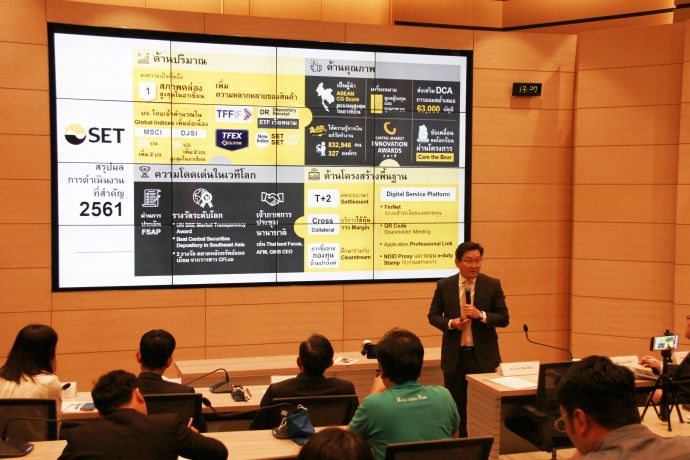

Photo: SET President Pakorn Peetathawatchai explains a three-year strategic plan (2019-2021) to media during a press conference held in the SET office on Jan. 31.

BANGKOK, Feb.1 (Xinhua) -- The Stock Exchange of Thailand (SET) on Thursday announced that it has set out a three-year strategic plan (2019-2021) to slim down costs and broaden business opportunities for the entire capital market industry, aiming to boost efficiency and become Thailand's one-stop capital market platform that boosts the country's growth.

During a press conference held in its office, SET President Pakorn Peetathawatchai said that SET, with an average daily trading value of THB57.67 billion (approximately USD1.8 billion), is poised to implement the strategic plan via four key strategies "Expand-Explore-Reform-Restructure" by improving working efficiency and diversifying into new businesses to make the capital market work for everyone.

Pakorn and other SET officials together explained the four key strategies to media. According to them, the stock exchange is to increase investor base in potential secondary provinces outside Bangkok, educate investors on investment planning for retirement and investment tools, build a culture of investment through dollar-cost averaging (DCA) approach and facilitate data accessibility for capital market stakeholders.

As for "Explore", the SET is to scale up to a full spectrum of digital transformation by creating an open utility platform, widen accessibility to mutual funds through FundConnext platform's services for cross-border fund distribution, interbank payment, online account opening, connect with international partnership to create business valuation for capital market and prepare to build a digital asset ecosystem.

The officials noted that "Reform" means initiating one-stop service platform inclusive of initial public offering (IPO), supervision, post-trade, sustainability development services, and expanding services for other stakeholders in the future, in order to eliminate duplicate processes, create flexibility, cut down industry cost, as well as work with regulatory agencies to truly remove business operation obstacles.

They also explained that "Restructure" as focusing on providing value added to stakeholders in the capital market to sharpen competitive edge by identifying businesses into three groups, namely core business, new business and infrastructure development, and capital market development.

In his speech, Pakorn reiterated the urgency to internationalize and digitalize the stock exchange and also to connect with CLMV countries, namely Cambodia, Laos, Myanmar and Vietnam. Enditem

A single purchase

A single purchase