BEIJING, June 16 (Xinhua) -- The Baltic Exchange has published its weekly report of the dry and tanker markets for June 7-11, 2021 as below:

Capesize

The Capesize market leapt up in the latter part of the week, erasing most of the losses since the closing week of May. The Capesize 5TC opened the week with a relatively paltry $20,933, took some moderate losses early in the week to $19,845 before rebounding strongly to close out the week at $27,752. The paper market was abuzz mid-week as FFA volumes spiked with the market sensing a turn around. The North Atlantic, which has struggled for activity in the past month, saw a rise in fronthaul cargo that fixed at significant premiums to the index. The C9 Fronthaul route rose $11,385 to close at $48,750. Out of Brazil to the Far East on the C3 route the beginning of the week saw split month loading dates and distressed vessels being taken advantage of earlier on. By midweek the focus was on first-half July loading where bid offers were seen to surge up wildly. While the Pacific tried to maintain some stability early on, the rises in western routes had owners in the east stiffening their backs and lifting offers. Period interest is heard to be very strong in the market as traders clamour for vessels. The second half of 2021 looks set to challenge the first half.

Panamax

The Panamax market erupted into life midweek with rates improving as a strong push from both South and North America led the drive. A fervent FFA market also gave the period market some traction and a raft of deals were concluded at stronger levels, notably a new build scrubber fitted 82,000dwt delivery ex Yard China achieving $27,000 for one year’s employment. In the Atlantic, the week began on a firm note against a tight tonnage count in the North. With strong mineral and grain-led demand, Charterers scrambled to hit the offers where owners were willing to stand still. Midweek witnessed a binge of fixing from EC South America and this in turn gave additional support to the Asia market that, up until that point, had been relatively flat. Offers now for the Pacific round trips were seen in excess of $30,000, $35,000 getting fixed for a trip via Indonesia redelivery Japan.

Ultramax/Supramax

Period activity has been busy this week with a 63,000dwt open Dangjin fixing for five to seven months at $30,000. A similar-sized vessel open Singapore was fixed for one year at $24,000. An Ultramax vessel delivery Bin Qasim for four to six months at $32,000. The surge from the US Gulf pushed the relevant Gulf routes to the highest point of the year, with brokers suggesting it was largely due to the shortage of tonnage in the region. A 61,000dwt was fixed from US east coast to the Continent at $45,000. From east coast South America, Ultramax vessels were reportedly fixed for a trip to Japan at $22,500 plus a ballast bonus of $1.25 million, and a 52,000dwt was fixed for a trip to the Philippines at $21,000 plus a one million ballast bonus. From the Indian Ocean, a 53,000dwt delivery Pakistan was fixed for a trip back to the Far East at approximately $36,000, and a 56,000dwt delivery Dammam was fixed for a trip via the Arabian Gulf to east coast India at $37,000.

Handysize

Sentiment in Asia has changed in recent days, with all three routes making positive moves this week. Brokers spoke of more cargo in general and less prompt tonnage open. A 38,000dwt open in CJK fixed a trip to the Continent at $28,500. A 33,000dwt open CJK was fixed a trip to Indonesia-Philippines range at $19,000 in the early part of the week. The Atlantic has seen steady improvements, with brokers saying more cargo was now open in East Coast South America. A 32,000dwt was fixed from South Brazil to the Continent at $26,000. A 39,000dwt was fixed basis delivery SW Pass for a trip to the Continent at $20,000. A 28,000dwt open Key West 16-22 June was fixed for two to three laden legs with redelivery worldwide at $19,000. A 35,000dwt open SW Pass in mid June was fixed for three to five months with Redelivery Atlantic Excluding West and South Africa at $20,850.

VLCC

The market in the Middle East for 280,000mt to US Gulf (routing via the Cape/Cape) continues to be assessed at the WS18-18.5 level, while rates for 270,000mt to China have reduced by one point to just above WS31 (a round-trip TCE of minus $4.1k/day). In the Atlantic, rates for 260,000mt West Africa to China have fallen 1.5 points to WS32.5 (minus $1,500/day TCE) and 270,000mt US Gulf to China dropped another $100k to just below $4.1m (a TCE of about $2.1k/day), with Chevron reported to have fixed the 2012 built Ingrid at $4.075m to South Korea.

Suezmax

The 135,000mt Black Sea/Med market rates have held at the WS57.5 level (a round-trip TCE of about minus $6.7k/day), while the 130,000mt Nigeria/UK Continent market rates have remained at WS47.5 (a round trip TCE of minus $2.3k/day). The market for 140,000mt Basrah/Med slipped one point lower at WS23.

Aframax

In the Mediterranean, the market has moved upwards with rates for 80,000mt Ceyhan/Lavera recovering four points to just shy of WS90 (a TCE of about $2.4k/day basis a round voyage). In Northern Europe, the market for 80,000mt Cross-North Sea remained flat at WS91 (about minus $3.4k/day TCE round trip), while in the 100,000mt Baltic/UK Continent market rates are assessed 1.5 points lower than a week ago at WS63.75 (a round trip TCE of about minus $2k/day). Across the Atlantic the market has seemingly bottomed out as rates for 70,000mt Caribbean/US Gulf and East Coast Mexico/US Gulf have remained steady around the WS80 mark (a TCE of about minus $2.6k/day and minus $1.7kpd round trip respectively). The 70,000mt US Gulf/UK Continent market regained a modest four points to WS72.5 (which shows a TCE of about minus $1k basis a round trip, obviously basis single trip economics this would be a positive number).

Clean

The start of the week in the Middle East Gulf saw LR2 rates drift down almost three points to WS76.25 and thereafter owners have had their backs to the wall with charterers relentlessly chipping away at rates. The market now for 75,000mt to Japan sits at WS75 level. The LR1s have fared marginally better with tonnage well balanced against demand and the market for 55,000mt has nudged up a couple of points into the low WS90s. The MRs have come under downward pressure and rates for 35,000mt into East Africa have lost around seven points and are now hovering at the WS160 region. For owners trading MRs from the Continent it has been a disappointing week with rates for 37,000mt to USAC sliding from low WS120s down to barely WS105 before recovering to WS110. Thereafter volatility has appeared with a deal reported back down at WS105, but also WS115 is now said to have been agreed. The one benefit for owners is the improvement in the 38,000mt backhaul market from the US Gulf to UK Continent, which dipped below WS 65 early in the week before plenty of enquiry from US Gulf helped thin the tonnage list and rates have climbed back up to low WS90s. Unsurprisingly, the knock-on effect has been seen for runs to Brazil with rates now in the low WS130s, in contrast to WS105 region at the start of the week. For owners plying the 30,000mts clean trade in the Mediterranean it has been another week to forget with charterers able to squeeze down rates a further 7.5 points to WS127.5, although the tonnage list has now tightened somewhat to give owners some comfort.

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

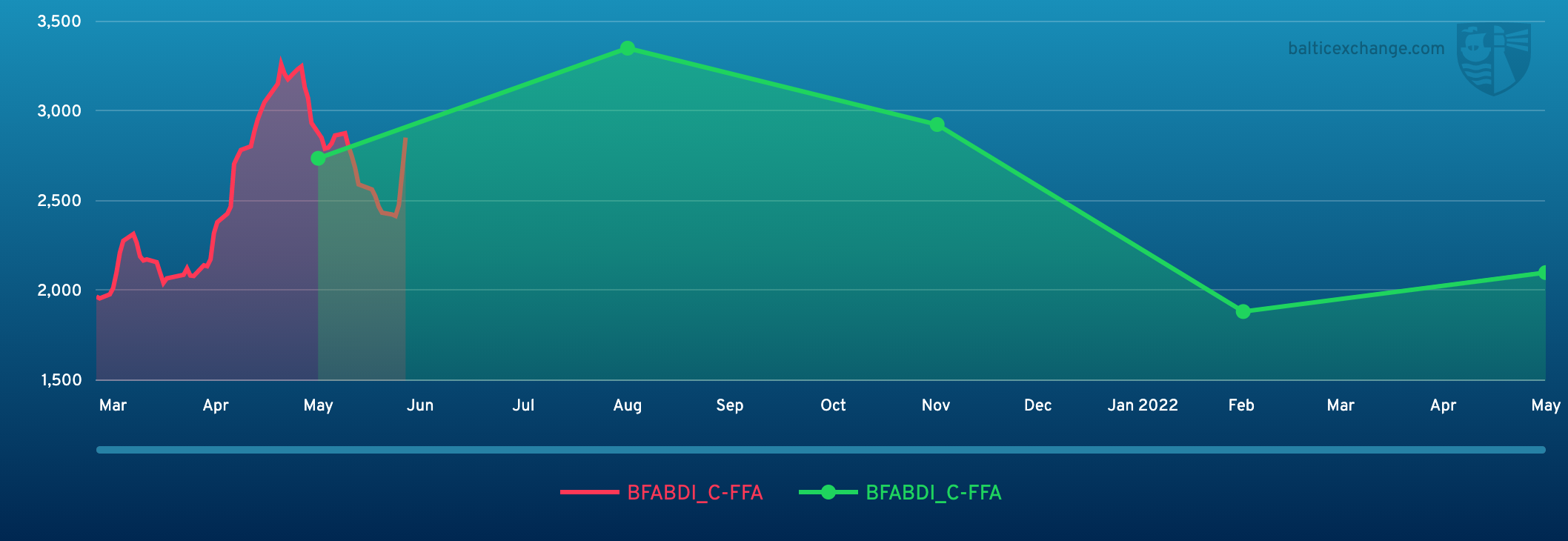

Chart shows Baltic Dry Index (BDI) during June 11, 2020 to June 11, 2021

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of timecharter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.

(Source: The Baltic Exchange, edited by Niu Huizhe with Xinhua Silk Road, niuhuizhe@xinhua.org)

A single purchase

A single purchase