BEIJING, Dec. 7 (Xinhua) -- The Baltic Exchange has published its weekly report of the dry and tanker markets for November 30-December 4, 2020 as below:

Capesize

The Capesize market continued its meandering behaviour this week as the 5TC opened at $12,712. It weakened throughout the week before reviving to close up Friday at $12,606. It was a varied market across the globe with some pockets of tightness having an overbearing effect on several routes. The West Australia to China C5 lifted 68 cents this week to $7.795, while the Brazil to China C3 saw rates under sustained pressure drop $1.45 down to $12.36. Re-scheduling of several vessels out of Ponta Da Madeira - due to an incident - was partly to blame for this decline. In the North Atlantic, prompt vessel tightness is causing firming of some rates. But overall, the basin remains in dire need of cargo. The Transatlantic C8, trading now at $12,725, lifted at weeks end but is firmly placed as the discounted basin with the Pacific C10 trading now at $16,638 with its more ample supply of cargo. With Q1 '21 only around the corner with its forward levels well below $10k level, the option of which basin to trade will largely favour the Pacific unless 2020 has another surprise up its sleeve.

Panamax

As we approached the holiday season, the North Atlantic Panamax market was described by a few as appearing like a two-tier market with premium rates paid for the quick Baltic coal trips. Close to $20,000 was paid a couple of times as tonnage count appeared tight. But elsewhere, discounted rates were witnessed as owners wanting longer duration employment to avoid opening their tonnage over the festive period. A similar picture emerged in Asia too, with Indonesia to China and Australia to India predominantly the market drivers this week with the NoPac taking something of a back seat. Indonesia to China coal trips were averaging out at around the $13,000 mark dependent on delivery. Meanwhile, $14,000 was concluded on an Australia to India coal trip on an 82,000dwt delivery China. In period news, an 82,000dwtachieved close to $11,000 with a grain house for one year's period.

Ultramax/Supramax

A rather patchy week with some areas remaining firm whilst others lost momentum. However, the overall trend week on week was lower with the BSI closing at 1,011 - down from the previous week's close of 1,018. Period activity again was limited with charterers showing little interest. A 61,000dwtopen in Asia was fixed at $10,275 for one year. Atlantic activity centred around the Mediterranean – Continent with tonnage in short supply. A 63,000dwtfixing delivery Marmara Sea redelivery US east coast in the upper $11,000s and 57,000dwtfixing a trip from the Continent via the Baltic to the east Mediterranean at $17,000. Elsewhere, last week's activity from the US Gulf waned with a 56,000dwtfixing a trans Atlantic run in the mid teens. Pressure eased from south east Asia after the flurry of demand for coal from Indonesia to China slowed. A 56,000dwtfixing delivery Singapore trip via Malaysia redelivery China at $15,000. Indian Ocean levels remained steady. A 56,000dwtfixing delivery South Africa trip Bangladesh at $11,900 plus $190,000 ballast bonus.

Handysize

The Continent / Mediterranean market started softening since mid of the week with the relevant HS1 and HS2 route turning to decline. East coast South America was largely flat, with brokers having slightly different opinions on the trend. It was suggested more ballasters sailing from west Africa towards east coast South America - whilst rates on transatlantic trips from the region then began to fall. However, the time charterer average and the overall index continued to improve, mainly with the aid from the US Gulf and Pacific routes in the second half of the week. A 37,000dwtwas fixed from the Continent for a trip to east Mediterranean at a rate in the $17,000s. A 33,000dwtdelivery Pecem next week was fixed for a trip to the US Gulf at $13,500. A 38,000dwtdelivery Veracruz was fixed for a trip via US east coast to the Continent at $13,500. A 29,000dwtwas fixed basis passing Jeddah for a trip via Israel to Japan at $10,000.

VLCC

Rates rose again this week, albeit modestly, which translates into an uplift in time-charter equivalent (TCE) earnings of between 45-50pctin the Middle East and West Africa. Rates firmed 2.5 points to WS31 (about $11,500 per day) for 270,000mt ME Gulf to China, while on the 280,000mt ME Gulf to USG via the Cape/Cape routing rates are assessed at WS16.5 level - up a single point. In the Atlantic, rates for 260,000mt West Africa to China firmed 4.5 points to just shy of WS35 (about $17,500 per day). 270,000mt US Gulf to China rates are now assessed at close to $4.7m, about $80k higher than a week ago.

Suezmax

Rates for 135,000mt Black Sea/Med were weakened by two points to WS51 level and 130,000mt Nigeria to UKContinent is now trading around WS37 - also down a couple of points. In the Middle East market, rates remain around WS18-19 for 140,000mt Basrah/Med.

Aframax

Rates for 80,000mt Ceyhan/Lavera remained steady at WS60. In Northern Europe the 80,000mt cross-North Sea market slipped a couple of points to just under WS75 and 100,000mt Baltic/UK Cont saw a marginal slide of 1 point to WS45. Across the Atlantic, after the Thanksgiving impetus had subsided, rates have tumbled with charterers seemingly able to regain control. 70,000mt Carib/US Gulf rates fell 15 points to WS90, while 70,000mt US Gulf/UK Cont saw rates down 17 points to WS62.5-65 region.

Clean

In the Middle East Gulf/Japan trade, charterers have managed to squeeze rates down further with the market for 75,000mt starting the week in the very low WS70s before Idemitsu covered at WS67.5. Today levels are closer to mid WS60S. By contrast, it was a marginally better week for owners in the LR1 trade with rates for 55,000mt to Japan hovering between WS80/82.5 region - representing a gain of around five points. The MR market again saw decent activity with rates for 35,000mt AG/East Africa starting the week around WS135 before climbing to WS145 and then WS160. There is now talk of BP taking the 'Maersk Cayman' with last cargo vegoil - also for 6 December - loading at WS175. Closer to home, in the 37,000mt UKContinent/USAC trade, it was an uneventful week with rates holding steady at WS75 region. There was little to enthuse after the Thanksgiving holiday in the USA, with the backhaul trip of 38,000ms from US Gulf to UKContinent losing three / four points to sit now around WS45/46 region. The 38,000mt US Gulf to Brazil run drifted down around 1.5 points to settle at WS65. There was activity in the 30,000mt cross-Mediterranean trade with East Med loaders achieving mid WS80s and Black Sea paid between WS90/92.5 level. West Med tonnage was tighter - and the market peaked here at WS95 - although it is now assessed closer to WS90.

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

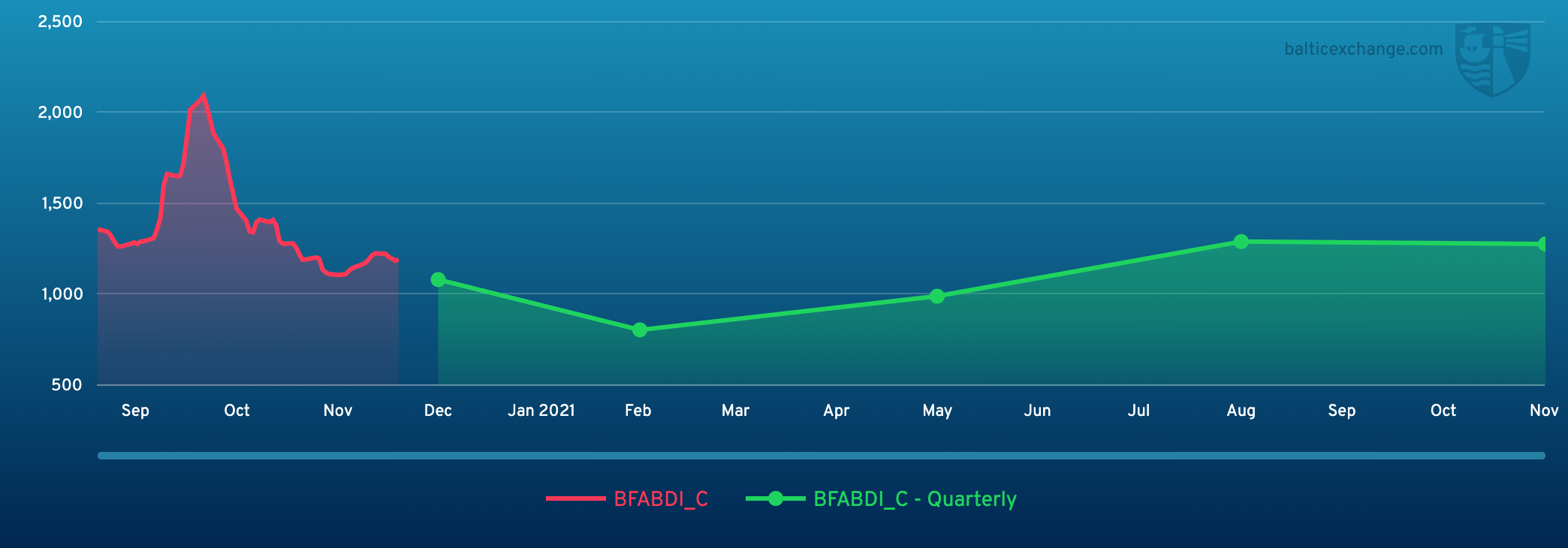

Chart shows Baltic Dry Index (BDI) during Dec.6, 2019 to Dec.4, 2020

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of timecharter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.

(Source: The Baltic Exchange, edited by Niu Huizhe with Xinhua Silk Road, niuhuizhe@xinhua.org)

A single purchase

A single purchase