BEIJING, May 31 (Xinhua) -- The Baltic Exchange has published its weekly report of the dry and tanker markets for May 24-28, 2021 as below:

Capesize

It was a dismal week throughout for Capesize earning as all routes softened in what was a largely disrupted week due to numerous public holidays around the globe. The Transpacific C10 opened the week at $40,246 and any upward momentum quickly plateaued before positive sentiment was extinguished for the route to close the week out on consecutive drops to $30,976. The Transatlantic C8 faired no better, all but hitching onto the downward rollercoaster to now rate as the lowest paying region at $20,425. While the ballaster routes had small smatterings of business there was little to get excited about as the C14 nosedived a relatively smaller amount of $4,057 to $25,014. Chatter throughout the week was on the low side with most unsure of where a floor could, or would, be found. The paper derivatives market was heard to have numerous spasms of strong activity, stoking hopes and fears alike, but all moves seemingly failed to build momentum and build confidence that they knew any better where this market is heading.

Panamax

A week disrupted somewhat by holidays saw the panamax market set off in an inauspicious tone. The transatlantic market was described as attritional throughout with delivery APS load port fixtures the norm early in the week equating to very low equivalent rates back to Gibraltar-Skaw delivery, until a surge of fixing late Thursday returned better levels. Fronthaul trading remained well supported throughout, $34,000 around the mean average on the week for trips via NC South America. In Asia, NoPac was generally softer all week with an over-supply of tonnage on nearby dates. A 77,000dwt delivery North China agreed $26,500 for said trip, the bulk of the action here remained on the mineral rounds out of Indonesia. And for the most part rates tried to resist the downward pressure but were forced down by end of the week, with an 82,000dwt delivery Taiwan, China agreeing $24,000 for a trip via Indonesia redelivery Philippines.

Ultramax/Supramax

With various holidays during the week it was a staggered market. Whilst the Atlantic picked up as the week progressed, sentiment eased in the Asian arena towards the end. Period activity was seen with a 56,000dwt open south east Asia fixed in the low $30,000s for a short period. From the Atlantic, there were better rates in many areas with a 63,000dwt fixing a trip from US east coast to the UK at $30,000. Supramax sizes were seeing in the mid $20,000s for Continent to the east Mediterranean. From Asia, as tonnage availability increased with less fresh enquiry, a supramax open Singapore was fixed for a trip via Indonesia redelivery China at $23,500 whilst nickel ore runs were being concluded in the mid-upper $20,000s. The Indian Ocean remained firm with ultramax size seeing in the upper $19,000s and upper $900,000s for trips from South Africa to China. Whilst a 52,000dwt fixed a trip from west coast India via Arabian Gulf redelivery Bangladesh in the $30,000s.

Handysize

In a week interrupted by holidays in both Atlantic and Asia markets, the BHSI has retained its positive sentiment in many areas. Brokers felt the market in Asia was quieter this week and that the tonnage was still tight with rates remaining fairly settled. The Paiwan Wisdom (31,900 2010) open South Japan 5-10 June fixed four to six months redelivery worldwide excluding India at $25,000. The Sun Aquamarine (32,221 2008) was fixed basis delivery Dakar 2 June for about 12 months with redelivery Atlantic Excluding West Africa at $15,000 to Fednav. The Bright Star (34,529 2011) open Sea of Marmara prompt fixed for minimum six to eight months at $21,500 to Lighthouse. In East Coast South America the Dodo (39,017 2013) was fixed basis Delivery Recalada for a trip to West Coast South America with an intended cargo of grains at $32,000. A 37,000dwt was fixed on subjects from South Brazil via River plate to the Continent at $25,000.

VLCC

In the Middle East the market for 280,000mt to US Gulf (routing via the Cape/Cape) continues to be assessed at WS19-19.5 level and rates for 270,000mt to China have also remained flat at the WS36-36.5 region (showing a round-trip TCE of $3250/day). In the Atlantic, rates for 260,000mt West Africa to China are assessed half a point lower to WS36-36.5 region ($4600/day TCE) on the back of minimal activity this week. However, overnight reports suggest that Glencore have taken the 2008 built Jana at WS40 for East options including India. Meanwhile, 270,000mt from US Gulf to China saw rates improve another $63k to $4.4m (a TCE of about $7.4k/day).

Suezmax

In the 135,000mt Black Sea/Med market rates eased half a point to the WS57.5 mark (a round-trip TCE of about minus $4.9k/day) while in the 130,000mt Nigeria/UK Continent market a similar easing in rates was seen, to WS48.5 (a round trip TCE of minus $300/day). The market for 140,000mt Basrah/Med is now rated four points higher than a week ago at WS22.5-23 level in response to the revised flat rate from Worldscale and the port cost allocation now being on owner’s account.

Aframax

In the Mediterranean, the market is slightly firmer with rates for 80,000mt Ceyhan/Lavera gaining another two points to WS89 (a TCE of about $3.5k/day basis a round voyage). In Northern Europe, rates have modestly improved, with the market for 80,000mt Cross-North Sea gaining 1.5 points to the WS 92.5-93 level (about minus $1.4k/day TCE round trip) while rates for 100,000mt Baltic/UK Continent are up one point to WS68.5 region (a round trip TCE of about $1.8k/day). Across the Atlantic, the market’s weakening continues with rates for 70,000mt Caribbean/US Gulf shedding 12.5 points to just below WS85 (a TCE of about $400/day round trip), while for 70,000mt US Gulf/UK Continent rates remain flat at WS77.5 (showing a round trip TCE of $1.8k/day however basis single trip economics this would be more attractive).

Clean

It has been another difficult week for owners trading MRs in the Atlantic. Charterers have been firmly in the driving seat with the 37,000mts Cont/USAC trade easing from close to mid WS130s at the start of the week to WS115 region now. The US Gulf market has fared little better with rates in the 38,000mts backhaul run to the Continent drifting down five points to very low WS70s and Brazil discharge is now assessed very marginally lower at WS108.75.

In the Middle East Gulf, LR2 owners have seen rates come under relentless downward pressure with the market for 75,000mts to Japan losing 10 points to sit now at WS80 level. The LR1s have been steady, generally hovering in the low/mid WS90s for the natural fixing window, although a forward position was covered at WS100 basis 55,000mts cargo. The MRs here have enjoyed a more productive week with rates moving up four points to WS176 region for 35,000mts in to East Africa.

For owners plying the 30,000mts clean trade in the Mediterranean, rates have hardly moved with WS160 looking established, although in the eastern Mediterranean tonnage is tight. Black Sea rates are seen in the low/mid WS170s, although there was a deal done reportedly below WS160, which is understood to be on non-approved tonnage.

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

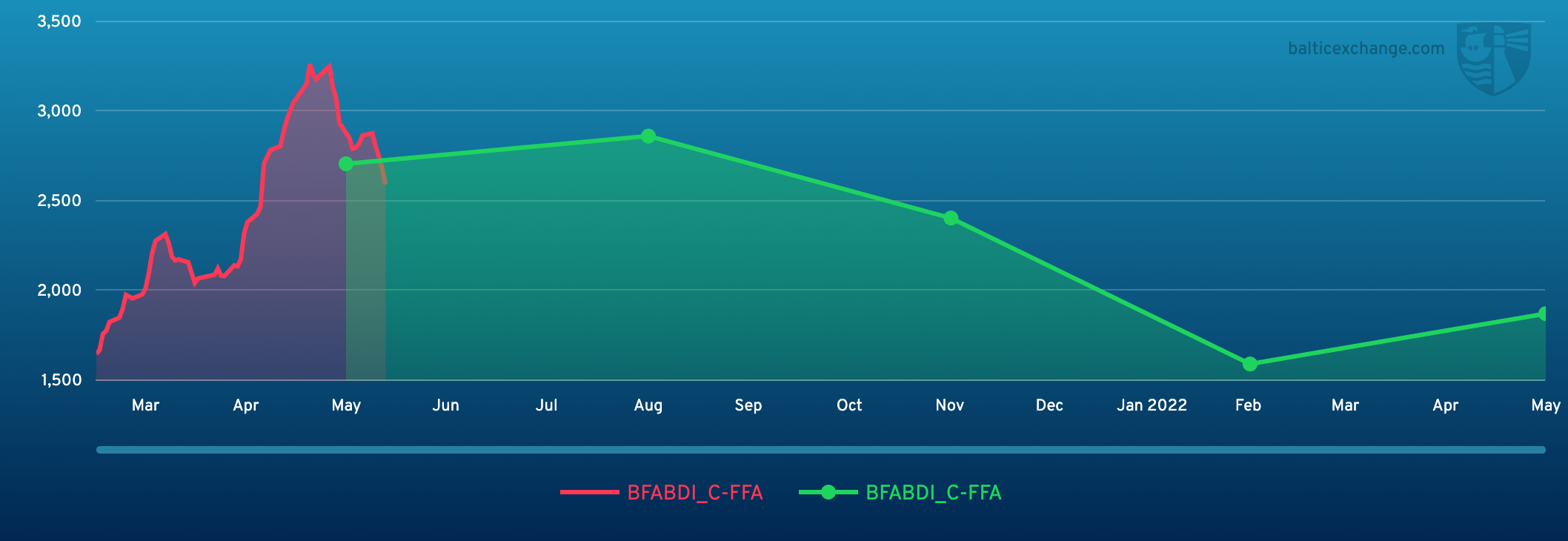

Chart shows Baltic Dry Index (BDI) during May 29, 2020 to May 28, 2021

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of timecharter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.

(Source: The Baltic Exchange, edited by Niu Huizhe with Xinhua Silk Road, niuhuizhe@xinhua.org)

A single purchase

A single purchase