BEIJING, Nov. 18 (Xinhua) -- China's traditional industries, emerging sectors, high-tech industries, advanced manufacturing and new consumption sectors are likely to lure more insurance capital to come in, reported Xinhua Finance Wednesday.

The report cited fund managers with many private equity investment funds as saying, after late in last week when the Chinese insurance regulator issued a circular permitting insurers to freely pick the industries for their financial-return-oriented minority equity investment in unlisted firms.

In view of the past regulatory documents and insurers' investment practices, insurers generally preferred stable financial-return-oriented equity investment and strategic investment while rarely participating in the fast-growing mobile Internet and related sectors in the past decade.

The medical and pharmaceutical industries in which insurers kept pouring capital in are still expected to obtain more equity investment and insurers will likely concentrate on the bio-pharmacy, genetic engineering, and artificial intelligence (AI) in medicine and healthcare in the following period, according to Dajia Insurance Group Co., Ltd.

As the insurer noted, insurance companies are more inclined to seek equity investment in such promising sectors as high and new technologies, advanced manufacturing, and new consumption sectors.

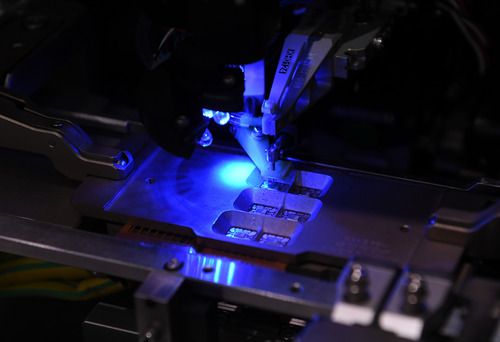

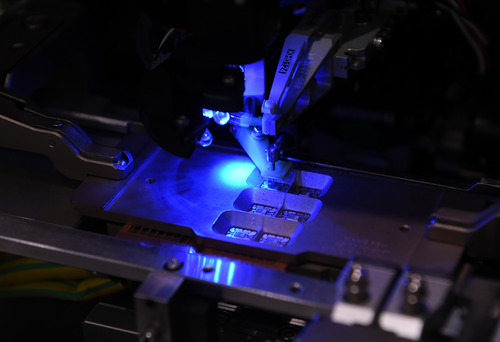

For instance, the concrete subsectors that insurers are interested in include AI and its application fields in city management and business environment, chips and smart hardware, new homegrown brands and community group purchasing, added the insurer. (Edited by Duan Jing with Xinhua Silk Road, duanjing@xinhua.org)

A single purchase

A single purchase