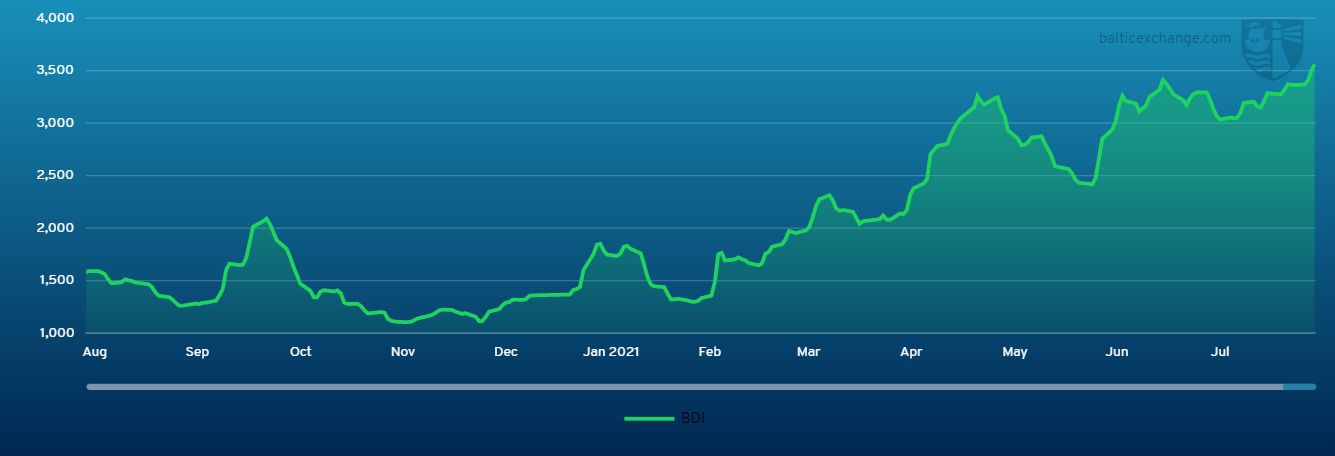

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

Chart shows Baltic Dry Index (BDI) during Aug. 14, 2020 to Aug.13, 2021

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of time charter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.

(Source: The Baltic Exchange, edited by Niu Huizhe with Xinhua Silk Road, niuhuizhe@xinhua.org)

A single purchase

A single purchase